Abstract:Failed to maximize your trading experience at Plexytrade because of the heavy forex slippage issue? Have you been constantly hearing NO on your withdrawal requests raised with the Saint Lucia-based forex broker? Do broker officials provide you with inexplicable reasons for withdrawal denials? Feeling stuck in your trading? These experiences have shaped many of your fellow traders’ negative reviews of this forex broker. Read this article further to check their reviews.

Failed to maximize your trading experience at Plexytrade because of the heavy forex slippage issue? Have you been constantly hearing NO on your withdrawal requests raised with the Saint Lucia-based forex broker? Do broker officials provide you with inexplicable reasons for withdrawal denials? Feeling stuck in your trading? These experiences have shaped many of your fellow traders negative reviews of this forex broker. Read this article further to check their reviews.

Top Reasons Why Traders Give Thumbs Down to Plexytrade

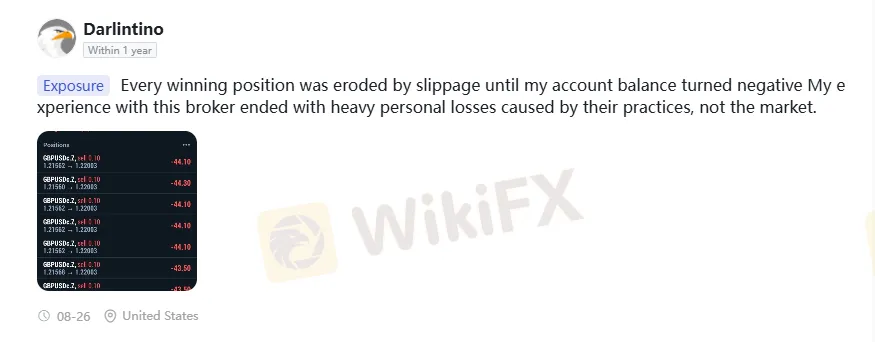

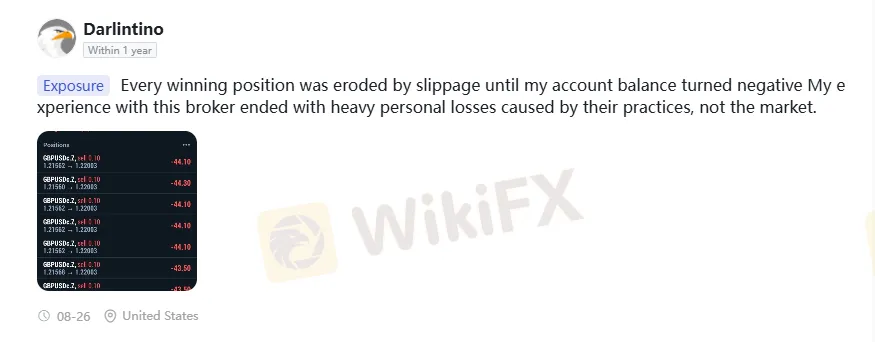

Slippage Issue Mars Traders

Traders win many positions using smart strategies. However, they all prove inadequate to earn profits because of high slippages. The pattern remains until the account balance turns negative. Concerned by these unfair trade practices, the trader has complained about this online. Take a look at this screenshot to know it better.

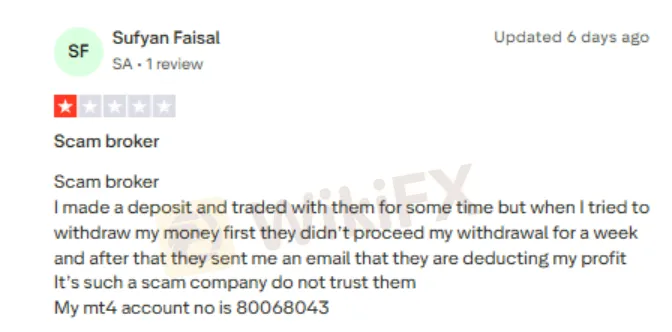

‘Profit Withdrawal’ Drama That the Trader Never Saw Coming

Profit withdrawal denial is increasingly becoming common among scam forex brokers. However, at Plexytrade, it is on a different level. As per one of the traders, the broker not only denied withdrawal access but also responded with an email stating profit deduction. This left the trader shocked and made him complain about it online.

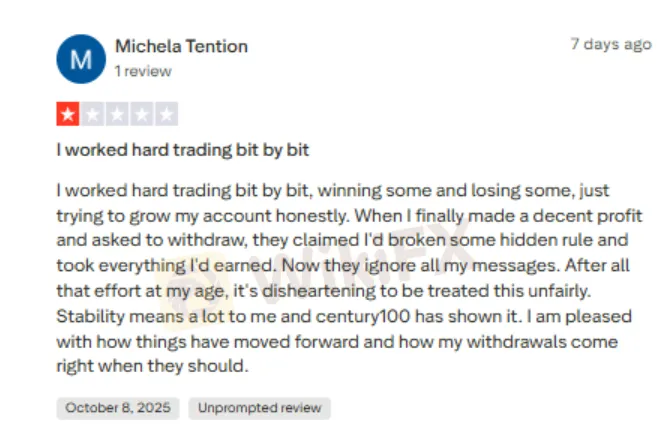

Another Unique Fund Withdrawal Drama

This complaint talks about the trader winning some trades and losing some. After posting a decent profit, the trader sought a withdrawal. However, the broker rejected the request by claiming that the trader had broken hidden rules. As per the trader, the broker withheld everything he earned. Have a look at this screenshot explaining the situation better.

Not a Convincing Customer Support Team

The customer support team does not respond effectively to the queries raised by traders. In one such case, the trader raised the profit withdrawal request and checked with the support team regarding the time it takes to access funds. The support team replied by saying 1-2 working days. After failing to receive funds during this timeframe, the trader contacted the support team. To which, the support team told the trader that the wallet used for withdrawal is flagged for this transaction. Understandably, the trader asked the support team to share evidence that supports their claim. The support team denied sharing the evidence, raising suspicion over Plexytrade.

Here is what the trader said in his review.

The Take of WikiFX on Plexytrade - Score & Regulation Status

WikiFX shares the review of Plexytrade, much in line with trading complaints mentioned above. As these complaints seemed serious, the WikiFX team investigated them and the reasons that may have accounted for poor trading experiences. The investigation saw Plexytrade to be an unlicensed broker, explaining the reason for these experiences. Trading via an unregulated forex broker like Plexytrader will always mean capital losses and unresponsive behavior. As a result, the team assigned Plexytrade a score of 1.96 out of 10.

Do You Want to Get More Updates on Forex Scam Alerts, Trading Strategies or News? This is Where You Should be - WikiFX Masterminds.

Enter the Elite Group by Following These Steps-

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.