简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

B2PRIME Gains DFSA License in Dubai — But What Do Traders Need to Know?

Abstract:B2PRIME secures a DFSA license in Dubai DIFC, but WikiFX scores show only average performance. Explore its regulatory status, licenses, and trader reviews.

B2PRIME, part of the wider B2Broker group, recently announced that its MENA subsidiary has been authorised by the Dubai Financial Services Authority (DFSA) to operate from the Dubai International Financial Centre (DIFC). The license, effective from August 15, 2025, allows the firm to act as both agent and principal in investment services while also holding client funds under strict controls.

The move strengthens B2PRIMEs presence in the Middle East, positioning Dubai as its regional base for banks, asset managers, hedge funds, and other institutional clients. But as with any broker expansion story, the more important question for traders is: how does B2PRIME actually measure up in terms of regulation, reputation, and client trust?

Regulatory Standing and Licenses

According to WikiFX records, B2PRIME operates with multiple regulatory registrations. It holds a license from the Cyprus Securities and Exchange Commission (CySEC), as well as other offshore authorisations. The new DFSA license adds weight in the Middle East, since Dubais DIFC is a globally recognised financial hub.

However, traders should note that not all of the broker‘s operations fall under the same regulatory standards. While CySEC and DFSA licenses offer stronger oversight, WikiFX data also flags that B2PRIME’s overall regulatory score is only 6.02, which reflects gaps compared to top-tier brokers.

WikiFX Rating: Average at Best

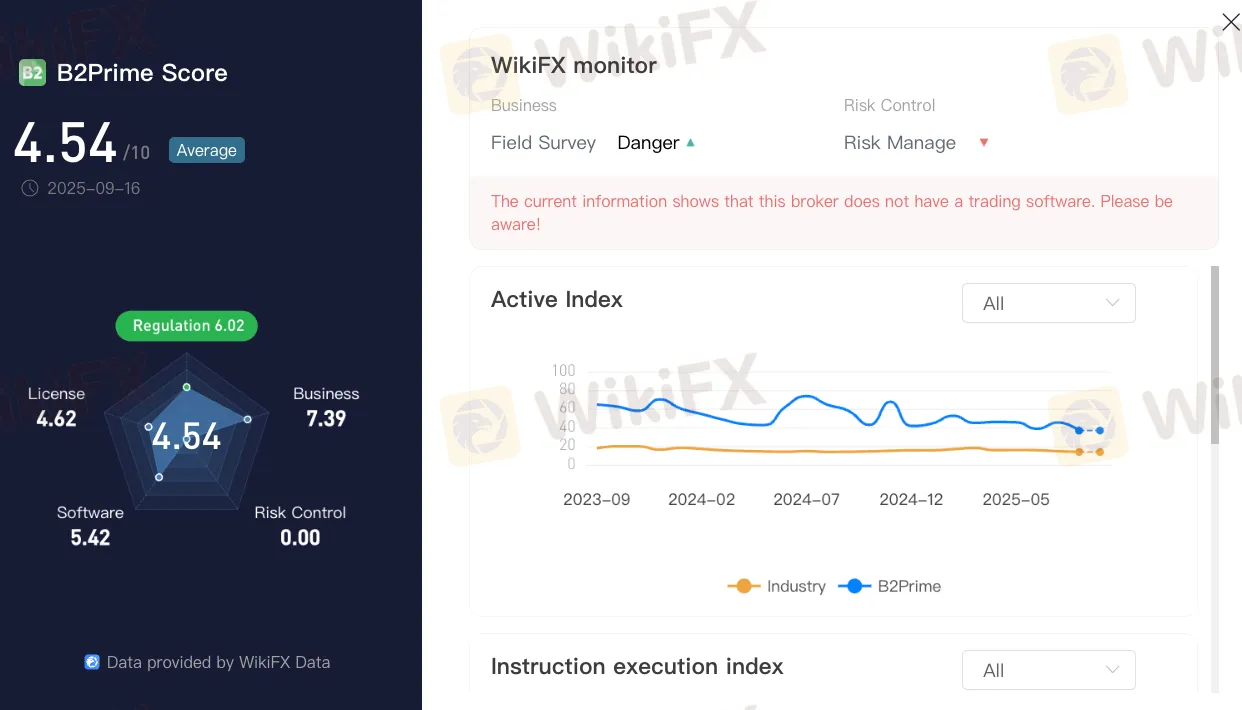

On WikiFX, B2PRIME scores 4.54/10, a rating that places it in the “average” category. The breakdown highlights:

- Business Index: 7.39, reflecting active operations and global presence.

- Software Index: 5.42, covering available platforms and connectivity.

- License Index: 4.62, weighed down by weaker or offshore licenses.

- Risk Control Index: 0.00, indicating concerns about transparency and risk management.

This mixed profile shows that, despite regulatory coverage in some regions, there remain unresolved issues around client security and operational risk.

User Complaints: Red Flags from Traders

Perhaps the most important perspective comes from actual traders. On WikiFX, B2PRIME has received exposure reports describing difficulties in withdrawing funds and transparency concerns.

One user claimed they made over $6,000 in trading profits, but despite requesting withdrawals, the funds never arrived in their account. The user accused the broker of hiding behind “false operations” to justify delays. Such complaints highlight that even brokers with official licenses may still face execution or trust issues in practice.

Balancing Expansion with Reputation

The new DFSA authorization is undoubtedly a milestone for B2PRIME. It signals ambition and a bid to earn credibility in the MENA region, where regulation is increasingly valued by both institutional and retail clients. However, regulatory paperwork alone does not guarantee smooth client experiences.

WikiFXs evaluation points to a broker with some legitimate oversight but also lingering concerns — from user complaints to weak risk control scores. For traders considering B2PRIME, the safest approach is to verify which entity they are opening an account with and to review client feedback carefully before depositing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

Evest Broker Review: Regulated, but Complaints Persist

Is Eightcap Safe or Scam? Eightcap User Reputation : Looking at Real User Reviews

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

Currency Calculator