Abstract:FBS’s research reveals institutions now anchor finance on Ethereum, driven by staking rewards, Layer 2 scaling, ETF momentum, and real-world asset tokenization—a decisive Wall Street shift.

Structural Shift: Ethereum as Financial Infrastructure

FBSs research signals a decisive market pivot: Ethereum is now recognized by Wall Street as foundational financial infrastructure, not just a volatile crypto asset, as major endorsements and product expansions mount. FBS links increased institutional adoption to concrete developments, including Ethereum-based treasury strategies tied to Peter Thiel and the swift rise of ETH spot ETFs.

Staking Yields Reshape ETHs Role

Ethereums staking ecosystem has recast ETH as a yield-generating asset, with average validator returns in 2025 hovering between 3–4%. Industry data shows Ethereum leading global staking, with millions of ETH locked and annual yields comparable to conservative fixed income, appealing to institutional allocators seeking bond-like exposure.

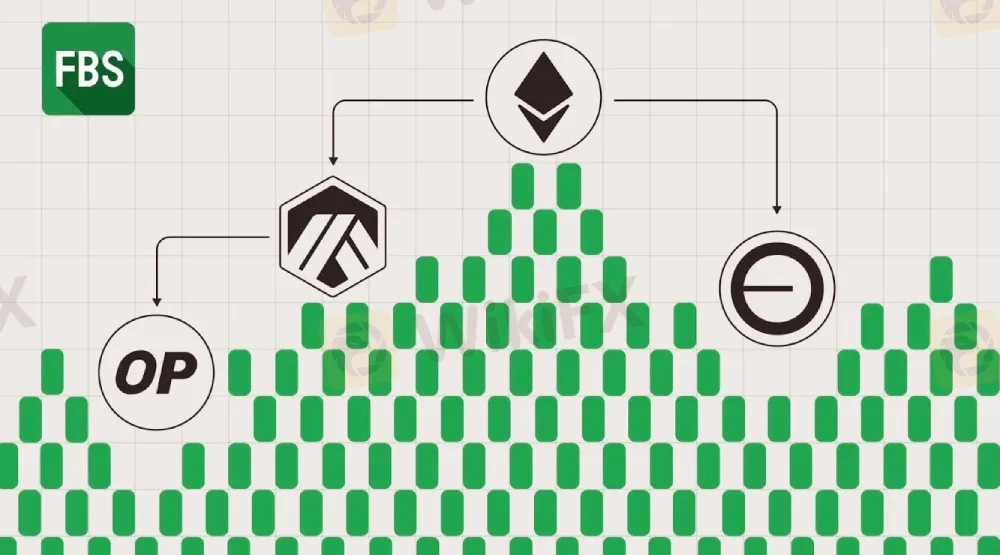

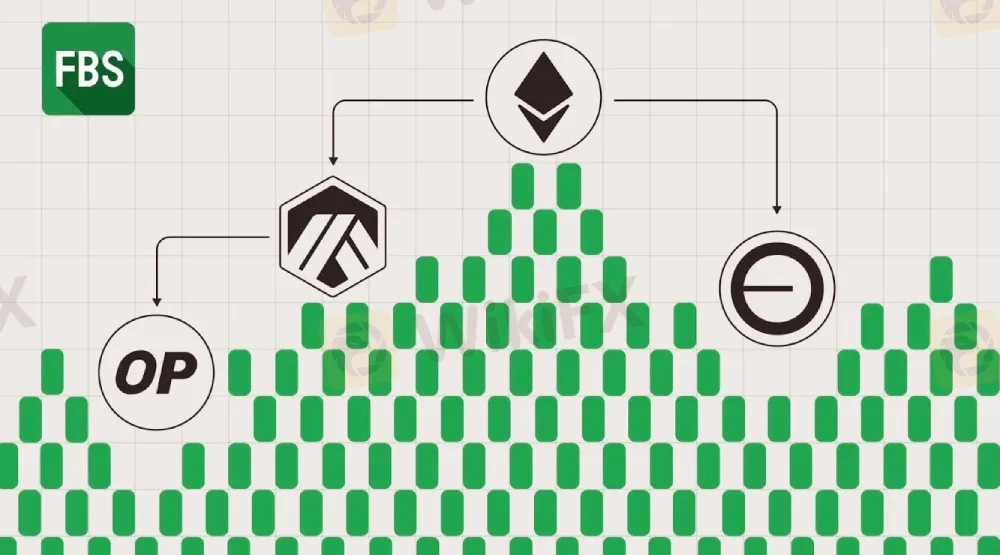

Layer 2 Scaling Powers Institutional Adoption

Ethereum Layer 2 solutions—Arbitrum, Optimism, and Base—now process more transactions than the Ethereum mainnet, delivering the throughput required for enterprise applications and real-world asset (RWA) tokenization. Base and Arbitrum dominate L2 activity, with record daily usage and monthly volumes, confirming their role as essential financial infrastructure.

ETFs and Tokenization Drive Mainstream Integration

ETH spot ETFs surpassed $20 billion in assets by mid-2025, propelled by steady inflows and marking a watershed in Ethereums financial integration. Simultaneously, firms like BlackRock, JPMorgan, and Citigroup are advancing RWA tokenization on Ethereum, cementing its position as the leading platform for real-world asset infrastructure.

High-Profile Endorsements Signal Institutional Confidence

Peter Thiel‘s support for Ethereum treasury strategies has amplified institutional momentum, with new stakes in ETH-focused firms positioning ETH as both a corporate reserve and yield engine. This trend echoes earlier Bitcoin corporate treasury adoption but leverages Ethereum’s programmability and staking rewards, reinforcing its infrastructure narrative over speculation.

Key Ecosystem Projects

FBS identifies projects poised to benefit from this shift: Arbitrum as the top ETH scaling network by value secured, Chainlink as critical middleware for RWA tokenization, and Lido as the dominant ETH staking protocol. These components illustrate the broader Ethereum ecosystems growth, connecting mainnet, Layer 2, and staking economies with institutional adoption.

About FBS

FBS is a globally regulated broker under CySEC, ASIC, and Belize FSC, serving over 27 million clients with a history of industry recognition. Independent reviews confirm FBSs regulatory footprint and market scale, underpinning its credibility in analysis and distribution.