简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

'Soft' Survey Data Shows US Services Surging... And Plunging In August

Abstract:Following the rise in US Manufacturing surveys earlier in the week, US Services sector surveys were

Following the rise in US Manufacturing surveys earlier in the week, US Services sector surveys were expected to show slight improvements

- S&P Global US Services PMI fellto 54.5 (August final) from 55.7 in July and August flash of 55.4.

- ISM US Services PMI roseto 52.0 from 50.1 in July (better than the 51.0 exp) - the best ISM Services print since Liberation Day

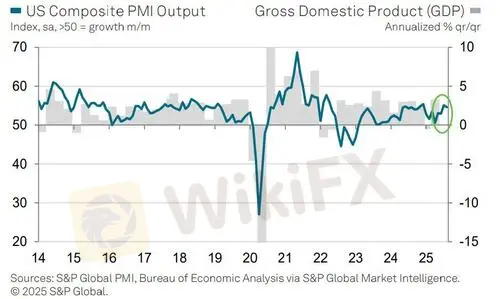

And all that as 'hard data' went nowhere...

Source: Bloomberg

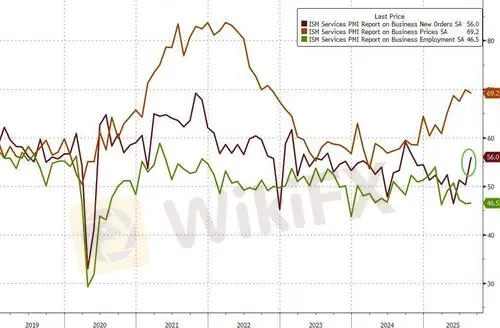

Under the hood of the ISM beat we sawNew Orders soar, employment stagnate, and price fears ebb modestly...

Source: Bloomberg

Spot the odd one out...

Source: Bloomberg

Although weaker than signaled by the preliminary ‘flash’ PMI reading, and below that seen in July, the expansion of the service sector in August was still the second strongest recorded so far this year, according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Fuller order books, reflecting a summer upturn in customer demand, has meanwhile encouraged service providers to take on additional staff in increasing numbers, accompanied by a return to hiring in the manufacturing sector, but then Williamson says, somewhat confoundingly:

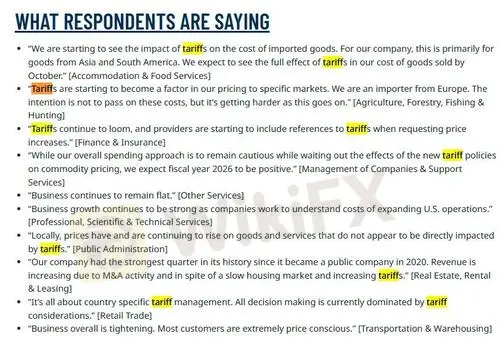

However, the brighter news on current economic growth and hiring is marred by concerns over future growth prospects and inflation.

Business optimism regarding the year ahead outlook has dropped to one of the lowest levels seen over the past three years amid escalating worries over the uncertaintyand drop in demand caused by federal government policy, most notably tariffs, as well as the associated rise in price pressures. Inflation concerns have been fanned by a further steep rise in input costs which have fed through to another marked increase in average charges for services.

With tariffs on everyone's minds still:

For now,. as is usual, the market is more focus on the ISM data (which improved significantly).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold and Silver Buckle Under BCOM Rebalancing Weight Ahead of Critical NFP

Why Southeast Asia Can’t Stop Online Scams

Trump Triggers Fiscal Jitters with $1.5tn Defense Ambition Funded by Tariffs

Is GMG Safe or a Scam? A 2026 Deep Dive

Pocket Broker Review: Why Traders Should Avoid It

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Is Assexmarkets Legit or a Scam? 5 Key Questions Answered (2025)

TibiGlobe Review 2025: Institutional Audit & Risk Assessment

TEMO Review 2025: Institutional Audit & Risk Assessment

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

Currency Calculator