Abstract:MultiBank Group (MEX Global Financial Services LLC) is widely known as one of the international forex brokers offering a variety of financial instruments, ranging from forex, indices, commodities, precious metals, to stock CFDs. However, behind that global image, numerous reports of alleged fraud have surfaced, raising concerns among traders, including in Indonesia. This article provides a comprehensive review of its legality, accounts, promotions, and WikiFX warnings to help you stay alert.

MultiBank Group (MEX Global Financial Services LLC) is widely known as one of the international forex brokers offering a variety of financial instruments, ranging from forex, indices, commodities, precious metals, to stock CFDs. However, behind that global image, numerous reports of alleged fraud have surfaced, raising concerns among traders, including in Indonesia. This article provides a comprehensive review of its legality, accounts, promotions, and WikiFX warnings to help you stay alert.

Article Outline

01. Overview of MultiBank Group

02. Reports of 728 Victims via WikiFX Exposure

03. Various Fraud Schemes of MultiBank Group Worldwide

04. Hidden Mysteries of MultiBank Group in Indonesia 2025

4.1 Executive Summary

4.2 Presence in Indonesia: digital platforms and representatives

4.3 Size and dynamics of the Indonesian market

4.4 Compliance and regulation in Indonesian jurisdiction

05. Disturbing! Office Visit Yields No Findings

06. WikiFX Tips to Avoid Forex Broker Fraud Threats

07. Conclusion

General Overview of MultiBank Group

MultiBank Group has been operating since 2005, claiming to be regulated in several jurisdictions. They offer various trading accounts such as ECN Pro, Multi-Asset, and Standard. Traders can log in through MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, with deposit methods ranging from bank transfers, credit cards, to e-wallets.

The instruments offered are diverse: forex, stock indices, CFDs, metals, and even crypto. They also frequently launch deposit bonus promotions, which they claim attract global traders.

However, according to WikiFX, even though MultiBank Group holds several licenses, there are serious concerns about regulatory compliance and transparency. WikiFXs regulatory score also raises doubts about the safety of client funds.

- Company Name: MEX Global Financial Services LLC

- Abbreviation: MultiBank Group

- Country of Registration: Cyprus

- Website:https://www.multibankgroup.com/en

- WikiFX Broker URL Code: 0001326398

Reports of 728 Victims Through WikiFX Exposure

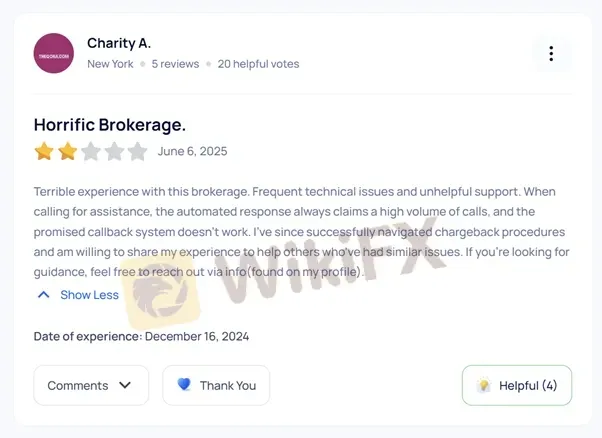

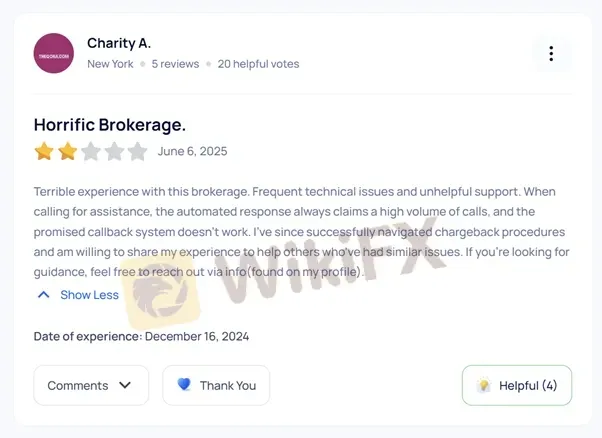

As of August 2025, WikiFX recorded at least 728 victim reports related to MultiBank Group. Some real testimonials include:

- A user claimed they failed to withdraw funds after their account was unilaterally closed.

- Another reported that deposits made could not be traded.

- An East Asian trader reported changes to trading conditions without prior notice.

- A “Romance Scam” case was linked to fake social media profiles.

- The latest complaints alleged outright cheating.

These cases show consistent fraudulent patterns such as withdrawal rejections, price manipulation, and unilateral rule changes.

Various Fraud Schemes of MultiBank Group Worldwide

Negative reports about MultiBank Group are not only on WikiFX but also across global platforms:

- Trustpilot: complaints from IBs/affiliates tricked out of their commissions.

· Telegram: Indonesian victims claimed they were lured with fake NDB (No Deposit Bonus).

· SiteJabber: bad reviews about poor customer service and technical support.

· Reddit: users reported unilateral changes to bonus rules, forcing clients to “LOSE” before being able to withdraw cashback incentives.

From these patterns, it is clear that MultiBank Group uses bonus traps, account manipulation, and withdrawal delays as tactics to withhold client funds.

Hidden Mysteries of MultiBank Group in Indonesia 2025

Executive Summary

MultiBank Group positions itself as the “largest and most regulated” global financial derivatives institution, claiming over 2 million clients, 20,000+ instruments, leverage up to 1:500, and 25+ global offices.

For Indonesia, verifiable proof of presence includes: the official site accessible to Indonesian users, a LinkedIn Showcase page “MultiBankGroup Indonesia,” and a listed Indonesian contact number on third-party directories.

However, there is no evidence of local Indonesian licenses; the highlighted compliance involves cross-border licenses (SCA,MAS, CySEC, ASIC, BaFin, etc.). This suggests that operations for Indonesian users—if any—are offshore-based, not through a licensed domestic entity.

Presence in Indonesia: digital platforms and representatives

- Official website: multibankgroup.com serves global communication and product offerings.

- LinkedIn Indonesia page: indicates localized marketing focus.

- Local contact (third party): Traders Union lists an Indonesian phone number (+62 02129264151). However, this is third-party info, not proof of domestic licensing

Market Size and Dynamics in Indonesia

- Global claim: 2M+ clients and 25+ offices, but no specific data for Indonesia.

- Local marketing efforts exist (LinkedIn, phone listing), but no clear market penetration figures.

- Attractive offerings for Indonesian traders include high leverage (1:500), a wide range of instruments, and copy trading/IB networks.

Compliance and Regulation in Indonesias Jurisdiction

No evidence of local licenses in these sources

From the three references you provided, none mention an Indonesian license (Bappebti/OJK) for MultiBank Group. The regulations emphasized are cross-jurisdictional, such as SCA (UAE), MAS (Singapore), CySEC (Cyprus), ASIC (Australia), BaFin (Germany), CIMA (Cayman), VFSC (Vanuatu), and others. These licenses do not automatically grant the right to offer retail CFDs/derivatives in Indonesia without local compliance.

Implications for cross-border marketing:

If Indonesian users open accounts with MultiBank‘s offshore entities, then the legal relationship typically falls under the jurisdiction of those entities. The consequences include differences in investor protection standards, dispute resolution mechanisms, and leverage/bonus provisions that may not align with Indonesia’s consumer protection practices. (This is a general policy analysis; no specific licensing claims are made in the provided sources.)

Compliance verification recommendations:

- Check domestic registration: Verify in the Bappebti and/or OJK registries whether a “MultiBank”/“MEX” entity is licensed to offer retail derivative products in Indonesia.

- Validate contract entity: Ensure that the entity name, regulator, and license number in the account opening documents are consistent with what has been publicly disclosed.

- Review product restrictions: Check whether instruments such as crypto CFDs comply with Indonesias regulatory framework. (Practical guidance; no specific local license sources were available in the provided links.)

Disturbing! Office Visit Yields No Findings

WikiFX investigation surveyed MultiBank Groups office address and found no office present. This strengthens suspicion that the company operates mostly virtually, without clear physical presence—making legal disputes harder.

WikiFX Tips to Avoid Forex Broker Scam Threats

Based on the MultiBank Group case, WikiFX provides several important tips to help traders stay safe:

- Check the brokers regulation on the official regulator websites such as BAPPEBTI, FCA, ASIC, or CySEC.

- Avoid being tempted by large bonuses, as the conditions are often manipulated.

- Read trader testimonials on WikiFX, review portals, and trading forums before making a deposit.

- Use officially regulated brokers with relevant oversight.

- Report suspected scams to regulators or oversight platforms like WikiFX.

Conclusion

Although MultiBank Group claims to be a reputable global broker, various reports from WikiFX and other platforms show clear patterns of fraud. With 728 reported victims in 2025, traders must be extra cautious. Before choosing a broker, always prioritize relevant official regulation and full transparency.

? Type multibank in the broker search box on the WikiFX website or app to access the full WikiScore and original references.