Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Victims reveal Forex trading scam stories on WikiFX. See how to collect evidence, expose fraudulent brokers, and help protect the trading community.

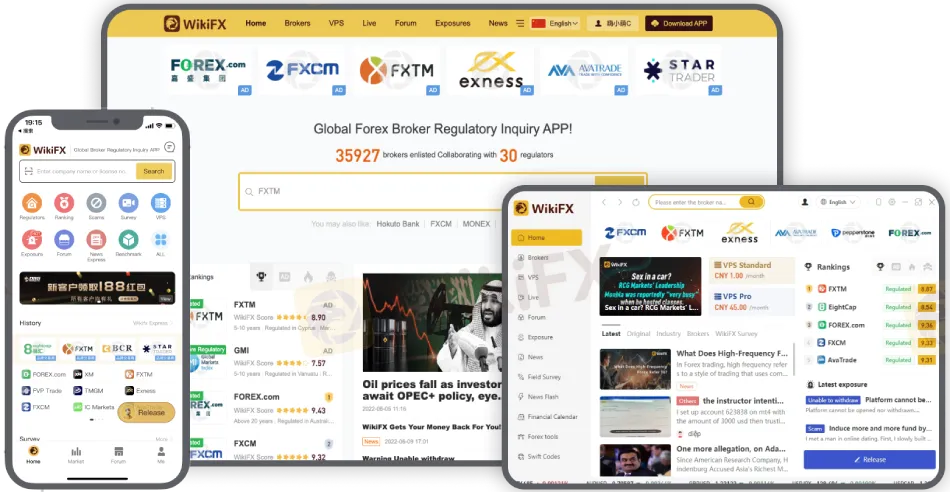

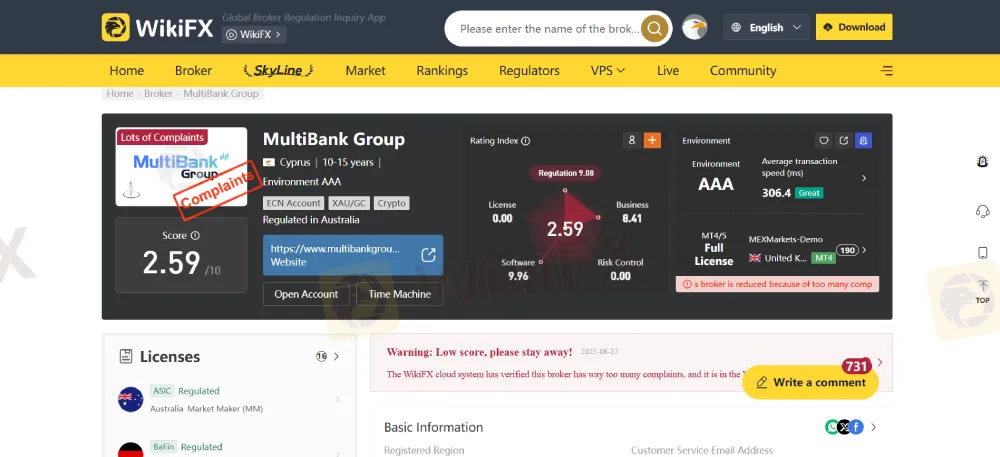

A rising number of real-world scams in the Forex trading sector is prompting traders to seek out platforms that expose fraudulent broker activity. Among these, WikiFX has emerged as a significant resource for scam detection—bridging the gap between aggrieved traders and accountability by transforming individual complaints into verifiable, public warnings.

Real Stories, Real Consequences

WikiFX scam reviews are not mere testimonials; they represent firsthand accounts from victims of elaborate Online trading scams. Traders submit detailed Forex trading scam reports, recounting everything from sudden account freezes and withdrawal denials to outright broker disappearances after large deposits. These real trader scam experiences—often corroborated by screenshots, email chains, and deposit receipts—are meticulously reviewed by WikiFXs team, ensuring only verified broker complaints make the public record.

One Forex fraud case study, submitted in early 2025, documented a broker who manipulated trading platforms to artificially induce losses, wiping out client balances. The user provided recorded calls and transaction IDs, which WikiFX cross-checked with regulatory databases and other victim submissions. This multi-source verification process underscores the platforms expertise and commitment to factual reporting.

How WikiFX Unravels Fraud—A Step-by-Step Process

Understanding how WikiFX exposes fraud begins with its open submission system. Users download the WikiFX mobile app, create an account, and navigate to the “Report a Scam or Exposure” section. Here, they upload scam broker evidence—including trade histories, correspondence, and payment records—alongside a written narrative of their experience. The platforms moderators, many with backgrounds in finance compliance, scrutinize each claim. Confirmed cases are published as online trading scam alerts, complete with broker names, regulatory status (or lack thereof), and actionable advice for affected users.

The platforms reputation for reliability in scam detection—evidenced by inclusion in financial news analyses and regulatory advisories—adds to its authority. For traders asking, “Is WikiFX reliable for scam detection?” the flood of detailed, cross-verified case studies offers a resounding answer.

Empowering Traders to Act

WikiFX is more than an archive; it is a tool for consumer defense. Each new Forex scam report not only warns others but also pressures regulators to investigate unlicensed brokers. Many victims, once silent, now cite the WikiFX broker verification guide as their first step after encountering fraud. The platforms structured reporting process—simple, secure, and transparent—has made it a cornerstone for safe trading advocacy.

Would-be victims are urged to act swiftly: document everything, secure copies of all communications, and follow WikiFXs submission process to turn individual harm into collective protection. In an industry rife with risk, such real-life Forex scam stories exposed serve as both caution and catalyst—proof that evidence, when shared, can stem the tide of fraud.

Exposing a Scam Broker on WikiFX: A Step-by-Step Guide

To report a fraudulent broker and contribute to WikiFX scam exposure:

By following these steps, victims not only seek justice but also fortify the trading ecosystem against future fraud. In the battle against Forex scams, WikiFX is proving that transparency and collective action remain the most effective shields.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Mastering forex broker regulation ensures you avoid pitfalls and select trustworthy platforms. We’ll cover regulator types, license details, the distinction between licensed and registered, and practical steps.

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!