Abstract:MultiBank Group faces growing scam claims despite multiple regulations; client complaints highlight withdrawal issues, inducement fraud, and shady practices.

MultiBank Group Under Fire Amid Flood of Scam Claims

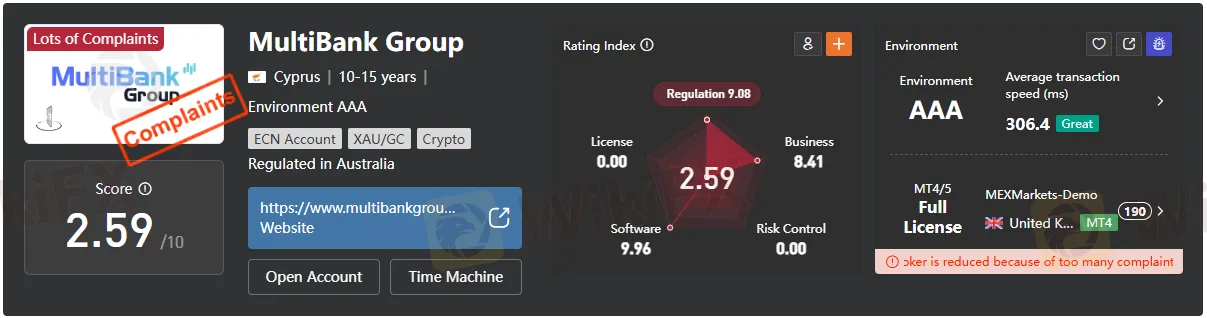

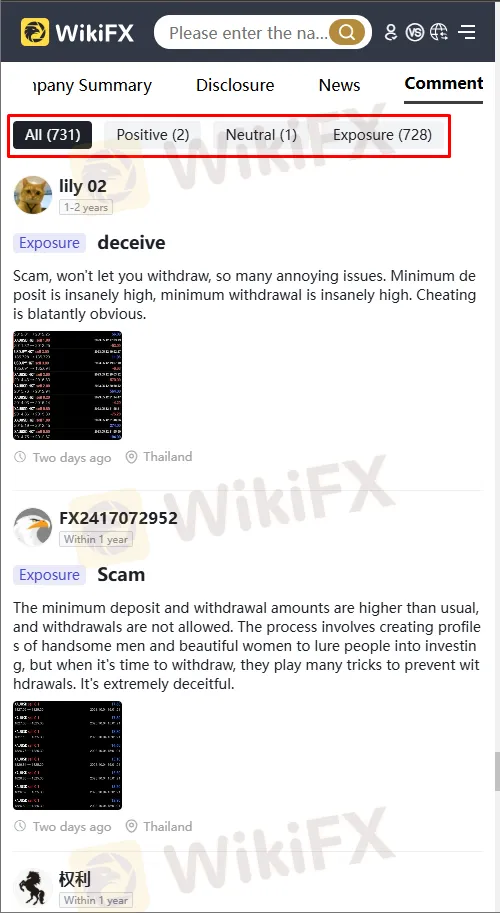

MultiBank Group, a forex broker operating globally and regulated in several major jurisdictions, is currently facing a surge in scam claims and customer complaints. According to recent MultiBank broker reviews and industry data, the broker has amassed a total of 728 complaints from clients, sparking heightened concerns over MultiBank Group scam claims and regulatory scrutiny.

Increasing Complaints Challenge Regulated Brokers Reputation

Despite being regulated by authorities such as ASIC, BaFin, CYSEC, SCA, MAS, and KNF, MultiBank Groups reputation has been overshadowed by the volume of negative MultiBank customer experiences. The firm holds additional offshore registrations, including with the FSC, while licenses from DFSA, FCA, CNMV, and CIMA have been revoked or exceeded regulatory limits. Certain statuses, such as under the VFSC and FSA, remain unverified, fueling further

MultiBank Group regulation concerns.

Recent customer exposures have brought troubling trends to light. For example, one user reported that MultiBank Group demands unusually high minimum deposit and withdrawal amounts, only to block withdrawal requests with elaborate excuses. Victims often find their withdrawal attempts stalled by dubious requirements and opaque procedures, fueling accusations of deception and fraud.

Additional cases highlight persistent platform-related problems:

- Website Accessibility Issues: Some users complain they are unable to access MultiBank Groups official website, raising suspicions about potential platform instability or deliberate lockouts targeting dissatisfied customers.

- Inducement Fraud: One report detailed how a previously defunct platform resurfaced to target Chinese investors with cashback offers that vanished after the first month, leaving clients unable to withdraw even modest amounts like $900. The company strictly enforces its own CPA rules and uses frequent, short-duration trades to lure participants, but ultimately fails to honor withdrawal requests—classic hallmarks of inducement fraud.

- Withdrawal Problems: Another impacted customer from Indonesia testified about being unable to withdraw approximately 100 million in funds, stressing the urgency and need for instant transfer to their e-wallet. Such cases, complete with screenshots of failed transactions and unprocessed withdrawal certificates, further amplify concerns over MultiBank Groups handling of client capital.

User reviews highlight a pattern of brokerage issues ranging from withdrawal difficulties to high minimum requirements and lack of transparent processes. A notable customer review deemed the brokers practices as blatantly deceptive and accused the company of obstructing fund withdrawals, which has stoked ongoing MultiBank Group fraud accusations.

Regional Influence and Biz Area Data

To better understand MultiBank Groups impact and reach, recent business area data reveals a concentration of influence in specific regions. The broker shows highest activity and market presence in the United Arab Emirates (AE) with an influence score of 7.32, followed by Spain (ES) at 5.20, Colombia (CO) at 4.83, and Australia (AU) at 4.20. Other notable regions include the US (4.07), India (3.77), Canada (3.66), Italy (3.53), France (3.45), and the Philippines (PH) at 2.85. This global dispersion indicates a wide client base and operational footprint, yet reports of negative experiences and regulatory sanctions are also widespread among these countries.

This distribution suggests that while MultiBank Group is actively marketing its services and gaining clients in these regions, negative reviews and regulatory actions are also concentrated across its major markets.

Regulatory Bodies Status and Oversight Complexity

MultiBank Group claims regulation by multiple financial authorities worldwide, creating an impression of strong investor protection. However, the regulatory landscape is complex with a mix of active licenses, revoked permissions, and unverified statuses, some of which raise questions about the brokers compliance and governance.

This regulatory patchwork showcases the challenges in assessing the brokers overall legitimacy. While licenses from tier-1 regulators like ASIC (Australia) and BaFin (Germany) provide some credibility, revoked or unverified licenses in other jurisdictions highlight risks. Potential clients should especially note that multi-jurisdiction regulation does not necessarily guarantee uniform compliance or protection across all entities and countries.

Is MultiBank Group Legit? Regulatory Status Explained

With regulatory approvals in place for several regions, some traders wonder: Is MultiBank Group a scam or a legit broker? While authorities in Australia (ASIC), Germany (BaFin), Cyprus (CYSEC), and others still list the company as regulated, the accumulation of forex broker scam alerts and revoked licenses in major financial centers like the UK and Dubai raises legitimate doubts about oversight and operational integrity.

Expert analysts emphasize that revocation or suspension of licenses can signal compliance failures or responses to customer protection concerns. While being regulated offers some degree of investor protection, the volume of MultiBank Group complaints demands careful risk assessment by potential clients.

What Clients Should Know Before Trading

For those considering MultiBank Group or searching for safe alternatives to MultiBank Group broker services, it is crucial to conduct thorough due diligence. Checking authoritative sources, reading MultiBank Group customer complaint reviews, and understanding regulatory updates should be a top priority for all forex investors. Consumers who suspect fraudulent activities are advised to learn how to report fraud against the MultiBank Group broker through official regulatory channels.

Always check the brokers negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone.