Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Malaysian traders using OctaFX Malaysia should take note of a significant update affecting their accounts. As of 18 August 2025, the broker has disabled deposits via Ethereum (ETH) and Bitcoin (BTC) for clients in Malaysia.

Malaysian traders using OctaFX Malaysia should take note of a significant update affecting their accounts. As of 18 August 2025, the broker has disabled deposits via Ethereum (ETH) and Bitcoin (BTC) for clients in Malaysia. This restriction applies only to deposits, while withdrawals in these cryptocurrencies will continue as usual.

At first glance, OctaFX presents itself as a long-established, professional broker with a strong international presence. Its sleek website, diverse range of trading instruments, and claims of regulatory oversight often reassure traders. However, a closer OctaFX review conducted by WikiFX reveals a different story.

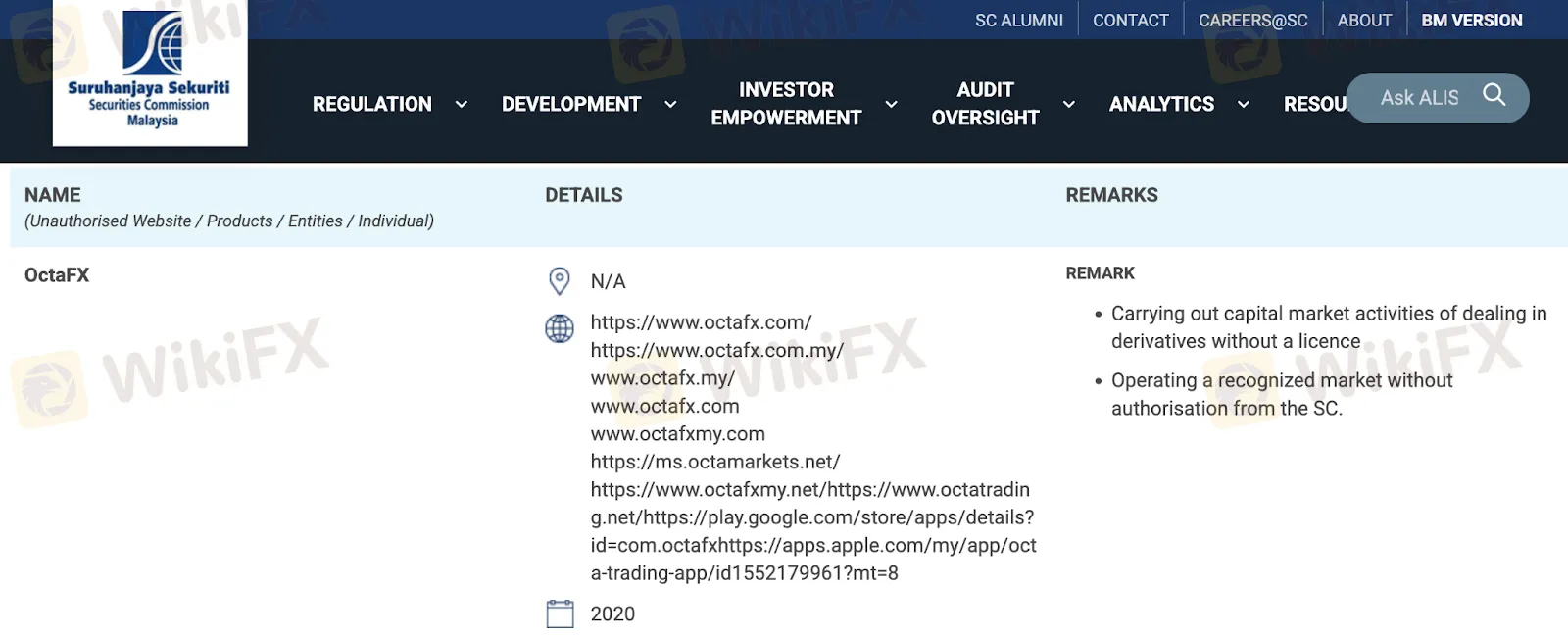

The Securities Commission of Malaysia (SC) has officially placed OctaFX on its Investor Alert List. The regulators notice states that OctaFX has been conducting derivative trading activities without a valid licence and operating a recognised market without authorisation. This means that, despite its global reputation, OctaFX is currently operating in Malaysia without proper approval from the SC.

Globally, OctaFX does hold a licence with the Cyprus Securities and Exchange Commission (CySEC) under licence number 372/18, registered as a market maker. While this offers a degree of legitimacy in Europe, it does not cover operations in Malaysia. This is where many investors misunderstand the concept of regulation. Being licensed in one jurisdiction does not automatically mean a broker is authorised everywhere.

For Malaysian traders, this distinction is crucial. A brokers regulation is only effective in the regions where it is recognised. In the case of OctaFX Malaysia, clients lack the local protections that come with dealing through an SC-approved broker. This exposes traders to risks such as limited recourse in cases of disputes, delayed fund recovery, or potential malpractice.

In every circumstance, investors should not only verify whether a broker is regulated, but also ensure that it is authorised specifically within Malaysias legal framework.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.