Abstract:The Financial Conduct Authority (FCA) has released a new warning list of unauthorized and potentially fraudulent brokers operating in 2025. These firms are not licensed to offer financial services in the UK and may pose serious risks to traders and investors.

If you're trading online or considering opening an account. It's crucial to check whether the broker is FCA-regulated or not. The Financial Conduct Authority (FCA) has released a new warning list of unauthorized and potentially fraudulent brokers operating in 2025. These firms are not licensed to offer financial services in the UK and may pose serious risks to traders and investors.

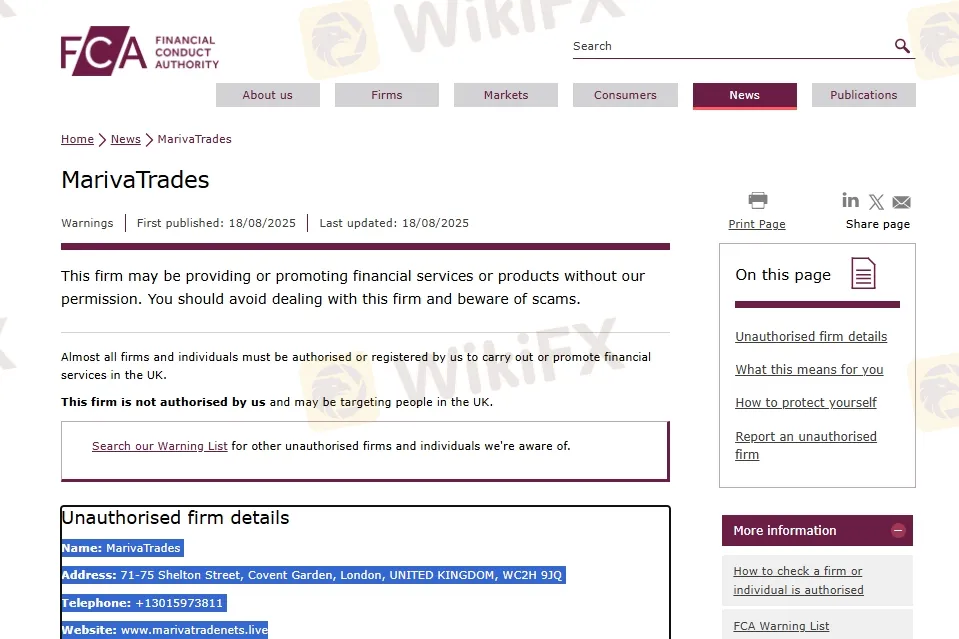

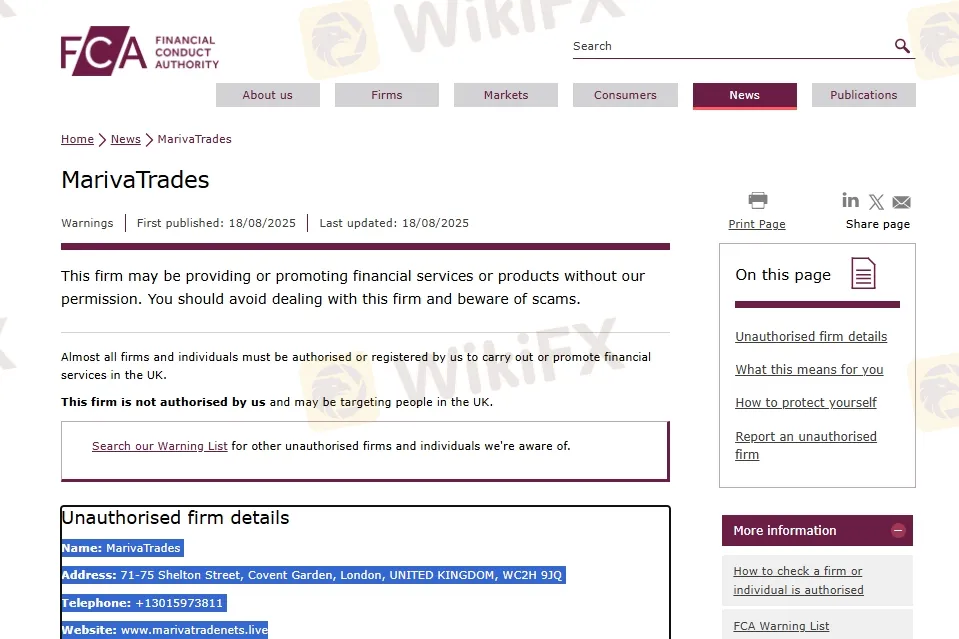

1. Name: MarivaTrades

Address: 71-75 Shelton Street, Covent Garden, London, UNITED KINGDOM, WC2H 9JQ

Telephone: +13015973811

Website: www.marivatradenets.live

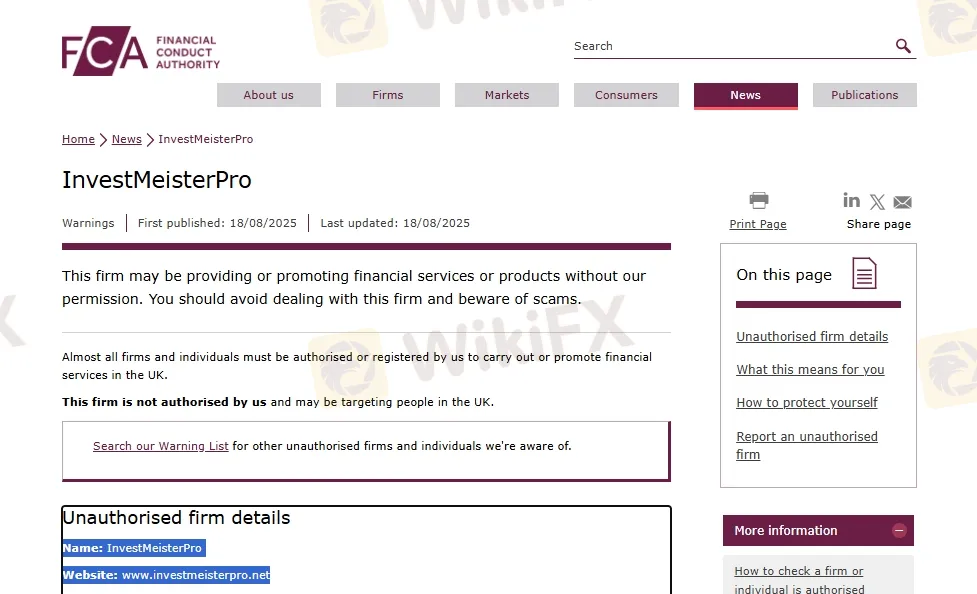

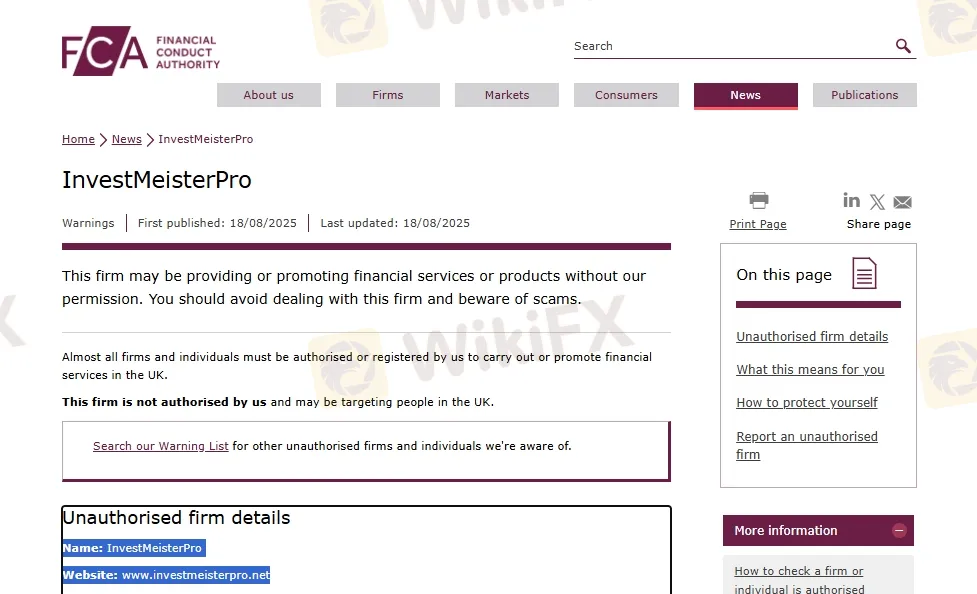

2. Name: InvestMeisterPro

Website: www.investmeisterpro.net

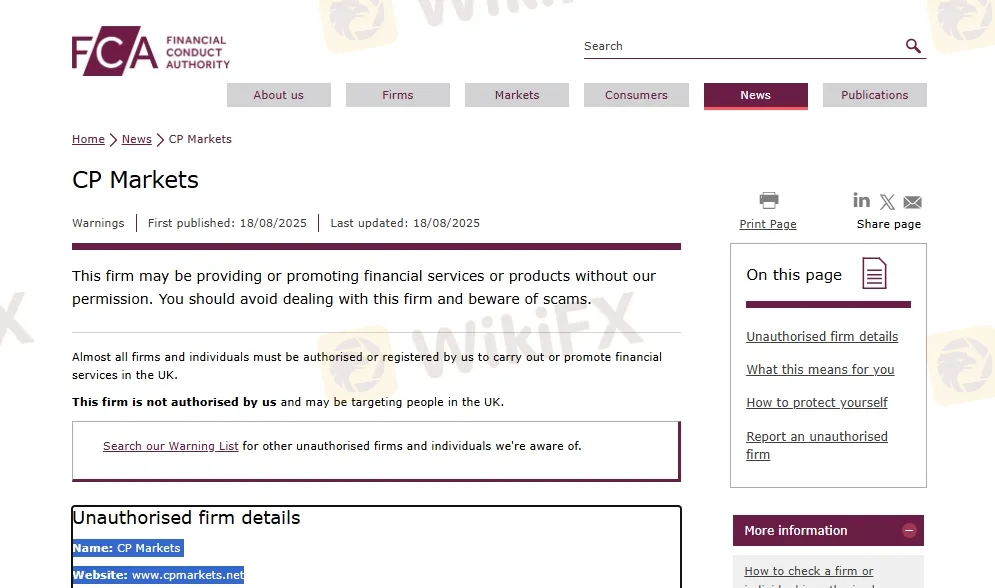

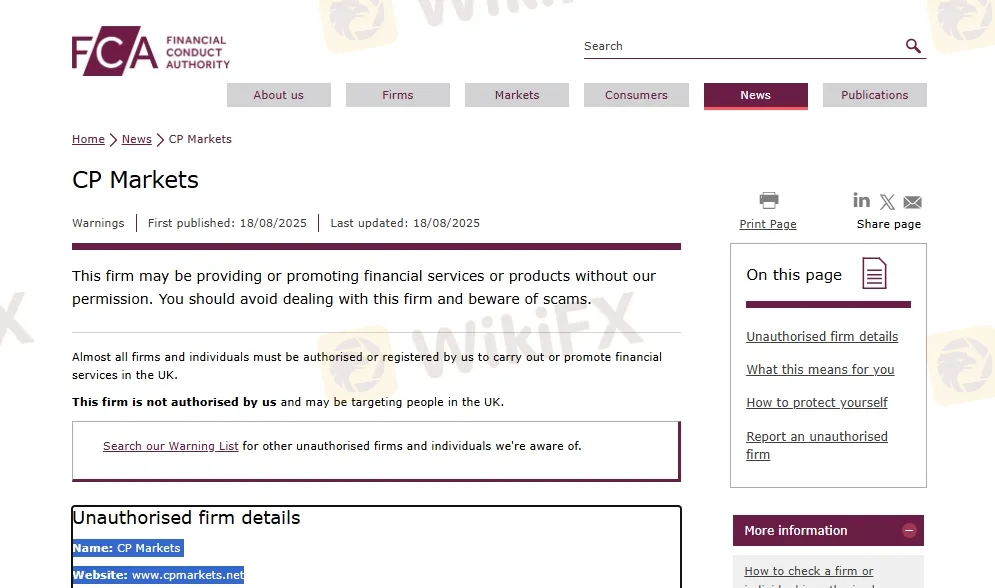

3. Name: CP Markets

Website: www.cpmarkets.net

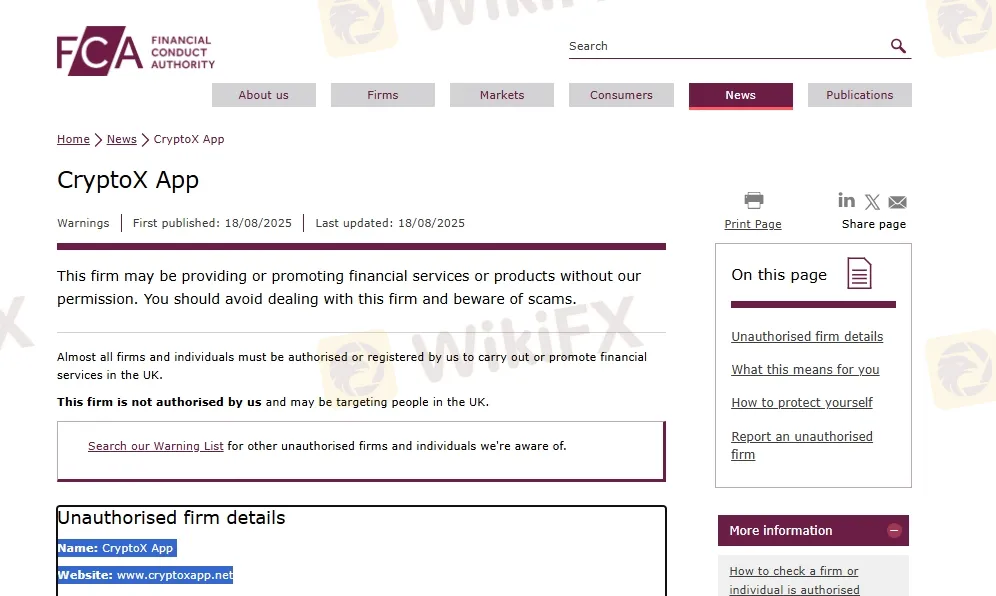

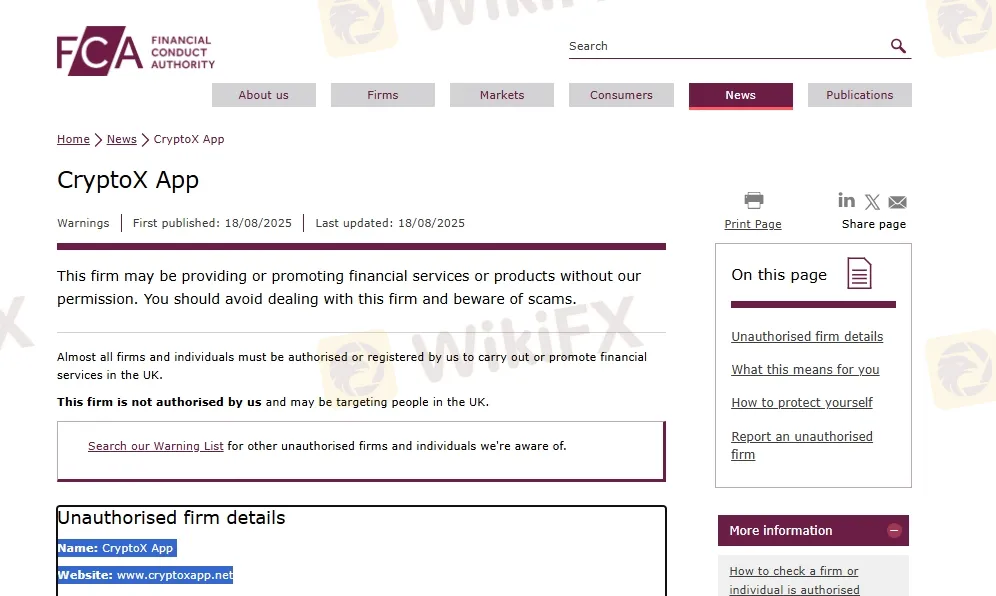

4. Name: CryptoX App

Website: www.cryptoxapp.net

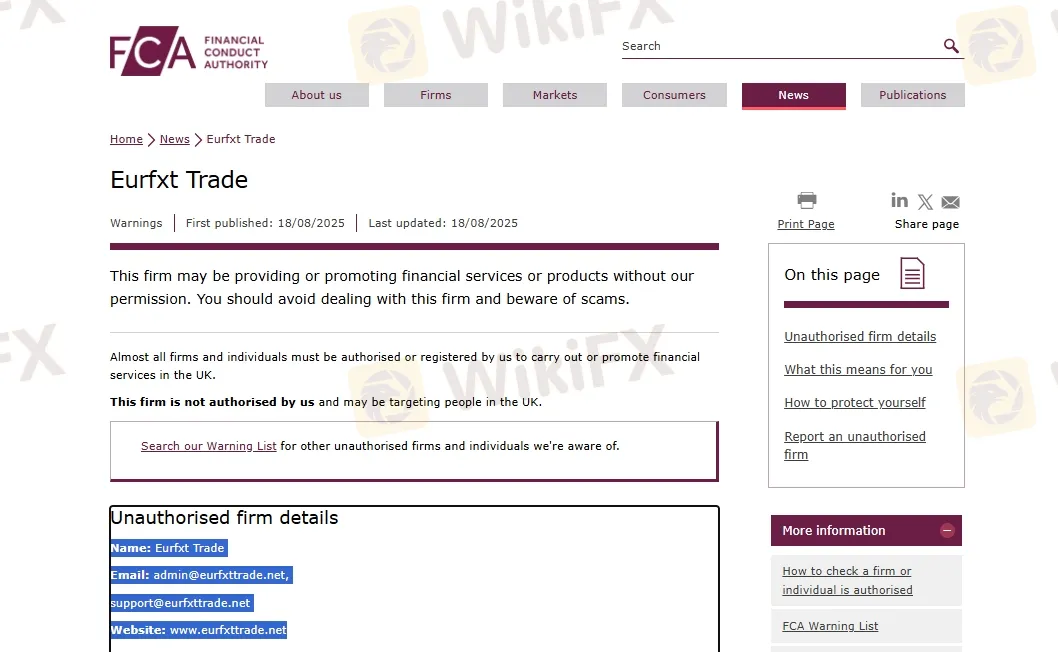

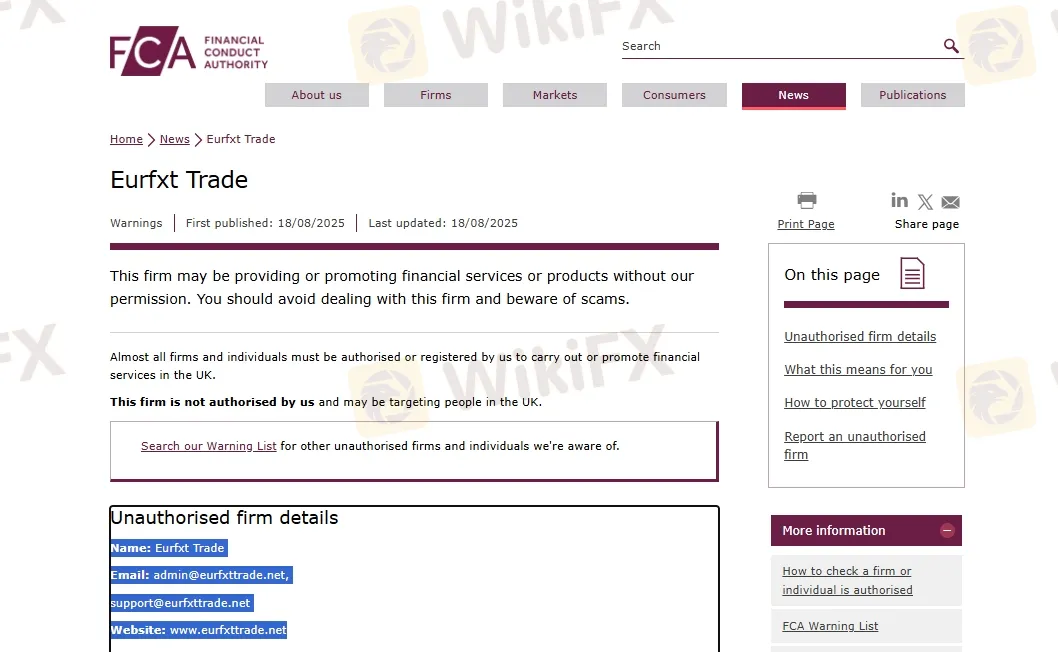

5. Name: Eurfxt Trade

Email: admin@eurfxttrade.net,

support@eurfxttrade.net

Website: www.eurfxttrade.net

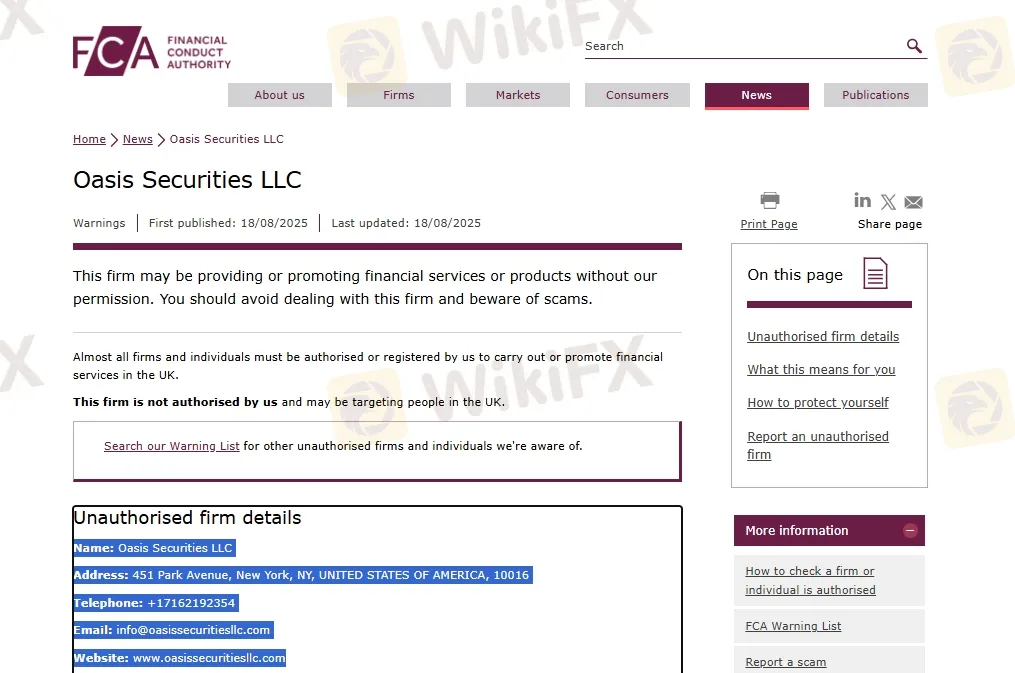

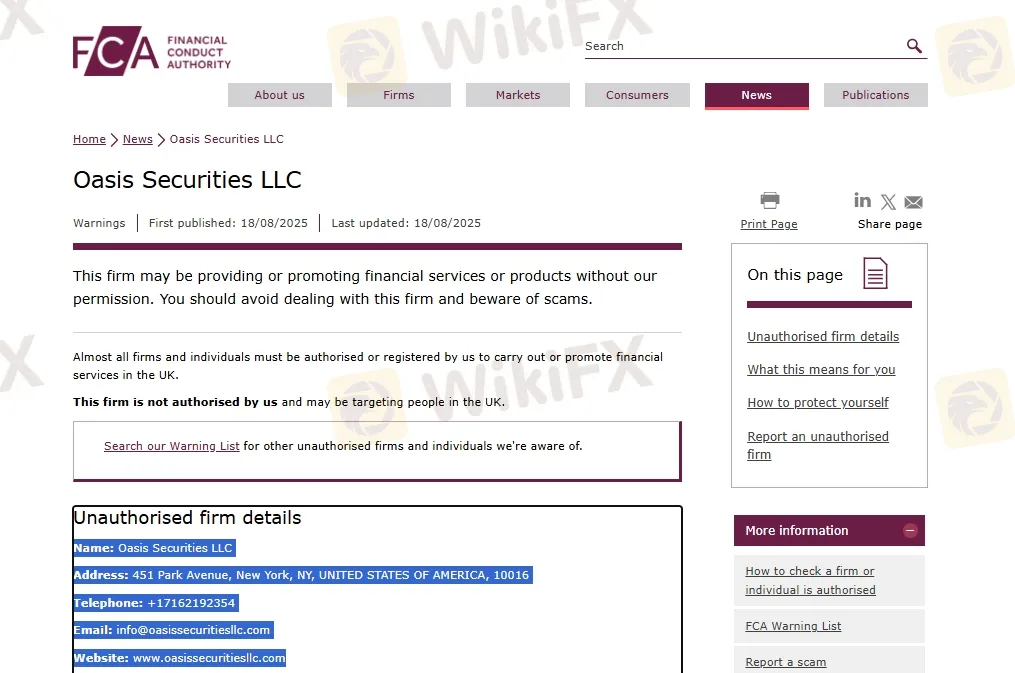

6. Name: Oasis Securities LLC

Address: 451 Park Avenue, New York, NY, UNITED STATES OF AMERICA, 10016

Telephone: +17162192354

Email: info@oasissecuritiesllc.com

Website: www.oasissecuritiesllc.com

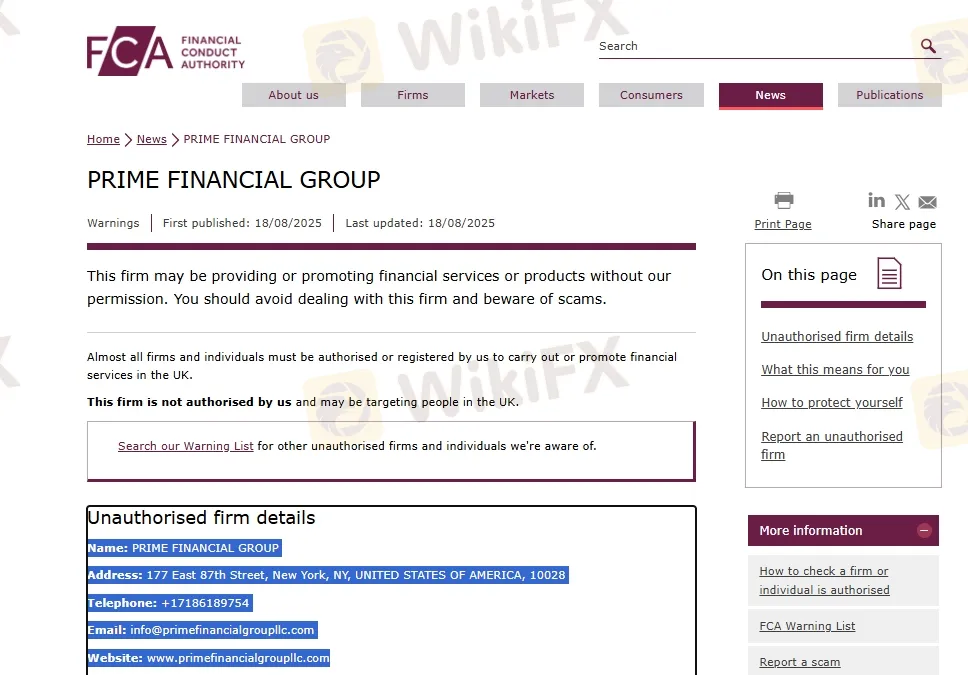

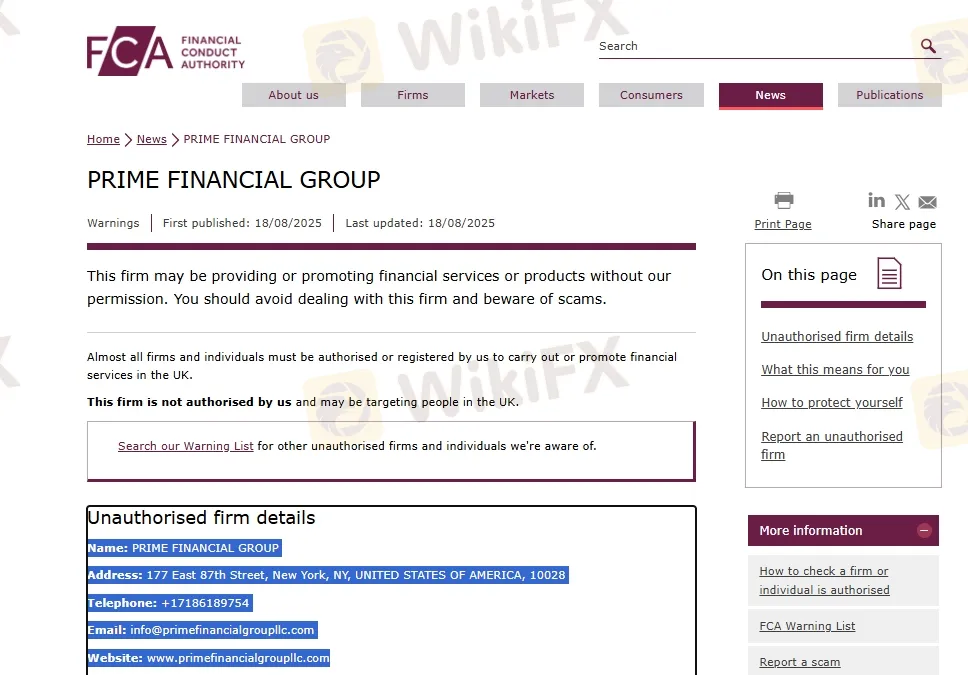

7. Name: PRIME FINANCIAL GROUP

Address: 177 East 87th Street, New York, NY, UNITED STATES OF AMERICA, 10028

Telephone: +17186189754

Email: info@primefinancialgroupllc.com

Website: www.primefinancialgroupllc.com

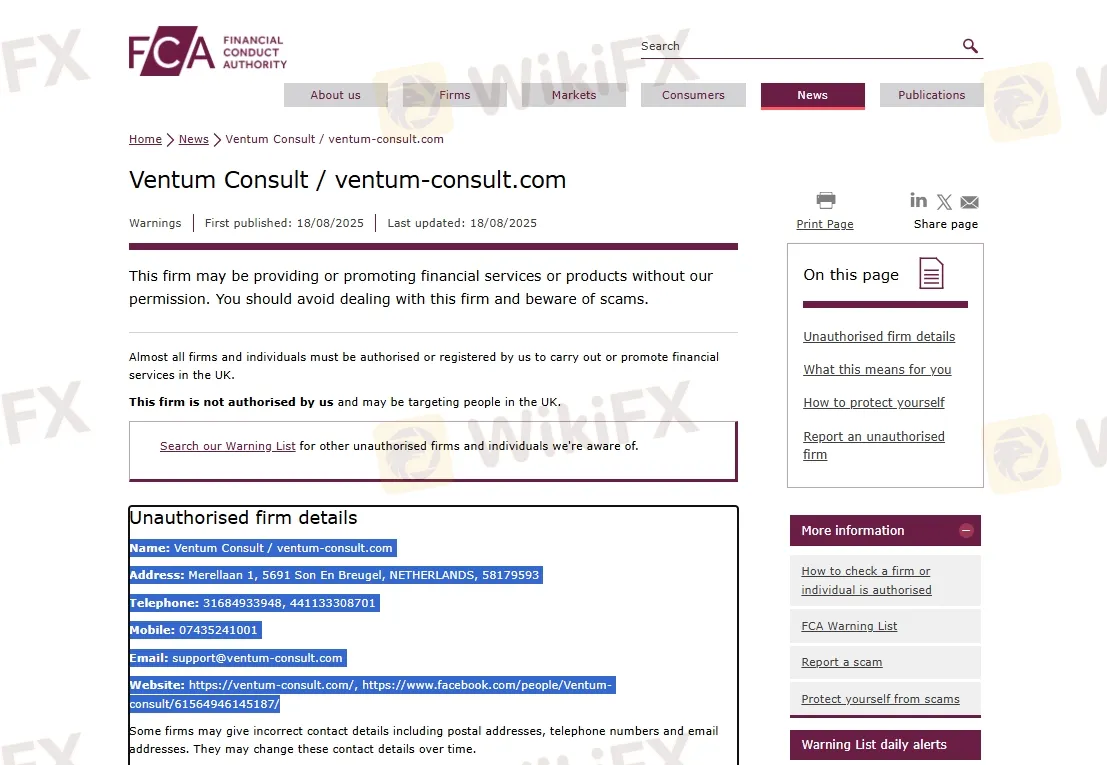

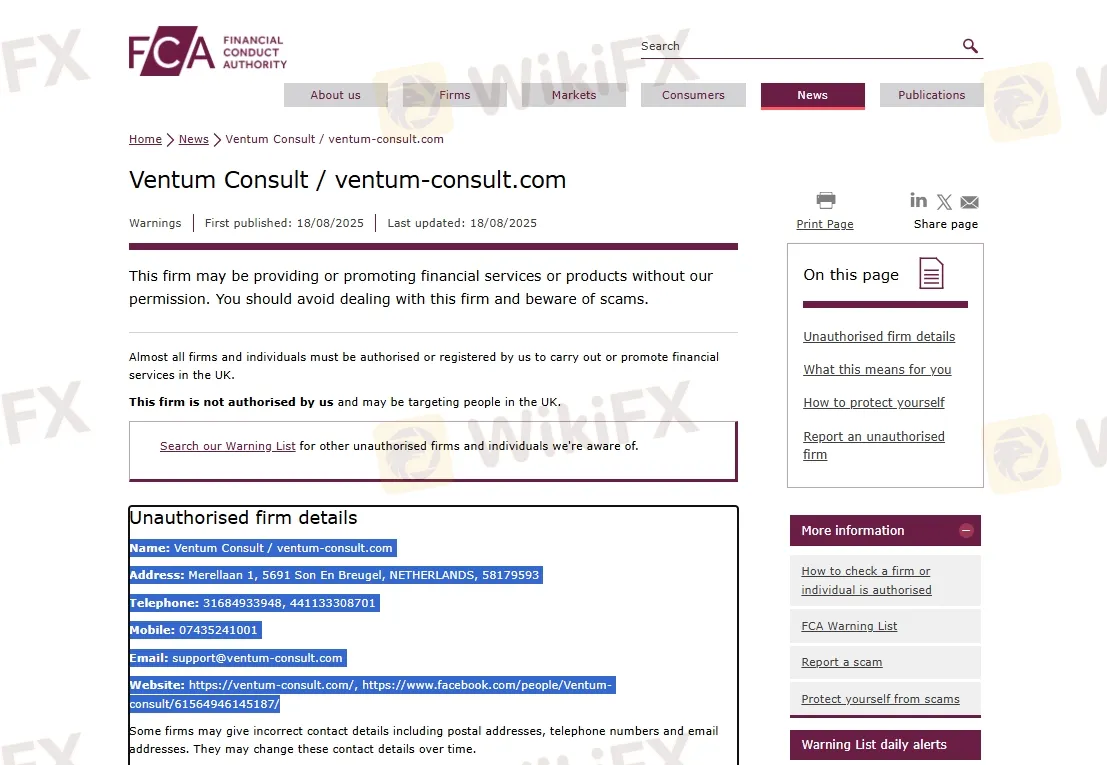

8. Name: Ventum Consult / ventum-consult.com

Address: Merellaan 1, 5691 Son En Breugel, NETHERLANDS, 58179593

Telephone: 31684933948, 441133308701

Mobile: 07435241001

Email: support@ventum-consult.com

Website: https://ventum-consult.com/, https://www.facebook.com/people/Ventum-consult/61564946145187/

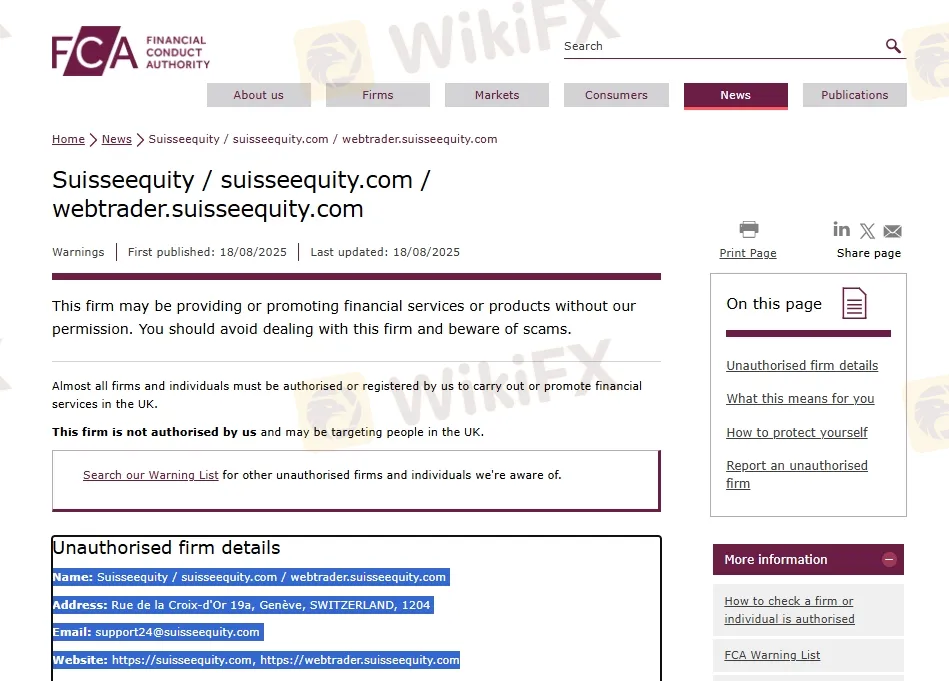

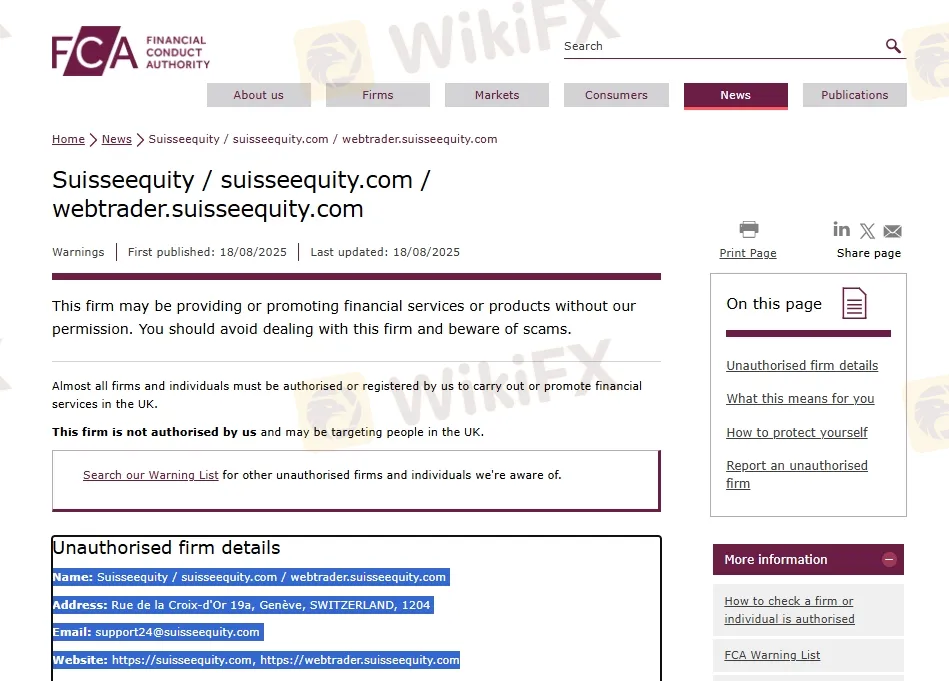

9. Name: Suisseequity / suisseequity.com / webtrader.suisseequity.com

Address: Rue de la Croix-d'Or 19a, Genève, SWITZERLAND, 1204

Email: support24@suisseequity.com

Website: https://suisseequity.com, https://webtrader.suisseequity.com

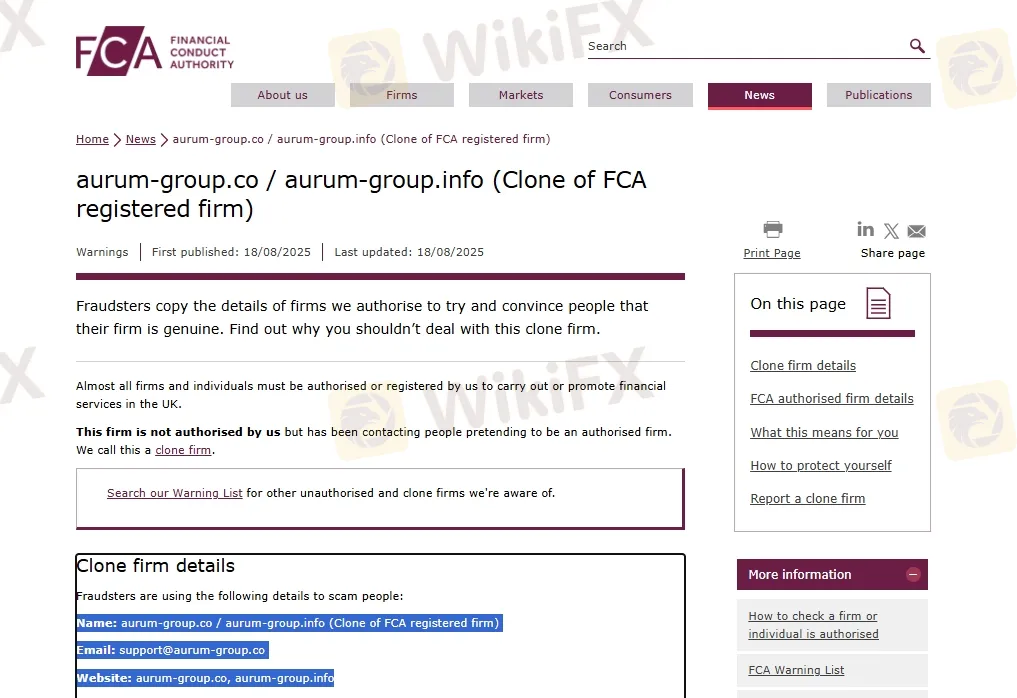

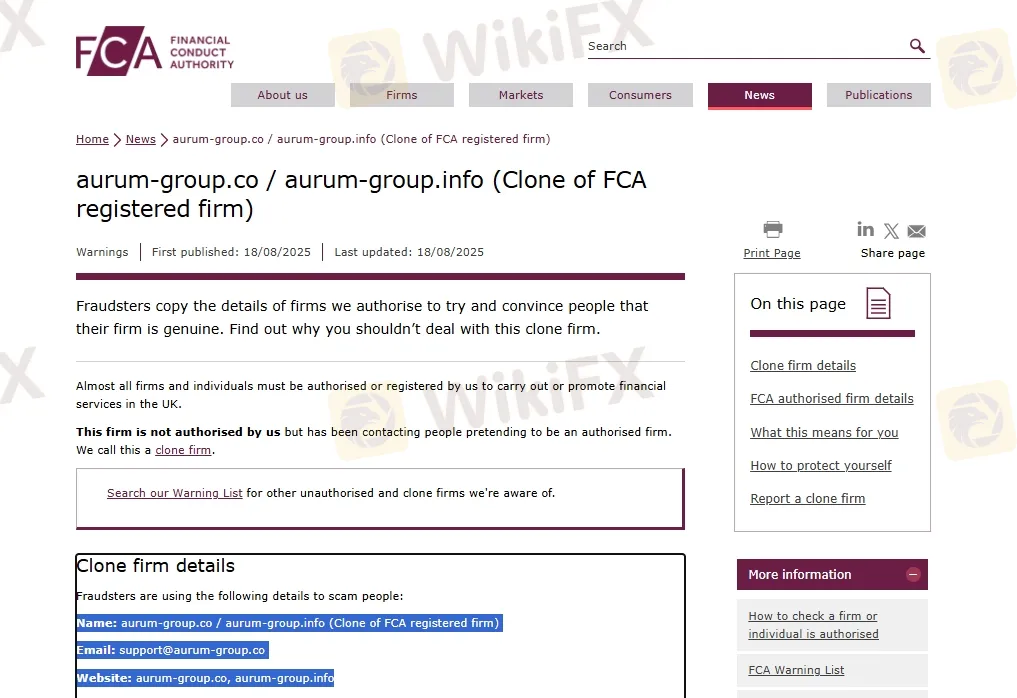

10. Name: aurum-group.co / aurum-group.info (Clone of FCA registered firm)

Email: support@aurum-group.co

Website: aurum-group.co, aurum-group.info

What Is the FCA & Why Does Its Warning Matter?

The Financial Conduct Authority (FCA) is the United Kingdom‘s independent financial regulatory body responsible for overseeing financial markets and firms. FCA’s core responsibilities include protecting consumers, maintaining the integrity of the UK financial system, and promoting healthy competition within financial markets.

An FCA (Financial Conduct Authority) warning is a serious alert that a broker or financial service is operating without proper authorization in the UK. The FCA is one of the worlds most respected financial regulators, and its role is to protect investors from fraud, scams, and unethical practices.

If a broker receives an FCA warning, it means:

1. The broker is not licensed or regulated by the FCA.

2. It is not allowed to offer financial services in the UK.

3. Your funds are not protected under UK financial laws.

4. You have no legal recourse if the broker disappears or refuses withdrawals.

What to Do If You' ve Been Scammed?

1. Verify the License of the brokers

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Dont Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Dont Rush

9. Report Suspicious Activity

10. Keep Records

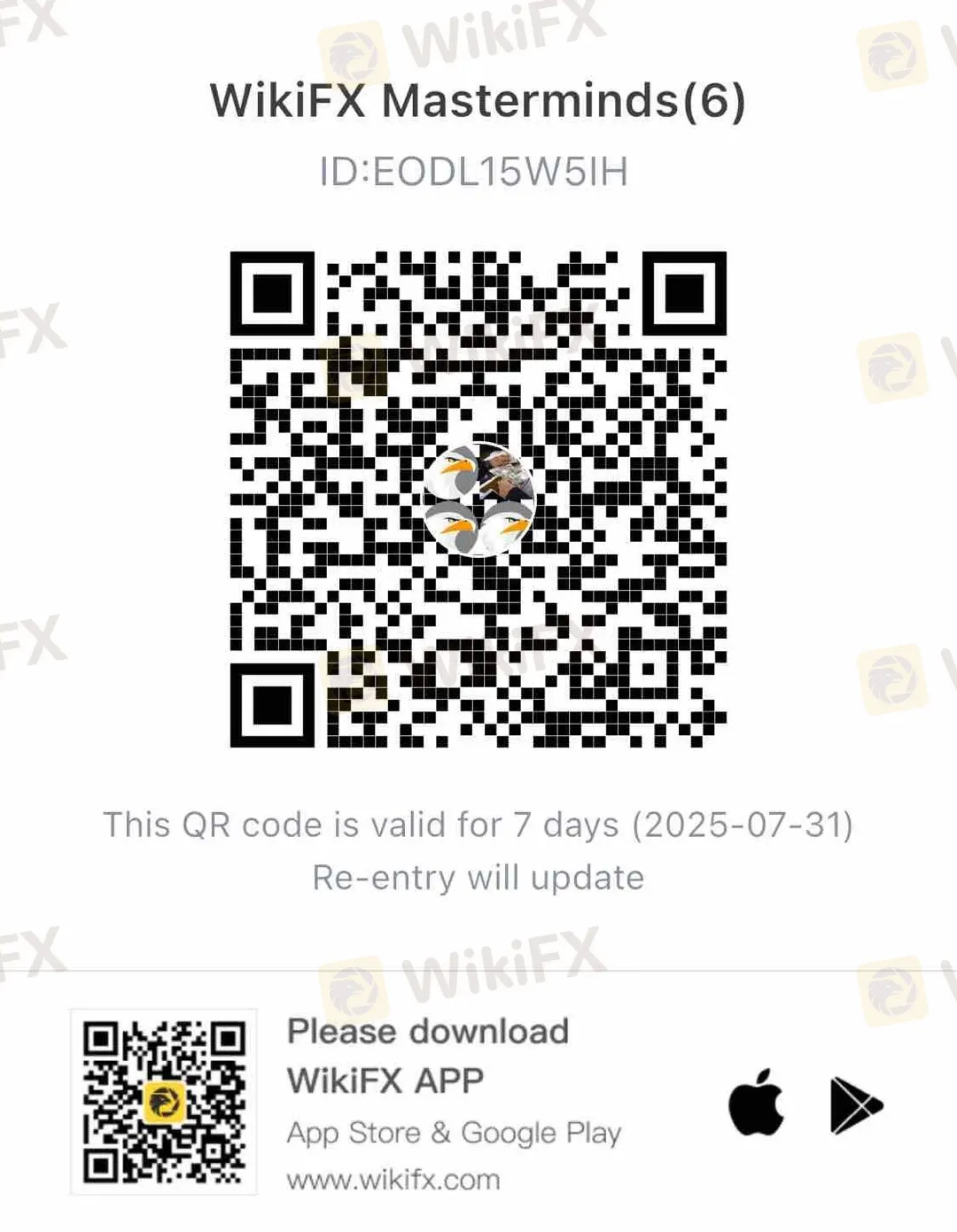

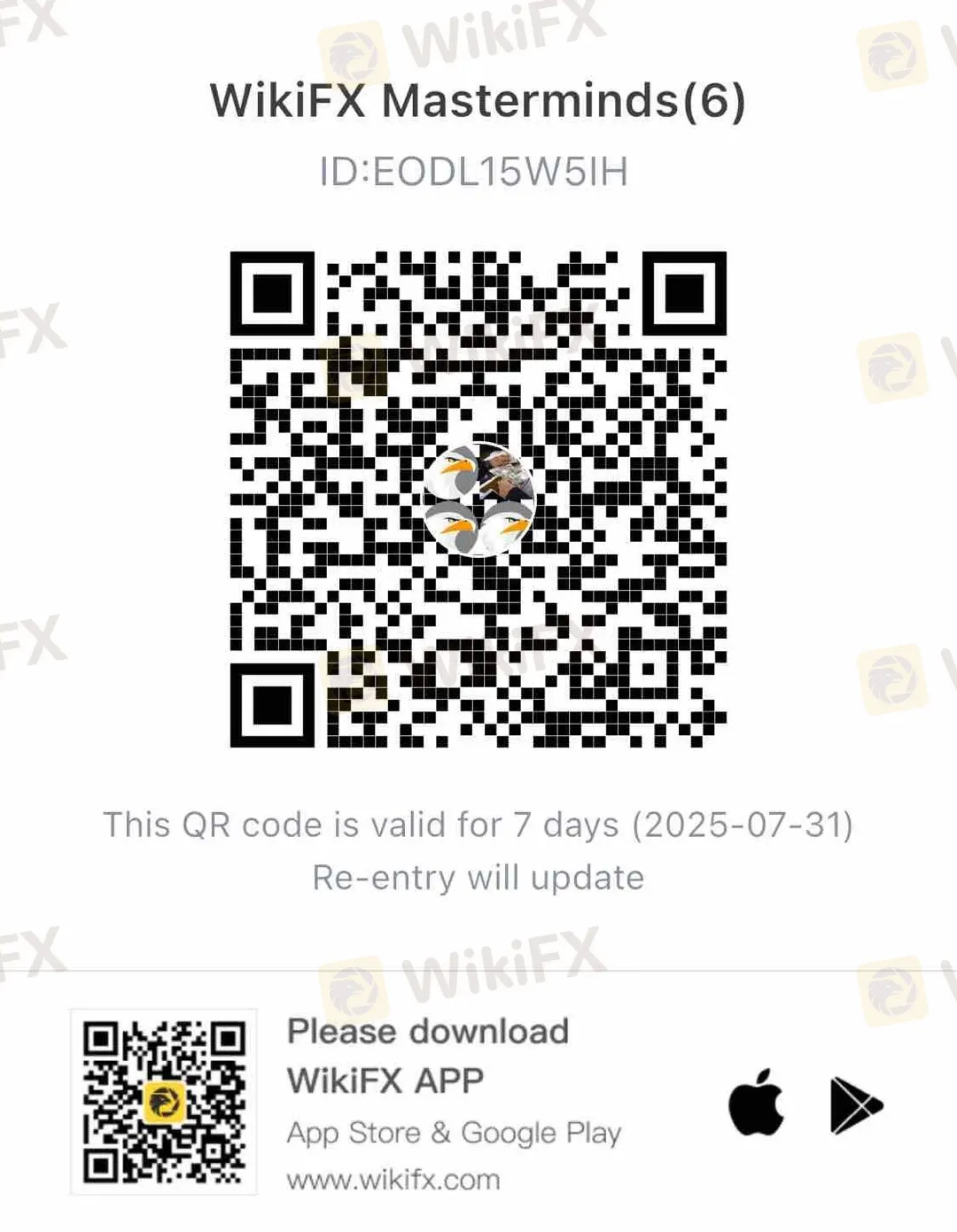

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!