WikiFX Invitation Rewards Program

Invite friends and earn points, the more you invite, the more you earn!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:TradeEU is a Cyprus-based CFD broker that launched around 2021 and offers more than 250 instruments across forex, stocks, indices, commodities, and crypto. The Article is about to give a comprehensive review of this broker.

TradeEU is a Cyprus-based CFD broker that launched around 2021 and offers more than 250 instruments across forex, stocks, indices, commodities, and crypto. The Article is about to give a comprehensive review of this broker.

Background & regulation

TradeEU is associated with Titanedge Securities Ltd, which is listed with the Cyprus Securities and Exchange Commission under licence 405/21 (license date Oct 18, 2021). That CySEC authorization means the firm must meet EU retail CFD rules (leverage caps for retail clients, segregation of client funds, basic disclosure requirements, etc.). That regulatory status is an important positive signal. Be aware that there are multiple “TradeEU” / “TradeEU Global” web properties and third-party pages that reference different legal entities (some pages point to a Tradesense/ Mauritius setup). That makes it worth double-checking which legal entity you are signing up with and which license covers your account.

Instruments

TradeEU advertises 250+ CFD instruments covering forex pairs, major stocks, indices, commodities, and a selection of cryptocurrencies. That breadth is typical for modern CFD brokers and suits multi-asset traders who want everything on a single platform.

Account types, spreads & fees

TradeEU offers tiered accounts aimed at different trader profiles:

The broker markets commission-free CFD trading (costs are embedded in the spread). Maximum leverage for retail clients is reported at 1:30, in line with EU retail caps. Sources publish the same spread figures across multiple review sites, which supports their consistency ,but spreads can vary by instrument and market conditions, so check live quotes before trading.

Trading platform

TradeEU uses MT5 as its main trading platform. While TradeEUs sites often emphasize a web/mobile platform or TradingView/WebTrader integration.

Is TradeEU Reliable?

Positives

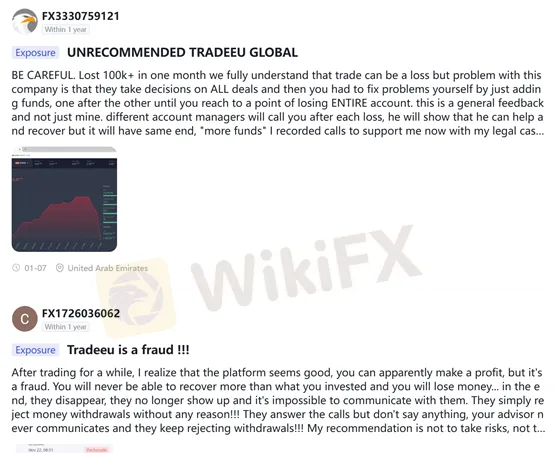

red flags

Multiple brands / legal names online: different marketing sites sometimes point to different legal entities (Titanedge in Cyprus vs Tradesense/ Mauritius for other “TradeEU” sites). This can be legitimate (different corporate structures for regional operations), but it can also confuse customers — always check which legal entity is operating the account and what regulator covers it.

Conclusion

TradeEU is a regulated broker with a full multi-asset offering and tiered pricing. That regulatory status is a meaningful plus. However, the combination of mixed online reviews and multiple brand/website variants can not be ignored as well.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Invite friends and earn points, the more you invite, the more you earn!

Did you fail to receive payouts from KUBERA MARKETS despite successfully passing the trading challenge? Failed to log in to the trading account despite passing both the evaluation and funded phase? Were you surprised by the sudden nominal fee norm to receive a funded account? Did you have to go through a long withdrawal process? We have investigated these user claims while preparing this KUBERA MARKETS review article. Keep reading!

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check