Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

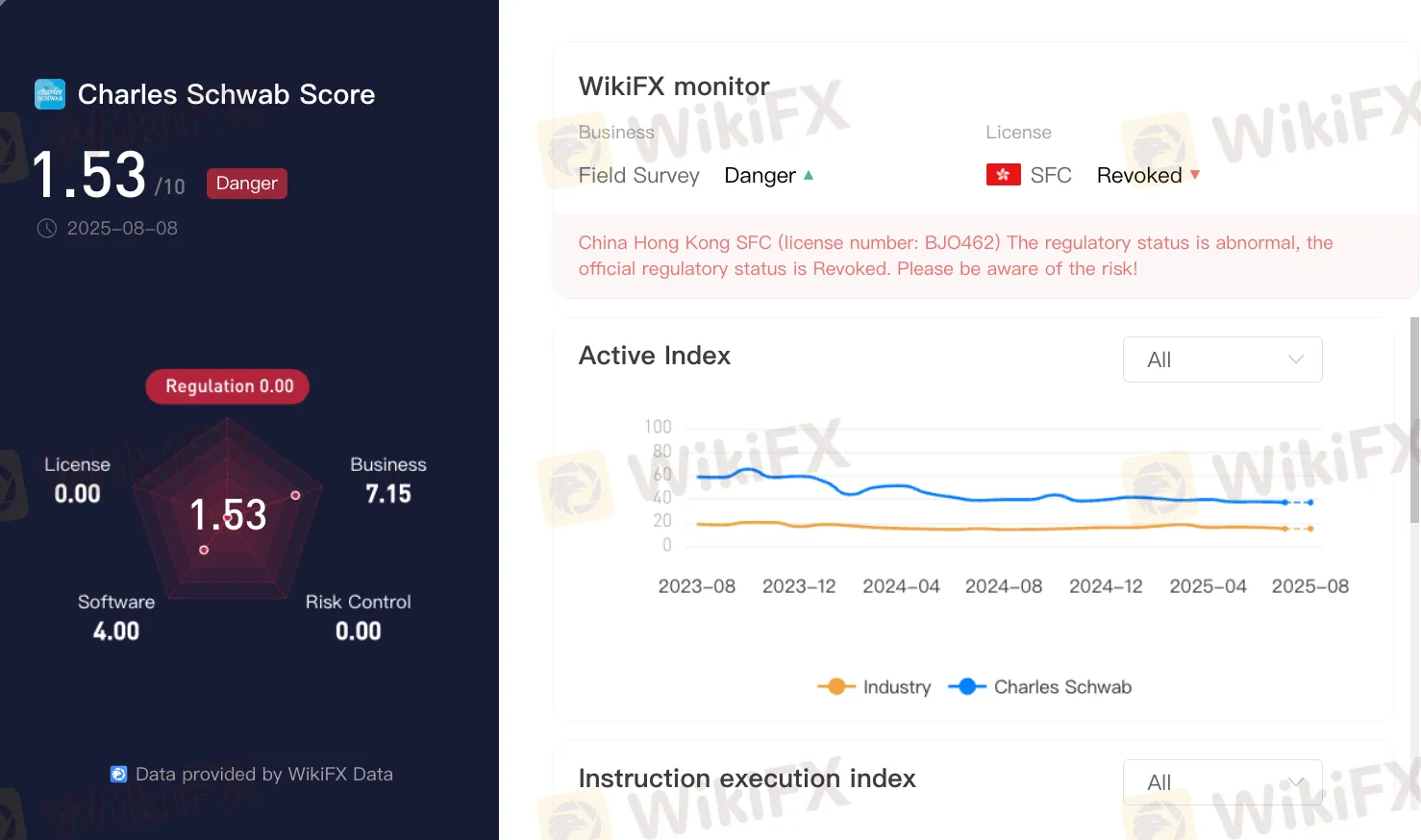

Charles Schwab is widely known as a major U.S. brokerage brand, but its presence in the forex market is limited. According to its broker profile, the company holds a rating of 1.53/10 with clear risk alerts and no active forex regulation displayed. Historical records also show a revoked Hong Kong futures licence connected to a previously affiliated entity.

The profile data shows no current forex-specific regulatory licence. The revoked licence on record pertains to a Hong Kong futures authorisation, which is no longer active. While Charles Schwab operates in highly regulated U.S. securities and futures markets, these frameworks do not substitute for dedicated retail forex oversight in jurisdictions where such licensing is required.

Schwab offers foreign exchange access primarily through Charles Schwab Futures and Forex LLC, focusing on select clients who meet eligibility requirements. This service is integrated within the companys proprietary trading systems rather than popular retail platforms like MT4 or MT5. For traders accustomed to retail-oriented FX environments with flexible account options and high-frequency execution, the structure may feel restrictive.

The forex service is not universally available. Access depends on client residency, account type, and meeting specific eligibility criteria. In some regions, Schwab does not provide retail forex trading at all, aligning more with its institutional and professional focus.

From a forex-only perspective, the combination of a low profile rating, absence of active FX regulation on record, and limited retail access makes Charles Schwab an unsuitable choice for traders seeking a dedicated, retail-focused forex broker. While the brand remains reputable in equities, ETFs, and wealth management, its role in the forex market is specialised and not designed for broad retail participation.

Charles Schwabs strength lies in its traditional brokerage and investment services, not in providing a wide-access retail forex platform. For traders whose primary interest is forex, especially on MT4/MT5 with competitive retail terms, alternative brokers with active forex regulation and higher FX-focused ratings should be considered.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.