Global Brokers Expand Into Crypto Trading While Testing Prediction Market Models

Regulators are scrutinizing prediction markets as brokers add crypto assets to their platforms. Is innovation outpacing compliance?

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

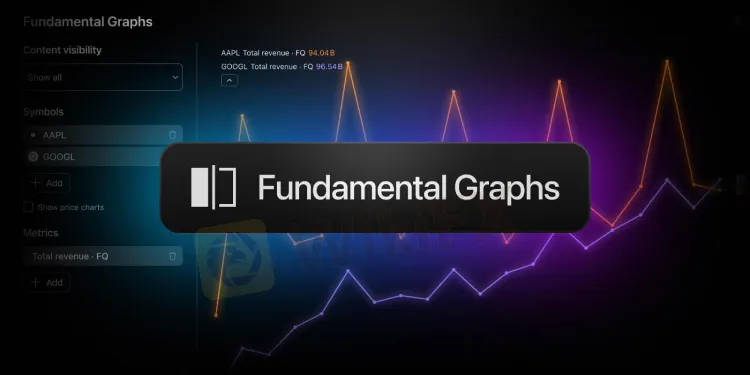

Abstract:TradingView introduces Fundamental Graphs, allowing users to easily compare financial metrics across multiple companies and enhance their investment strategy with data-driven insights.

TradingView has launched a powerful new feature for investors and traders: Fundamental Graphs. This tool is designed to help users compare key financial metrics on TradingView, offering an intuitive way to visualize company fundamentals easily and refine analysis—whether youre a novice trader or a seasoned analyst.

The ever-growing complexity of financial markets demands tools that deliver insights efficiently. TradingView‘s Fundamental Graphs address this need by allowing users to visualize company fundamentals easily. Investors can delve into earnings per share (EPS), revenue, profit, R&D spending, and more. By presenting these metrics side by side, the platform offers a clear view of a company’s financial health, helping you move beyond price charts and into the realm of fundamental analysis for a well-rounded perspective.

One standout feature is multi-symbol fundamental data comparison. With the ability to add or remove up to nine symbols and nine metrics in a single chart, users can quickly gauge performance across companies and industries. Whether youre evaluating tech giants or comparing competitors within a single sector, this tool brings all relevant financial data into focus. Switching between symbols and metrics is seamless, letting you customize your comparison for rapid, reliable investment insights.

TradingView excels in chart customization. The Fundamental Graphs interface is user-friendly and built for flexibility. Users can choose from various visibility modes—showing all metrics for all symbols, focusing on one company‘s full suite of metrics, or zeroing in on how each company fares in a single financial category. The control panel allows for adjustments to chart scale (from regular to logarithmic or indexed views) and date range, letting you tailor every chart to your analysis style. Plus, price charts can be toggled on or off, ensuring fundamental data doesn’t get lost in price volatility.

Fundamental Graphs help users enhance investment strategy with data. Instead of relying solely on technical signals, you can base decisions on real business performance—backed by data from income statements, balance sheets, and cash flow. Every chart configuration is automatically saved to a unique URL, making it easy to share analyses with colleagues or clients. Instant snapshots let you document findings for future reference, promoting better collaboration and decision-making.

Imagine trying to discover which tech stock is scaling efficiently or which competitor might be stagnating. With TradingView, you can visualize metrics ranging from quarterly revenue growth to R&D investments—in one chart and at a glance. This multi-metric, multi-symbol approach means investors can spot trends, divergences, and opportunities that would be difficult to identify through traditional research methods.

In fast-moving markets, data-driven tools are vital. TradingView‘s Fundamental Graphs empower you to compare key financial metrics, visualize company fundamentals easily, perform multi-symbol fundamental data comparison, and customize financial charts for analysis—all in an effort to enhance investment strategy with data. It’s an essential upgrade for anyone serious about navigating todays complex equity markets with confidence.

Don't miss out on the latest news and updates of TradingView. Download and install the WikiFX app on your smartphone by scanning the QR code below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Regulators are scrutinizing prediction markets as brokers add crypto assets to their platforms. Is innovation outpacing compliance?

Failing to transfer funds into or out of your Moneycorp trading account? Have you faced a sudden account closure by a United Kingdom-based forex broker? Has the broker’s customer support service failed to resolve your queries? Did their behavior remain far from good while addressing your queries? You are not alone! Many traders have questioned such alleged trading practices by the broker. In this Moneycorp review article, we have highlighted some of their complaints. Read on!

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

FXRoad exposure review: withdrawal red flags, offshore status, and safety risks explained. Learn what to watch for and how to protect your funds—read now.