Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about FIBO Group and its licenses.

When choosing a broker, regulation is often the first line of defense for any trader. In the case of FIBO Group, what may appear at first to be a well-established trading company reveals a number of concerning facts upon closer inspection. Although the broker holds some regulatory credentials, several red flags regarding its licensing status and offshore presence should not be overlooked.

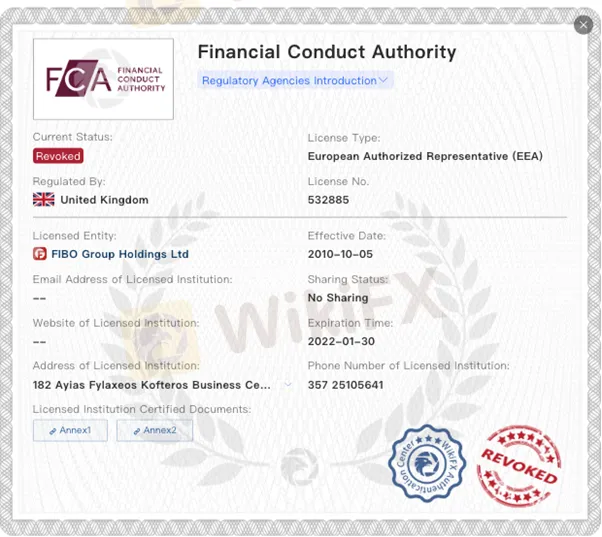

FIBO Group was once regulated by the United Kingdom‘s Financial Conduct Authority (FCA) under license number 532885. The FCA is known for being one of the most trusted financial regulators in the world, ensuring transparency and strict compliance from brokers under its supervision. However, FIBO Group’s FCA license is currently revoked, which raises immediate questions about what led to this change and whether the broker can still be trusted to meet high regulatory standards. A revoked license is a strong indicator that the broker may no longer meet the requirements of its former regulator, which can be a warning sign for traders trying to avoid scams.

In Cyprus, FIBO Group is licensed by CySEC under license number 118/10. While this license is listed as active, the broker reportedly exceeds the business scope allowed under its CySEC license, operating in ways that go beyond its approved regulatory boundaries. This means FIBO Group may be offering services it is not legally authorized to provide within that jurisdiction. Such overreach may not only breach regulatory conditions but also increase risks for users who believe they are operating under a fully compliant framework.

Another active license is held under the British Virgin Islands Financial Services Commission (BVI FSC) with license number SIBA/L/14/1063. While the BVI FSC does serve as a financial regulator, it is considered an offshore regulator, with less rigorous oversight compared to onshore authorities like the FCA or ASIC. Being registered in the British Virgin Islands, a jurisdiction known for its lenient financial regulations, means that FIBO Group can operate with more flexibility, but also with less accountability. Brokers operating offshore often escape strict regulatory scrutiny, which can create opportunities for unethical practices or even scams.

In fact, the brokers registration in the Virgin Islands is itself a point of concern. While it's legal to register companies there, the lack of strong investor protections means traders have little recourse in the event of disputes or losses. For anyone considering trading with FIBO Group, this offshore setup should be taken seriously, especially when paired with a revoked FCA license and a CySEC license that has reportedly been exceeded.

According to WikiFX, a platform that reviews brokers based on their regulatory background, platform operations, and user safety, FIBO Group scores just 4.95 out of 10. While this doesnt confirm that the broker is a scam, it certainly places it in a risk category that traders should approach with caution.

In summary, while FIBO Group may appear to be a regulated broker on paper, the full picture reveals multiple licensing issues, offshore risks, and signs of regulatory overreach. For traders seeking to avoid potential scams, it's crucial to look beyond just a list of licenses and ask more in-depth questions about their status and enforcement. A revoked FCA license and excessive activities under a CySEC license should not be taken lightly. As always, verifying a brokers current regulatory status and understanding the implications of offshore registration can go a long way in protecting your investments.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.