Abstract:Every Trader or Investor in India who wants to invest in the dynamic forex market must read this important article. It explores the future of the forex market in India and answers a common question: Forex market will rise or crash in India ? Checkout the article below.

Every trader or investor in India who wants to invest in the dynamic forex market must read this important article. It explores the future of the forex market in India and answers a common question: Forex market will rise or crash in India ? Checkout the article below.

SEBI & RBI: Key Regulators of India's Forex Market

The Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) are the two primary regulators overseeing the foreign exchange (forex) market in India. They play a crucial role in maintaining transparency, stability, and investor protection within the financial system.

These authorities regulate forex activity, issue licenses to authorized dealers, and frequently release Scam Alert against unregulated or fraudulent platforms. Due to their strict regulatory framework, many international forex brokers find it challenging to operate or establish a direct presence in India. This approach aims to safeguard Indian investors from high-risk and unregulated trading environments.

Why Future of the FX Market in India Looks Promising?

The FX market will evolve in India due to the following Reasons-

1. Digital revolution

Increasing access to advanced digital trading platforms. These platforms have made forex trading more accessible, transparent, and convenient for both retail investors and professional traders. With user-friendly mobile apps, real-time market data, and sophisticated trading tools now widely available, more people can participate in the FX market than ever before.

2. Use of Blockchain Technology

Blockchain technology is helping improve Indias forex market by making trading safer and faster. It keeps a secure and clear record of every transaction, which helps prevent fraud. Blockchain also makes sending money across countries quicker and cheaper. As more banks and companies in India start using this technology, the forex market will become more reliable and efficient, helping it grow in the future.

3. Improved Regulatory Framework

Indias forex market is growing stronger because of better rules and regulations set by authorities like the RBI and SEBI. These improved laws help protect investors from fraud and unfair practices, making the market safer for everyone. Clear guidelines also encourage more companies to join the market confidently. With a strong regulatory framework in place, the forex market in India is becoming more trustworthy and attractive to both new and experienced traders.

4. Growing Economic Size & Trade Volume

India‘s rapidly growing economy and increasing trade with other countries are key reasons why the forex market is expanding. As businesses import and export more goods and services, the demand for foreign currencies rises. This higher trade volume means more currency exchange transactions, which helps the forex market grow bigger and stronger. With India’s economy expected to keep growing, the forex market is likely to become even more important in the years ahead.

5. Rising Popularity of Forex Trading Among Indians

Forex trading is becoming increasingly popular among Indians, especially the younger generation. With easy access to online trading platforms and mobile apps, more people are exploring currency trading as a way to diversify their investments and potentially earn higher returns. The excitement around forex trading is fueled by the market‘s 24-hour availability and the opportunity to trade globally. As financial awareness grows, this rising interest is contributing significantly to the expansion of India’s forex market.

What RBI Governor Said About FX Market?

The RBI Governor stated that India's forex market has nearly doubled in size over the past four years, growing from $32 billion in 2020 to $60 billion in 2024. He added that Indias financial markets have become more dynamic and resilient, playing a key role in supporting the country's economic growth.

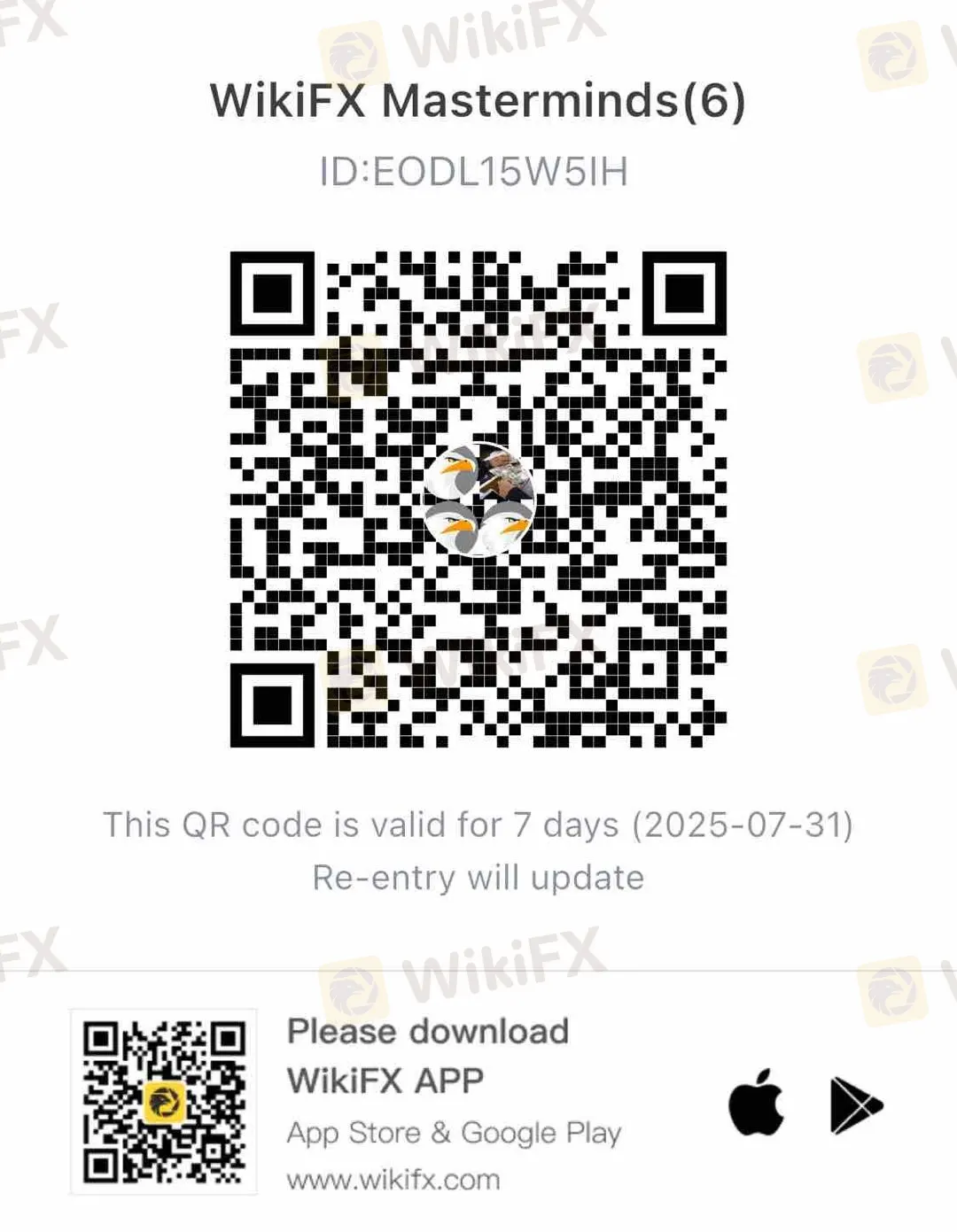

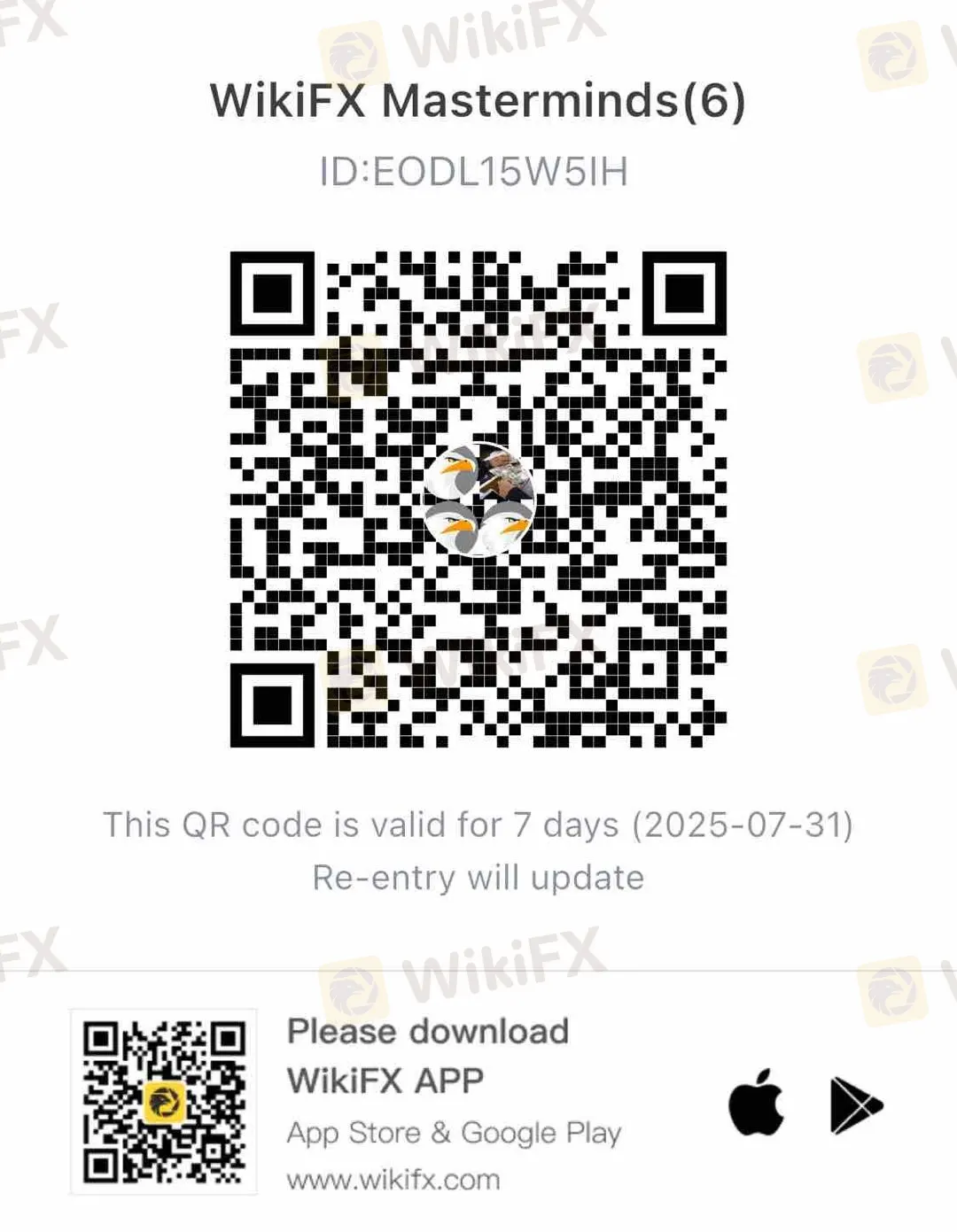

Join WikiFX Community

Investment scams have become a reality in the Forex market. While trading forex, you can avoid these scams by staying informed and alert. Therefore, be attentive and stay updated with fraud alerts. With WikiFX, you can get all the information you need about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR Code at the bottom.

Steps to Join?

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!