简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Startling Differences Between Hedging and Arbitrage

Abstract:The two risk management investment tools - hedging vs arbitrage - have been helping investors achieve their respective financial goals. Explore this comparision to understand their functionalities, the investment purpose they serve, the risk attached, and several other aspects.

The two risk management investment tools - hedging vs arbitrage - have been helping investors achieve their respective financial goals. Arbitrage is a tool by which investors gain risk-free profits by leveraging price differentials across different markets. Hedging, on the other hand, is designed to reduce potential losses by offsetting risks. In this article, we will help you explore the differences between hedging and arbitrage and find out the suitable alternative for you.

Arbitrage Definition

Arbitrage is a calibrated strategy by which investors purchase an asset at a lower price in one market and sell it at a greater price in another market. This largely revolves around leveraging price differences to earn profits.

Example - A currency pair is trading at 1.1000 on one exchange and at 1.1003 on another exchange. So, an arbitrageur will buy the currency pair available at 1.1000 and sell it for 1.1003 to gain a profit of 0.0002.

The strategy works brilliantly amid varying prices across markets. However, as markets become increasingly efficient, the profits tend to diminish.

Hedging Mechanism

Hedging is a proven financial investment strategy that helps reduce the risks associated with price movements in an asset. It helps offset a position by using some derivatives, such as futures or options, to protect against potential loss. For example, exporters expecting payment in Euros can enter into a forward contract to lock in the exchange rate to hedge against currency fluctuations.

The hedging mechanism helps stabilize cash flows and financial results while protecting against unfavorable price movements. On the downside, it reduces potential upside gains for the investors. At the same time, investors need to pay costs such as premiums or meet margin requirements.

Differences Between Hedging and Arbitrage

Still confused which of the two - Hedging vs Arbitrage - is better for you? We get it clear for you through this comparative analysis based on various aspects such as the investment objective, risk, time horizon, etc.

Investment Objective

Arbitrage is designed to maximize profits for investors, while hedging deals with minimizing investment risks for them.

Investment Risk

Arbitrage is a risk-free approach to reaping profits, while hedging helps reduce risks, but it may not be able to eliminate them.

Primary Tools

Arbitrage leverages market inefficiencies to help investors post high profits, while hedging uses derivatives such as futures, options or swaps to mitigate investment risks.

Time Horizon

Arbitrage works well over the short term, whereas hedging works better over the long term.

Market Impact

While arbitrage helps equalize prices across markets, hedging leads to stabilizing financial outcomes.

Summing Up

Hedging and arbitrage help investors with their unique characteristics. While arbitrage ensures efficiency by leveraging price differences, hedging protects against market uncertainties. Traders, based on their investment goals, exercise either of these two options to navigate a seemingly complex financial market.

Frequently Asked Questions (FAQs) on Hedging vs Arbitrage

Can I Use Hedging and Arbitrage Together?

Yes, you can use both of these strategies that serve your different investment purposes.

What are Some Common Hedging Instruments?

These are futures, options, forwards, and swaps

Can Arbitrage Ensure Profits Every Time?

While arbitrage is indeed a tool to earn risk-free profit, it does not guarantee it every time. Factors such as transaction costs, execution risk and market volatility can erode or eliminate profits.

Why Investors Resort to Hedging Amid Market Volatility?

Hedging helps protect investments from adverse price fluctuations and lets investors sail amid a highly volatile market.

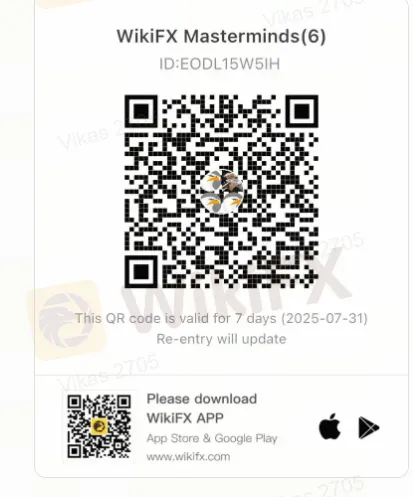

We cant wait for you to join our growing community - WikiFX Masterminds. Scan the QR code today to join and discuss forex.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Seaprimecapitals Withdrawal Problems: A Complete Guide to Risks and User Experiences

Worries about Seaprimecapitals withdrawal problems and possible Seaprimecapitals withdrawal delay are important for any trader. Being able to get your money quickly and reliably is the foundation of trust between a trader and their broker. When questions come up about this basic process, it's important to look into what's causing them. This guide will tackle these concerns head-on, giving you a clear, fact-based look at Seaprimecapitals' withdrawal processes, user experiences, and trading conditions. Most importantly, we'll connect these real-world issues to the single most important factor behind them: whether the broker is properly regulated. Understanding this connection is key to figuring out the real risk to your capital and making a smart decision.

iFX Brokers Review: Do Traders Face Withdrawal Issues, Deposit Credit Failures & Free Coupon Mess?

Have you had to pay several fees at iFX Brokers? Had your trading profit been transferred to a scamming website, causing you losses? Failed to receive withdrawals from your iFX Brokers trading account? Has your deposit failed to reflect in your trading account? Got deceived in the name of a free coupon? Did the broker officials not help you in resolving your queries? Your problems resonate with many of your fellow traders at iFX Brokers. In this iFX Brokers review article, we have explained these problems and attached traders’ screenshots. Read on!

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

World Forex Review: Does the Broker Deny Withdrawals and Scam Traders via Fake Bonuses?

Does World Forex prove to be a not-so-happy trading experience for you? Do you struggle to withdraw your funds from the Saint Vincent and the Grenadines-based forex broker? Do you witness hassles depositing funds? Failing to leverage the World Forex no deposit bonus, as it turned out to be false? These accusations are grabbing everyone’s attention when reading the World Forex review online. In this article, we have shared some of these. Read on!

WikiFX Broker

Latest News

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Pepperstone CEO: “Taking Down Scam Sites Almost Every Day” Becomes “Depressing Daily Business”

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

eToro Cash ISA Launch Shakes UK Savings Market

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

Close Up With WikiFX —— Take A Close Look At Amillex

GGCC Bonus and Promotions: A Data-Driven Analysis for Experienced Traders

Currency Calculator