Abstract:Choosing a reliable broker is essential in online trading, and understanding how a broker is regulated, or if it is regulated at all, plays a major role in that decision. Exnova is a trading platform that has drawn attention due to the absence of proper regulation and concerns about its business practices.

Choosing a reliable broker is essential in online trading, and understanding how a broker is regulated, or if it is regulated at all, plays a major role in that decision. Exnova is a trading platform that has drawn attention due to the absence of proper regulation and concerns about its business practices.

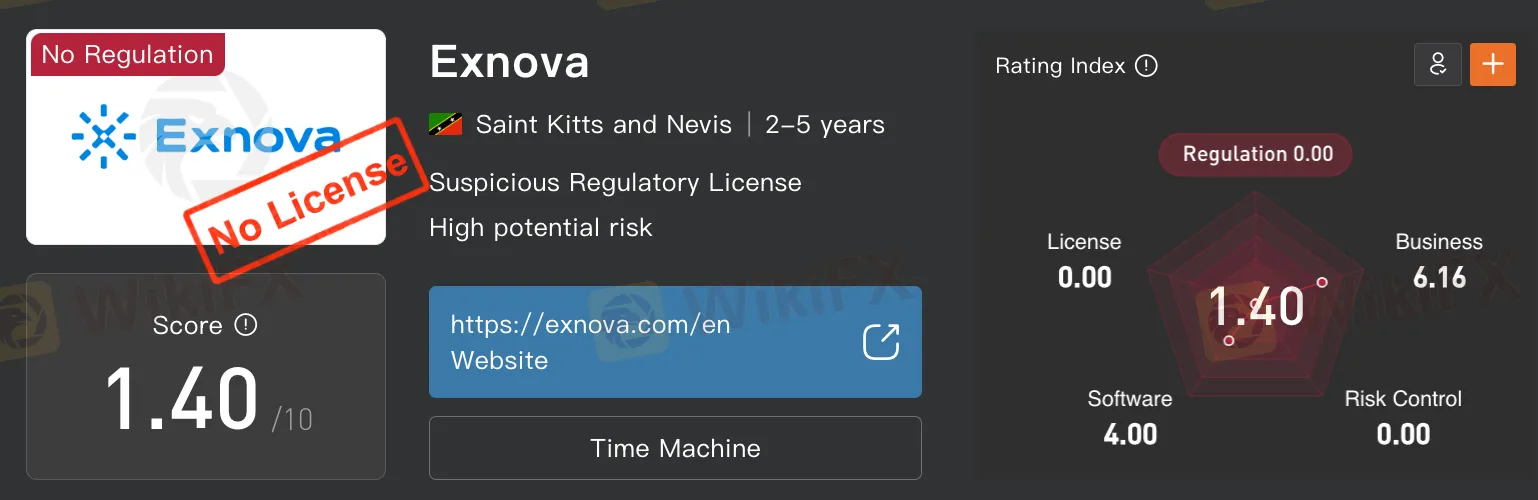

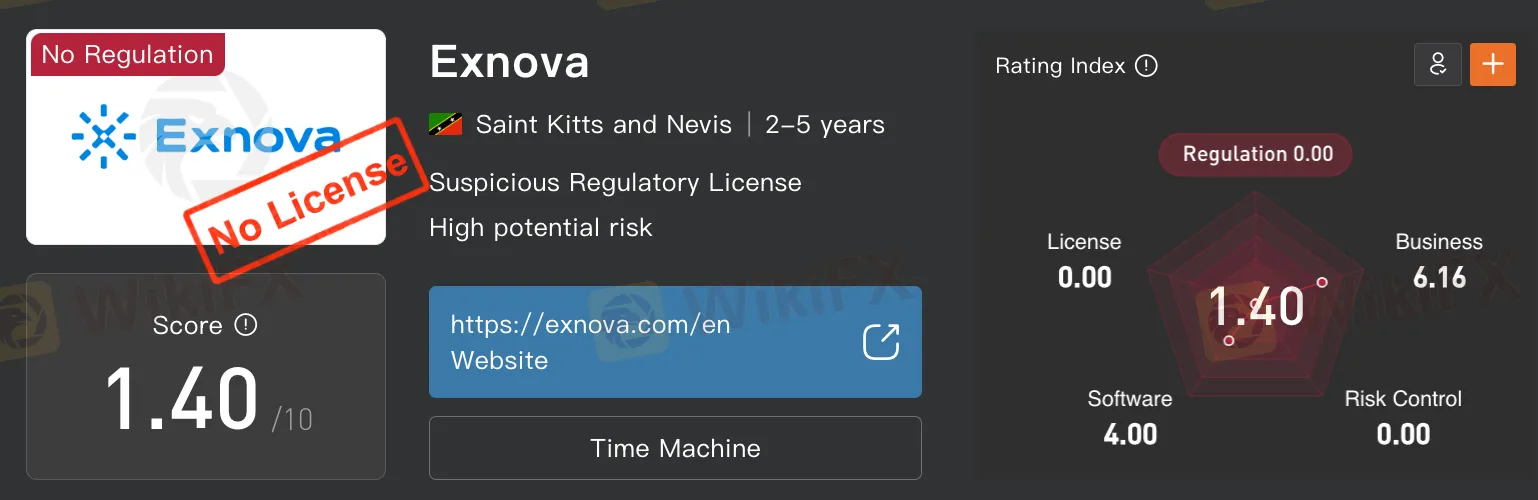

On WikiFX, a global broker regulatory query platform, Exnova has a significantly low WikiScore of 1.4/10. This score reflects various factors, such as regulatory status, platform operations, risk management, and user feedback. A score this low suggests that the broker falls short in several important areas and may not meet the standards that many traders expect from a trusted trading provider.

Exnova currently does not hold any valid financial regulation, according to verification conducted by WikiFX. This means there is no official regulatory authority monitoring its activities or ensuring that client funds are protected. Brokers that are unregulated operate outside of the rules and oversight required in many countries, which can increase risk for traders.

Additionally, Exnova is registered in Saint Kitts and Nevis, a jurisdiction known for its minimal regulatory oversight of forex and trading firms. While it is legal to form a business in this country, it does not have a dedicated financial regulatory body for overseeing trading brokers. Being based in such a location often means that the broker can operate with limited transparency and fewer protections for its users.

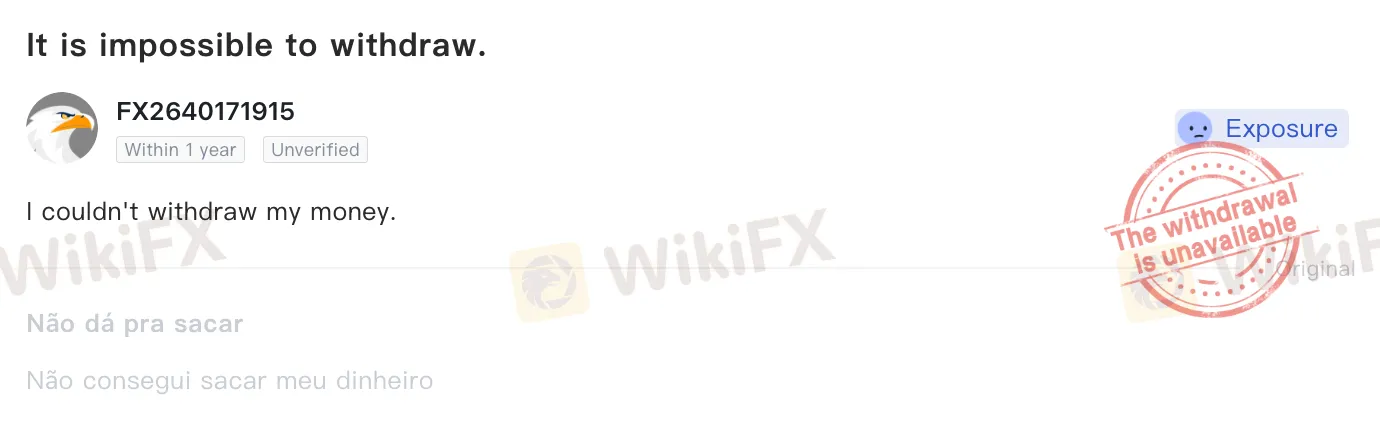

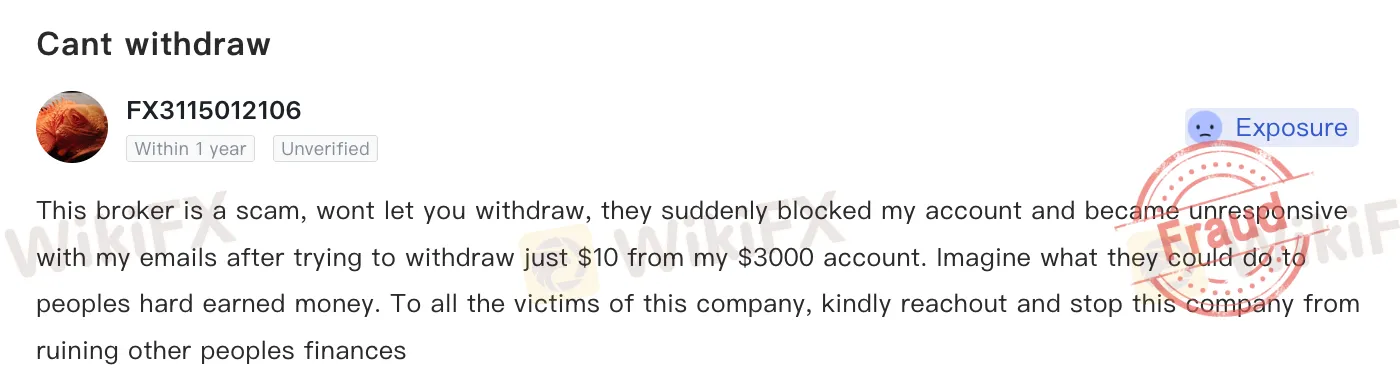

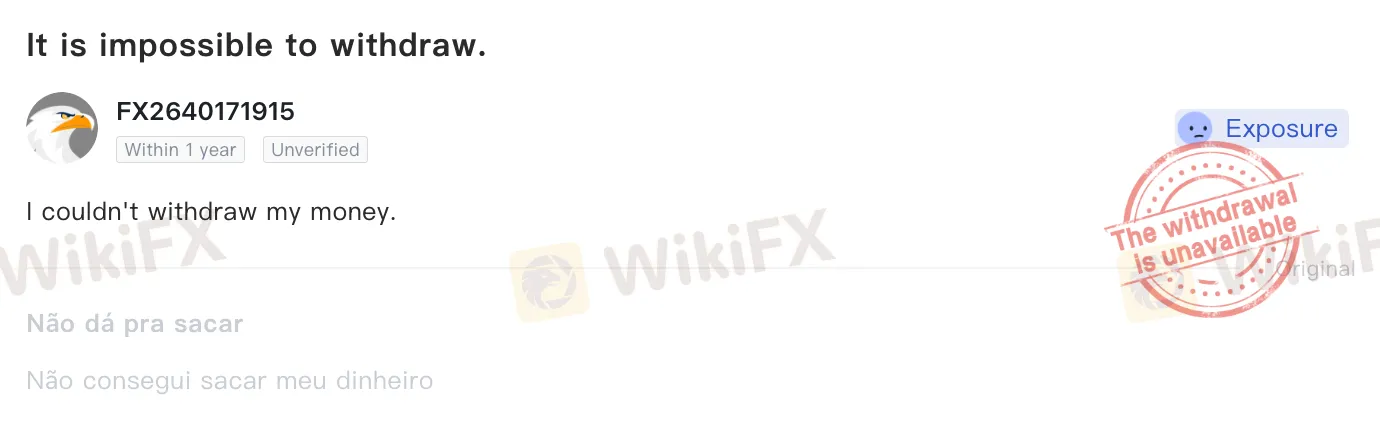

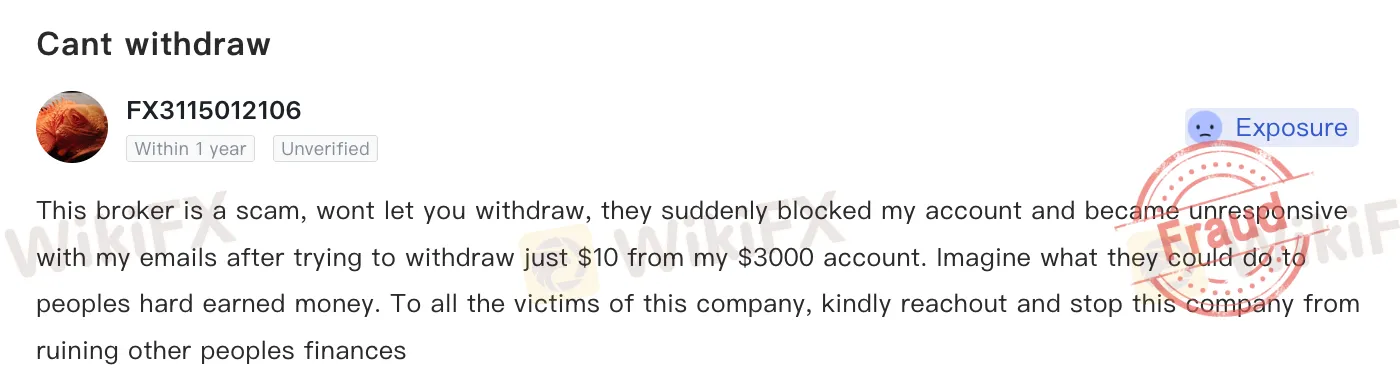

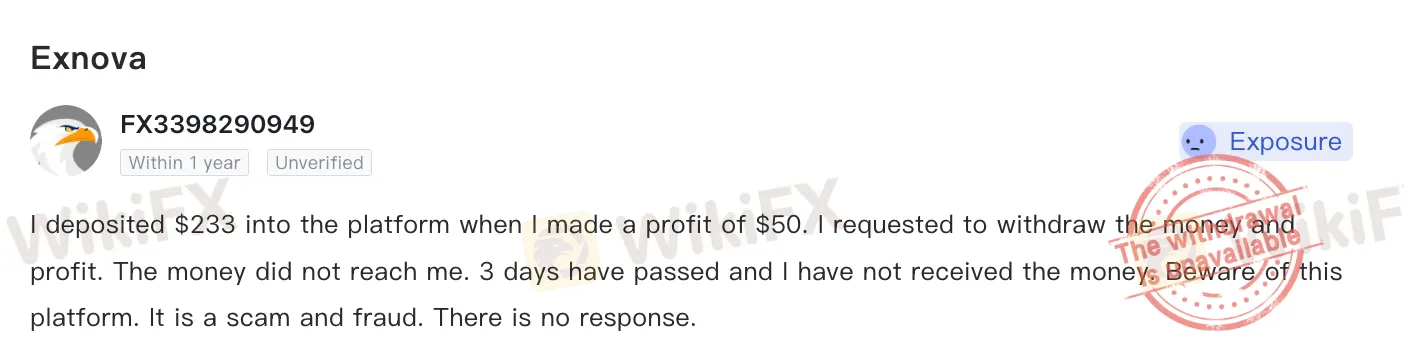

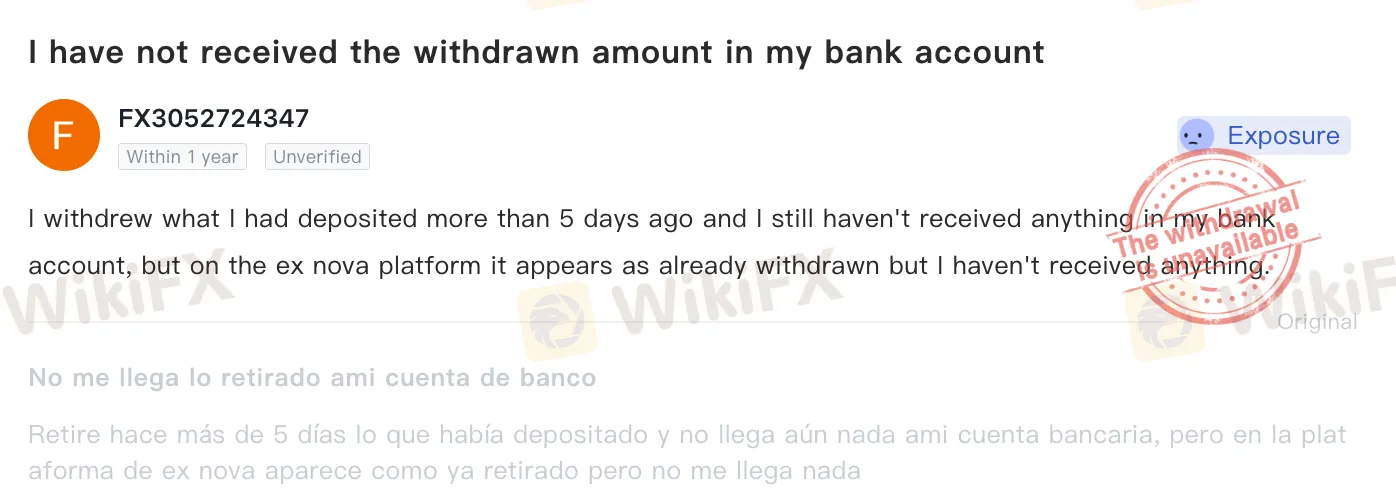

Several complaints have also been reported by Exnova users. A number of traders have shared concerns that they were unable to withdraw their funds from the platform. These kinds of complaints are serious and may indicate operational or customer service issues. When multiple traders report similar problems, it is worth taking the time to investigate further before making any deposits or trading commitments.

Exnova‘s lack of regulation, its offshore registration in a loosely supervised jurisdiction, and the number of unresolved user complaints raise important concerns. These factors may affect the level of safety, reliability, and accountability users can expect when using the platform. While every trader must make their own decisions, it's important not to ignore these red flags. Taking time to review a broker’s regulatory status and track record can help reduce the risk of encountering issues later on.