Abstract:Over $172,000 lost in POSB phishing scams since April. Learn how to protect yourself from banking fraud with these crucial safety tips.

Since April, phishing scams targeting POSB customers have led to at least $172,000 in losses. The police have received 13 reports related to these scams, where cybercriminals impersonate the bank to steal personal information.

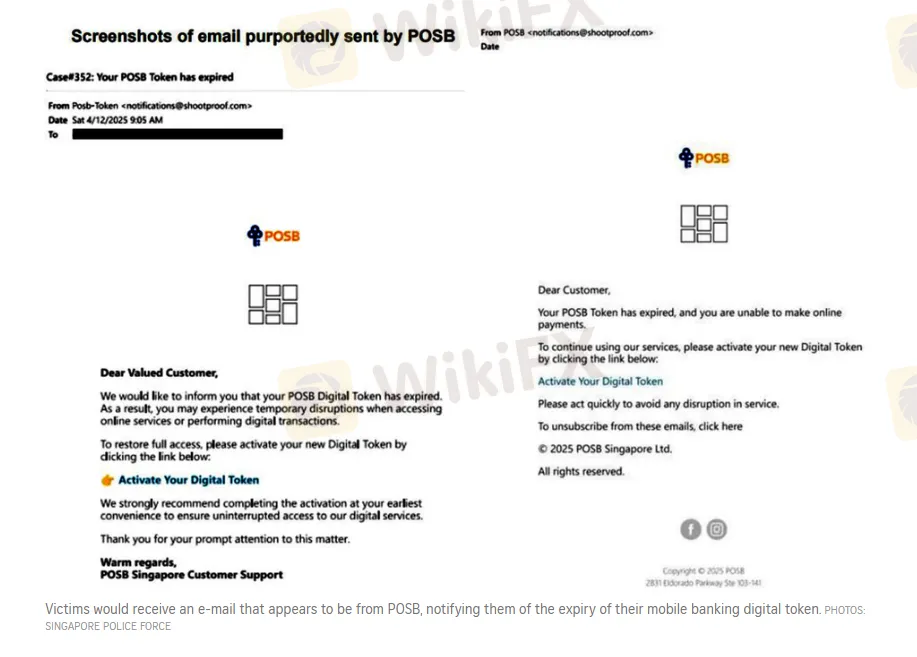

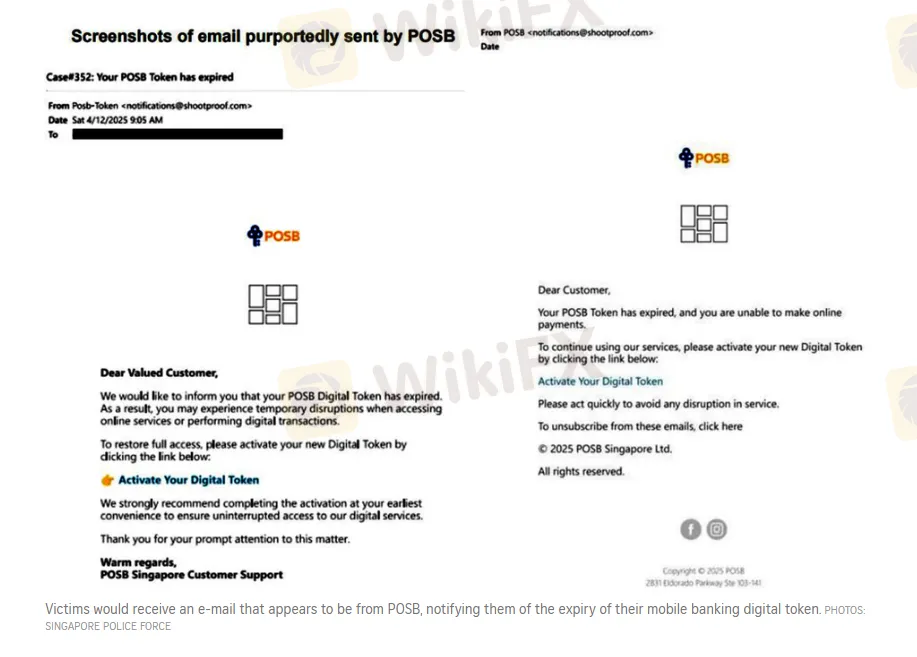

Victims receive an email that appears to be from POSB, claiming that their mobile banking digital token is about to expire. The email urges them to activate or update their token by clicking on a link provided in the message.

However, this link directs them to a fraudulent website designed to steal sensitive information. Once victims enter their banking credentials, card numbers, and one-time passwords, their accounts are compromised. Unauthorized transactions, often in foreign currencies, typically alert them to the scam.

On May 6, police issued a public warning, advising people to avoid clicking on links in suspicious emails, SMS messages, or communications from platforms like iMessage or Androids rich communication services, which claim to be from banks.

To prevent such attacks, customers are encouraged to set transaction limits on their internet banking and utilize features like Money Lock. Money Lock allows users to digitally secure their savings in an account from which no funds can be withdrawn, adding an extra layer of protection.

Singapore experienced a record $1.1 billion in scam losses in 2024, highlighting the growing threat of phishing fraud. Victims are urged to stay cautious and avoid interacting with unsolicited messages or clicking on unknown links.