Melaka police bust fake investment scam run by Chinese nationals

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A 57-year-old factory supervisor in Penang has lost RM558,000 to a sophisticated online investment scam, marking the third such case reported in the state within a single week.

A 57-year-old factory supervisor in Penang has lost RM558,000 to a sophisticated online investment scam, marking the third such case reported in the state within a single week.

The Southwest District Commercial Crime Investigation Department confirmed receiving a report from the victim, who had been drawn into the scam through a Facebook profile named “AI Investment.” According to the police, the man had encountered an advertisement in February promoting an investment opportunity in Chinese company shares under the brand name SERICREST PRO.

The advertisement promised highly attractive returns of between 5% and 15% within just three days, depending on the investment tier selected. Enticed by the offer, the victim initiated contact with the alleged perpetrator via WhatsApp. He was subsequently persuaded to download an application called SERICREST through a link provided by the suspect.

Three investment packages were promoted: Level One requiring RM100,000, Level Two at RM300,000, and Level Three at RM500,000. Believing in the promised returns, the victim opted for the Level One package and transferred money in 29 separate transactions to ten different bank accounts, as instructed.

State police chief Datuk Hamzah Ahmad stated that the deception became apparent when the victim was informed he would receive RM1.2 million in profits on April 24 or 25. However, no funds were transferred, prompting the victim to report the incident. The case is being investigated under Section 420 of the Penal Code for cheating.

This incident is part of a concerning pattern in the region. Earlier in the week, a 70-year-old accounting manager reported losing RM1.365 million to an online investment scheme, while a 62-year-old retired civil servant was defrauded of RM229,800 under similar circumstances.

As online scams become increasingly sophisticated, financial awareness tools are proving essential in combating fraud. Platforms like WikiFX are playing a pivotal role in helping investors verify the legitimacy of brokers and financial entities. Offering access to a global database of broker profiles, regulatory credentials, user reviews, and risk ratings, WikiFX provides critical information to identify and avoid unlicensed or suspicious operators. By utilising such resources, potential investors can better protect themselves from falling victim to fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.

The rise of deepfake scams impersonating national leaders and public figures has caused significant financial losses in Malaysia, prompting the government to propose an AI Governance Bill aimed at strengthening safeguards, restoring public trust and providing regulatory clarity to support responsible AI use and investment.

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

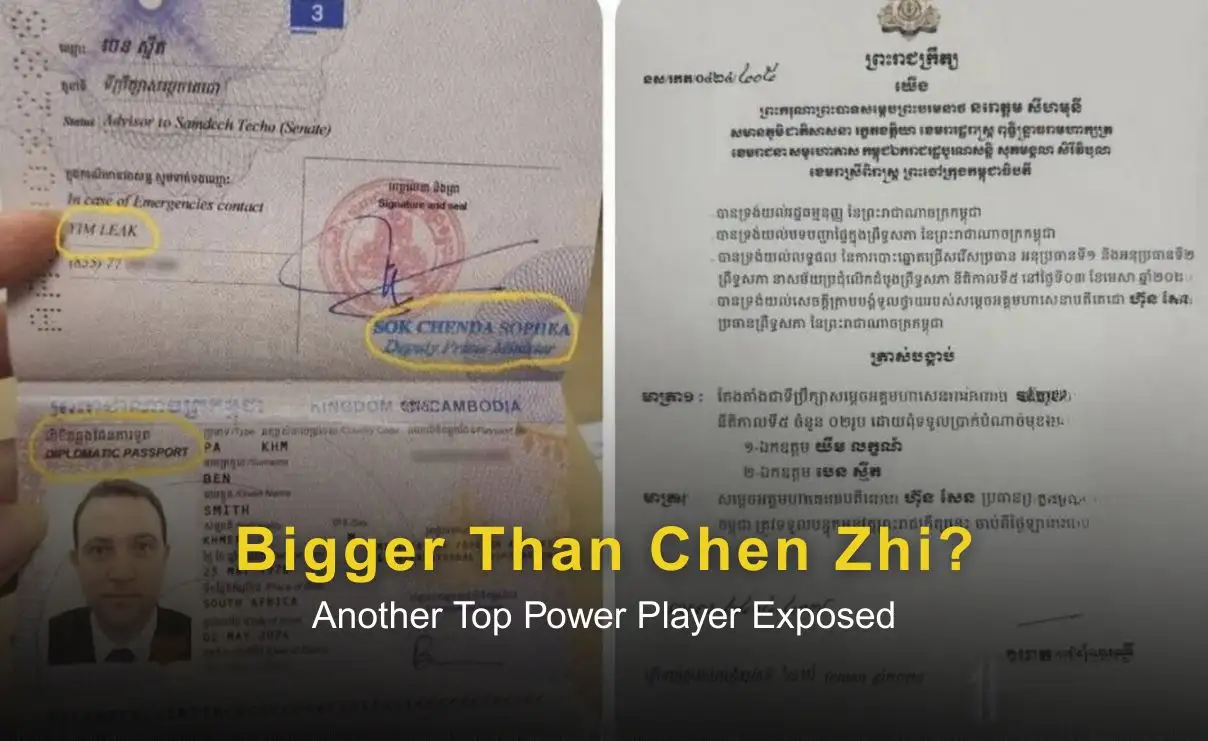

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.