Abstract:The stories are all too familiar: “A slick website, aggressive marketing on social media, promises of guaranteed returns, and then radio silence when it’s time to withdraw.”

In recent years, Southeast Asia has emerged as one of the worlds fastest-growing hubs for retail forex trading. As internet penetration, digital literacy, and mobile-first banking continue to expand across the region, many are turning to online trading and investment as a path toward financial independence.

But alongside this boom, a darker trend has surfaced: the rapid rise of unregulated and fraudulent forex brokers exploiting the trust and ambitions of new traders.

According to regional watchdogs and financial literacy organizations, scam-related losses in online trading have surged. Many of these victims fall prey to platforms that appear legitimate, but are in fact operating without licenses, using fake regulatory claims, or vanishing entirely once deposits are made.

The stories are all too familiar: “A slick website, aggressive marketing on social media, promises of guaranteed returns, and then radio silence when its time to withdraw.”

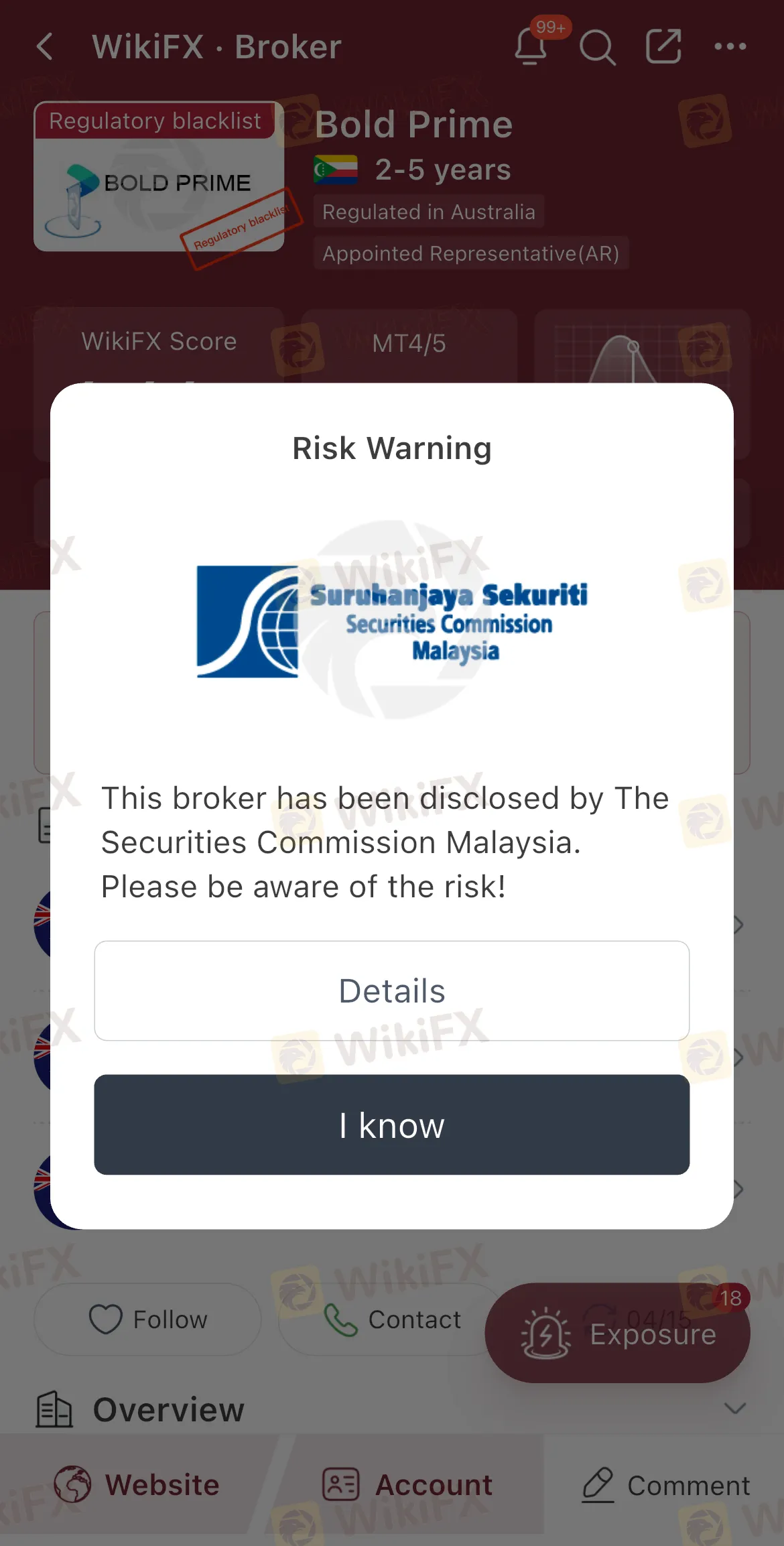

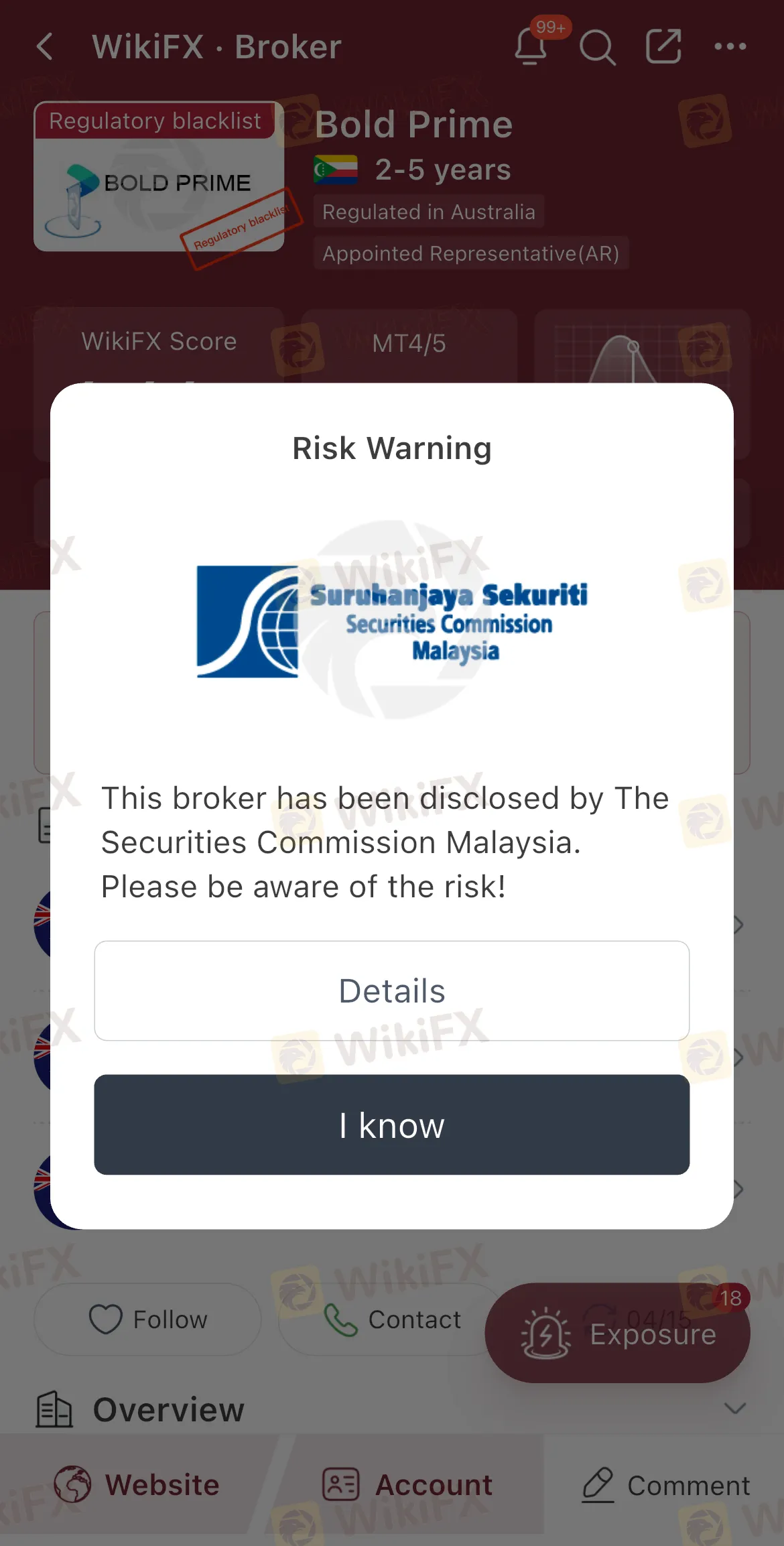

In regions where regulatory oversight varies significantly, traders are increasingly seeking tools to verify broker legitimacy before committing funds. One platform leading the charge in this mission is WikiFX, a global broker verification and regulatory data service that has become particularly influential among traders in Southeast Asia.

WikiFX houses regulatory data from over global financial authorities, including the FCA (UK), ASIC (Australia), CySEC (Cyprus), MAS(Singapore), and others. The platform currently monitors more than 50,000 brokers worldwide, providing transparency through license verification, user reviews, regulatory blacklists, and office location validation.

At the core of WikiFXs value is its free mobile application, available on both iOS and Android. The app is designed for ease of use for everyone.

Key features include:

- Regulatory Status Lookup: Instantly check if a broker is licensed and by whom.

- Broker Scorecard: A comprehensive trust rating based on compliance, transparency, and operational history.

- Real Trader Reviews: Hear directly from other users in/beyond your region.

- Scam Alerts: Stay informed of brokers flagged for fraud or misconduct.

- Geolocation Verification: See whether a brokers claimed office location actually exists.

While many still dream of financial freedom through forex and other forms of online trading, theyre no longer willing to gamble with unverified platforms. Instead, they are arming themselves with tools and data, determined to make smarter, safer choices.

As forex trading continues to expand in Southeast Asia, the presence of unregulated brokers remains a serious threat. But the growing adoption of verification platforms like WikiFX marks a turning point in the industry by giving everyday traders the means to protect themselves and elevate the standards of the trading ecosystem.

Whether youre trading part-time or aiming to go full-time, one thing is clear:

In an industry where misinformation can cost you everything, the smart move is to verify before you trade. Thats what makes WikiFX essential.

The WikiFX app is free to download on iOS and Android. To learn more, visit www.wikifx.com.