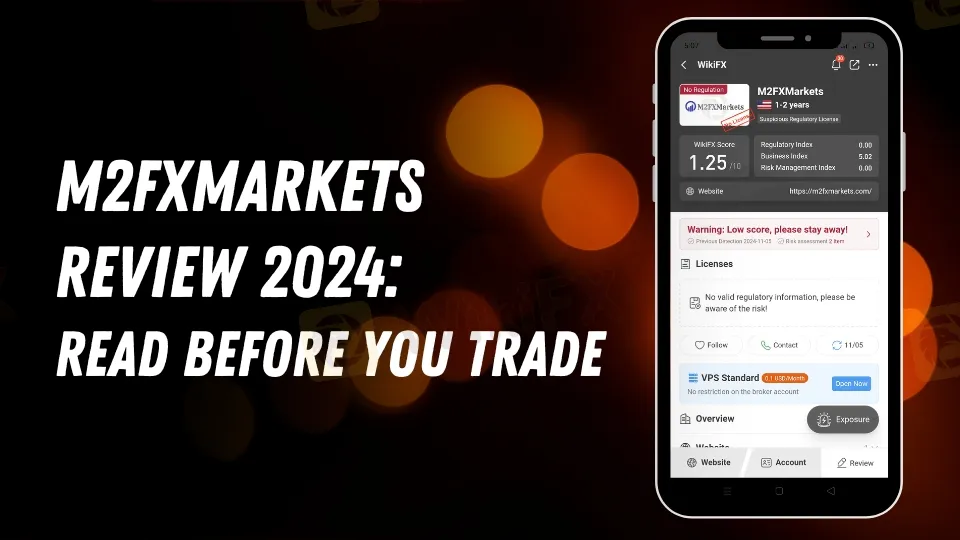

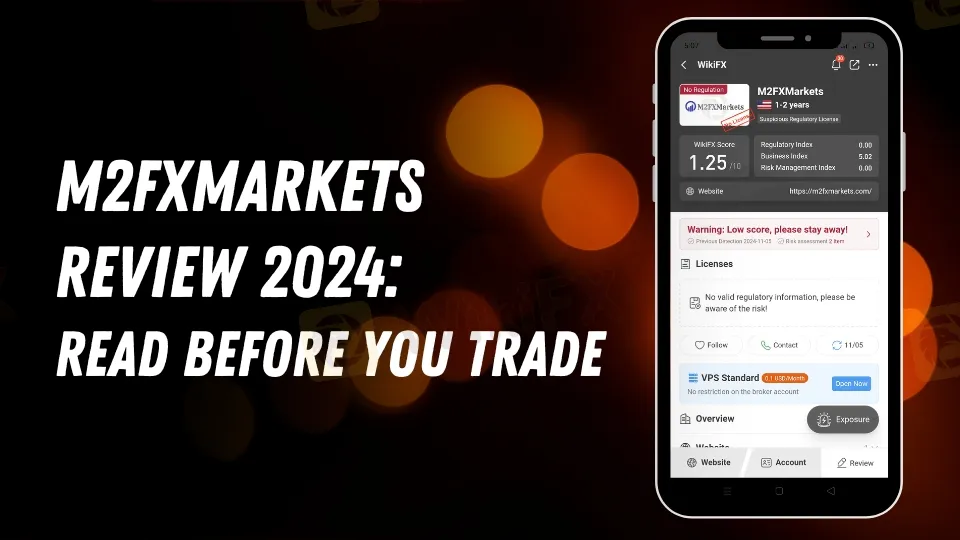

Abstract:Avoid M2FXMarkets! Unregulated, dubious trading plans with daily returns of up to 25%. A low 1.25 WikiFX rating highlights serious concerns. Read why its risky.

Overview

M2FXMarkets claims to be a leading financial technology corporation, founded in 2016, with a mission to “provide unprecedented financial freedom and income equality for the 99%.” The broker's offerings include cryptocurrency, stocks, forex, and even real estate trading. However, with an alarmingly low WikiFX rating of 1.25 and a regulatory status marked as unregulated, there are serious red flags for anyone considering this broker.

Unregulated Status

Operating without any form of license or regulatory oversight is the primary concern with M2FXMarkets. Regulated brokers are required to adhere to strict financial standards and client protection policies; M2FXMarkets, however, lacks these essential safeguards. The absence of regulatory status means investors face heightened risk, with no assurance that their funds will be handled ethically or securely. Given its unregulated status, M2FXMarkets' claims of providing “unprecedented financial freedom” seem more promotional than factual.

About the Company

The companys description, while ambitious, is uncharacteristic of what one might expect from a reputable forex broker. M2FXMarkets presents itself as the “largest full-service blockchain technology company in the world,” with a focus on “replacing our current financial systems.” This claim feels more like an ideological sales pitch than a practical description of a reliable brokerage service.

Moreover, M2FXMarkets enforces a peculiar withdrawal policy, requiring traders to deposit 20% of their profit as a fee before withdrawals can be processed. This is a highly unusual practice not typically seen among regulated brokers, which usually deduct fees directly from client balances rather than requiring additional deposits. This approach raises questions about the brokers motives and adds yet another layer of risk for investors.

Trading Plans

M2FXMarkets offers four trading plans, promising substantial daily returns:

Standard Plan: 10% daily return

- Minimum Deposit: $200

- Maximum Deposit: $4,999

Premium Plan: 15% daily return

- Minimum Deposit: $5,000

- Maximum Deposit: $29,999

Professional Plan: 20% daily return

- Minimum Deposit: $30,000

- Maximum Deposit: $49,000

VIP Plan: 25% daily return

- Minimum Deposit: $50,000

- No maximum limit

These promised returns—ranging from 10% to 25% daily—are extraordinarily high and far exceed typical market returns, even in high-risk environments. Such guaranteed rates are often associated with investment scams, as they aim to lure in investors with the prospect of quick and significant profits. The lack of transparency about how these returns are generated further supports the suspicion that M2FXMarkets trading plans are unsustainable and risky for investors.

The Role of the WikiFX App

The WikiFX App provides critical insights for traders, helping them avoid unreliable brokers like M2FXMarkets. Its 1.25 rating for M2FXMarkets, combined with detailed reviews, serves as a crucial warning for potential investors to reconsider their choices. The apps role in highlighting regulatory status, user feedback, and operational red flags makes it an invaluable resource for anyone venturing into forex trading.

Conclusion

M2FXMarkets presents itself as a revolutionary platform but fails to meet fundamental standards of transparency, regulation, and client protection. Its unregulated status, impractical withdrawal policies, and exaggerated return promises signal significant risks. Traders are strongly advised to consider regulated brokers and rely on trusted sources like WikiFX to make informed decisions.