Abstract:The Malaysian police have recently uncovered a sophisticated investment scam operating under the guise of 'Pantheon Ventures,' an elaborate scheme that has been aggressively promoted across Facebook and Instagram, with reported losses totalling over RM14.9 million (approximately USD 3.4 million).

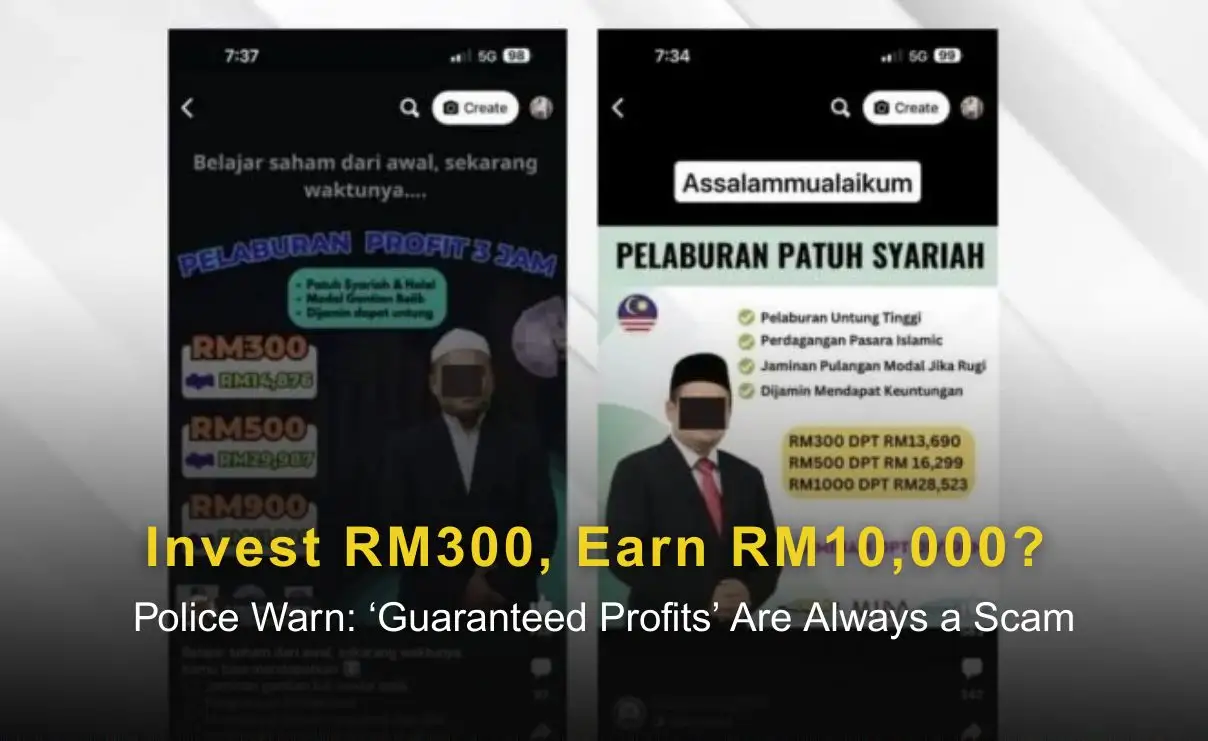

The Malaysian police have recently uncovered a sophisticated investment scam operating under the guise of 'Pantheon Ventures,' an elaborate scheme that has been aggressively promoted across Facebook and Instagram. This fraudulent operation has reportedly caused significant financial losses to a wide range of victims, highlighting the growing threat of online investment scams.

Investigations led by the Bukit Aman Commercial Crime Investigation Department revealed that the perpetrators of the scam falsely claimed to offer investment opportunities linked to the stock markets of Malaysia, Taiwan, and China. The scheme enticed investors with promises of high returns ranging between 8% and 23%, tied to these markets, with the allure of weekly profits.

Since July, authorities have initiated 35 investigation papers related to this scam, with reported losses totalling RM14,959,416.76 (approximately USD 3.4 million). The victims include six retirees, four business owners, a housewife, 19 private-sector employees—including a bank officer—and five civil servants, including two lecturers. This broad spectrum of victims underscores the extensive reach of the scam.

Police have identified 22 bank accounts, registered under various companies and businesses, that were used to facilitate this fraudulent scheme. The scam operated by adding interested individuals to a WhatsApp group named “Pantheon Ventures,” where they were provided with deceptive guidance on supposed stock market investments.

Investors were instructed to transfer funds to several company accounts suspected to be mule accounts, and were also directed to download the 'Nexus Equity' or 'neeq' app, which was claimed to allow them to monitor their investments. While the app created the illusion of profitable investments, investors were ultimately unable to withdraw their earnings, with the company offering numerous excuses to avoid disbursements.

Further investigation revealed that Pantheon Ventures is, in fact, a legitimate investment company based in the UK, established in 1982, but it has no connection to the fraudulent 'Pantheon Ventures' scheme being promoted on social media.

The case is currently being investigated under Section 420 of the Penal Code, which addresses cheating and dishonestly inducing delivery of property. Authorities have urged any individuals who believe they may have fallen victim to this scam to come forward and file a police report.

This case serves as a stark reminder of the importance of vigilance when engaging with online investment opportunities, particularly those promoted through social media channels.