Abstract:In the world of online trading, the unfortunate reality is the existence of scam brokers preying on unsuspecting investors. The burning question for those who have fallen victim to such schemes is whether there's a chance to recover their hard-earned money.

In the world of online trading, the unfortunate reality is the existence of scam brokers preying on unsuspecting investors. The burning question for those who have fallen victim to such schemes is whether there's a chance to recover their hard-earned money.

Scam brokers employ various tactics to lure individuals into their traps, promising lucrative returns and unparalleled investment opportunities. Once entangled, victims often find themselves facing financial losses and a daunting challenge to retrieve their funds.

The first crucial step for individuals who suspect they have been scammed is to act swiftly. Time is of the essence in reporting the incident to relevant authorities and regulatory bodies. In many cases, financial regulators have mechanisms in place to investigate and take action against fraudulent brokers.

Furthermore, victims should contact their financial institutions promptly. Banks and credit card companies may have procedures to address unauthorized transactions and, in some instances, can initiate chargebacks. Timely communication with these institutions increases the chances of recovering funds.

Legal recourse is another avenue for individuals seeking restitution. Consultation with legal professionals specializing in financial fraud can guide victims through the process of filing complaints or pursuing legal action against scam brokers. Some jurisdictions have investor protection funds that may offer compensation to those defrauded by financial entities.

In the digital age, technology can be both a curse and a blessing. Victims can harness the power of online communities and forums to share their experiences and seek advice. Connecting with others who have successfully reclaimed their funds or have valuable insights can provide a roadmap for navigating the recovery process.

However, it's crucial to approach third-party recovery services with caution. While some legitimate firms specialize in recovering funds from scam brokers, there are also fraudulent entities seeking to exploit victims a second time. Thorough research and due diligence are essential before engaging any recovery service.

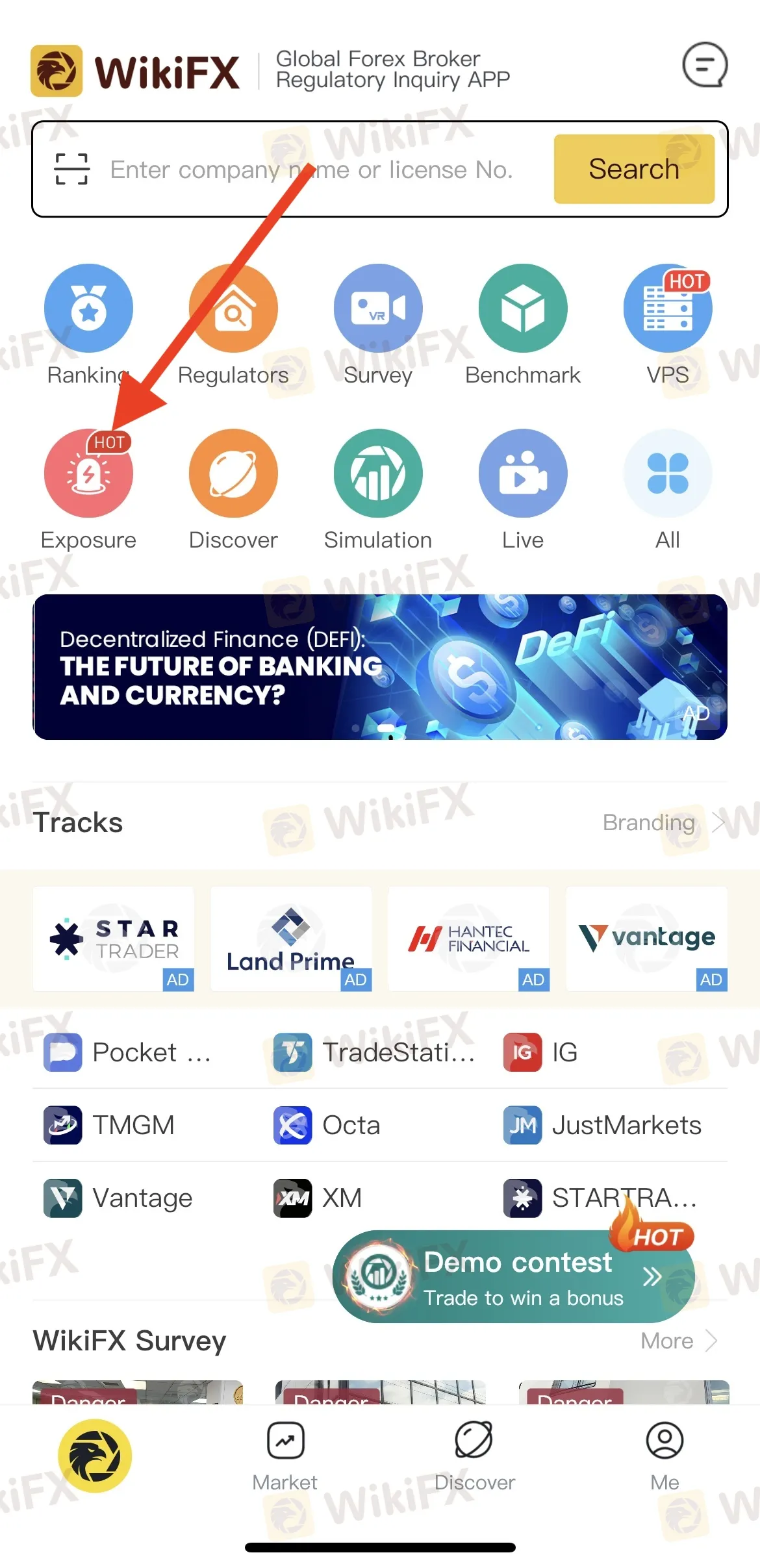

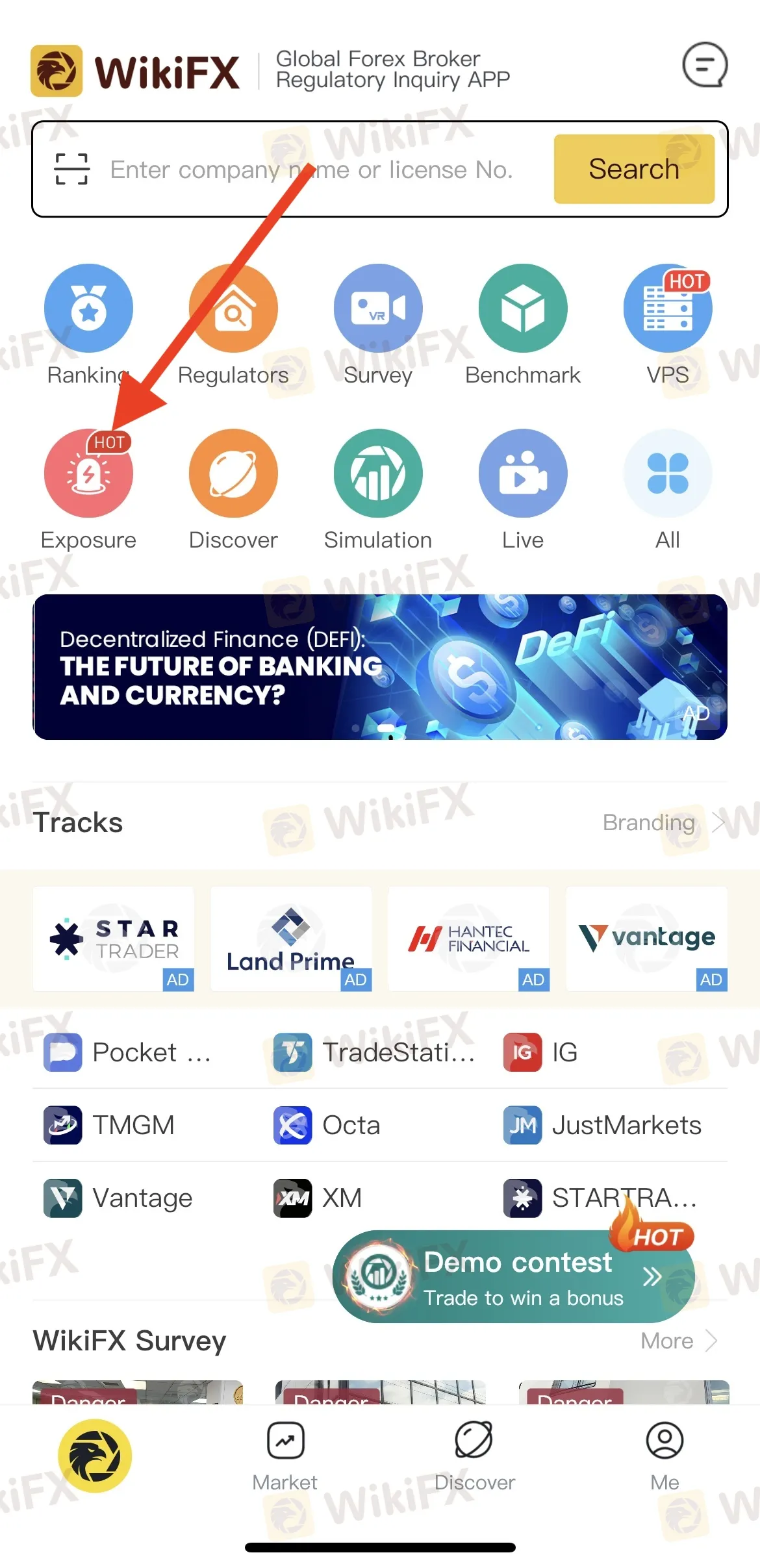

WikiFX users often overlook the valuable function of the Exposure page, where users candidly share experiences with their forex brokers. Traders can use these reviews to assess the credibility of the brokers. The WikiFX mobile app is freely available on Google Play/App Store.

Upon downloading the app, navigate to the homepage and click on “Exposure.” This section reveals transparent accounts of trading clients facing issues, exposing tactics employed by unreliable forex brokers to manipulate clients' funds.

If you've fallen victim to a forex broker's scheme, stay calm as WikiFX offers assistance. Click the red “Exposure” button and submit your unresolved dispute case, providing comprehensive information and evidence for WikiFX to facilitate resolution.

WikiFX has successfully aided over 14,400 people, resolving disputes totalling over 60 million USD. While success is not always guaranteed, WikiFX would always do our best to prevent money ending up in the pockets of deceitful forex brokers. Success cases can be found in the 'rights protection centre' section under the Exposure page.

Don't hesitate to seek help from the WikiFX support team; we are here to assist you as best as possible.