Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:eToro, a leading social trading and investment platform, recently announced that it has been granted a BitLicense and a Money Transmitter License by the New York State Department of Financial Services (NYDFS).

eToro, a leading social trading and investment platform, recently announced that it has been granted a BitLicense and a Money Transmitter License by the New York State Department of Financial Services (NYDFS). This is a significant milestone for eToro, as it allows the platform to expand its operations in the United States and offer cryptocurrency trading services to New York residents.

BitLicense is a regulatory framework that was introduced by the NYDFS in 2015, with the aim of regulating the activities of virtual currency businesses in the state of New York. The license is required for any business that engages in virtual currency activities, including buying and selling virtual currency as a customer business, performing exchange services, and holding virtual currency on behalf of others.

The Money Transmitter License, on the other hand, is a license that is required by businesses that engage in the transfer of money or value, including virtual currency, in or from the state of New York.

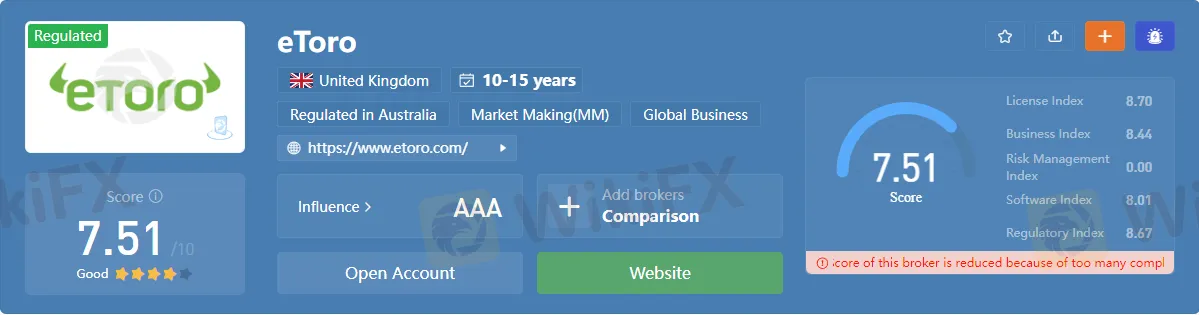

Obtaining both licenses is a significant achievement for eToro, as it demonstrates the platform's commitment to operating in a regulated and compliant manner. It also allows eToro to offer its services to New York residents, who make up a significant portion of the cryptocurrency market in the United States.

eToro's CEO, Yoni Assia, commented on the news, stating that “New York is a global center for finance, and we're delighted to be able to offer our services to New York residents. We believe that regulation is essential to the growth and maturation of the cryptocurrency industry, and we're committed to working with regulators around the world to ensure that our platform is operating in a safe, secure, and compliant manner.”

The news of eToro's licenses comes at a time when the cryptocurrency market is experiencing significant growth and interest from institutional investors. The recent surge in the price of Bitcoin and other cryptocurrencies has led to increased mainstream adoption, as more and more businesses and individuals looking to invest in these digital assets.

With its user-friendly interface and social trading features, eToro has become a popular platform for cryptocurrency traders and investors around the world. The platform allows users to buy and sell a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, as well as trade traditional assets such as stocks, commodities, and currencies.

In addition to its cryptocurrency trading services, eToro also offers a range of educational resources and tools to help users make informed investment decisions. The platform's CopyTrader feature allows users to automatically replicate the trades of successful traders, while its Popular Investor program rewards top-performing traders with additional benefits and perks.

The granting of eToro's licenses by the NYDFS is likely to have a positive impact on the cryptocurrency industry as a whole. It demonstrates that regulatory authorities are beginning to recognize the importance of digital assets and are taking steps to ensure that they are regulated in a responsible and effective manner.

As the cryptocurrency market continues to evolve and mature, it is likely that we will see more companies following eToro's lead and seeking regulatory approval. This can only be a positive development for the industry, as it will help to build trust and confidence among investors and pave the way for further mainstream adoption.

In conclusion, eToro's recent acquisition of a BitLicense and a Money Transmitter License from the NYDFS is a significant milestone for the platform and for the cryptocurrency industry as a whole. It demonstrates that regulatory authorities are beginning to take digital assets seriously and are taking steps to ensure that they are regulated in a responsible and effective manner. With its user-friendly interface and commitment to compliance, eToro is well-positioned to capitalize on the growing interest in cryptocurrencies and to help drive the industry forward.

WikiFX is a platform that provides information and ratings on Forex brokers and their services. The platform aims to help traders make informed decisions by providing comprehensive information on various aspects of a broker's services, including regulation, trading conditions, customer support, and more.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.