简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FCA Warning List Of Unauthorized Entities

Abstract:The Financial Conduct Authority (FCA) maintains a warning list of firms and individuals that it has identified as potentially operating without its authorization and supervision, or that it has concerns about for other reasons. The list is intended to protect consumers and the integrity of the UK financial system by helping them to avoid doing business with these firms and individuals. It is updated regularly, and consumers are advised to check the list before engaging in any financial transactions.

FCA stands for Financial Conduct Authority, which is a regulatory body in the United Kingdom that oversees financial markets and firms to ensure they operate in a way that is fair, transparent, and in the best interests of consumers. The FCA issues warnings to consumers about potential scams, fraudulent activities, and other risks to protect them from financial harm. These warnings can be found on the FCA's website and are often shared through the media and other channels to reach a wide audience.

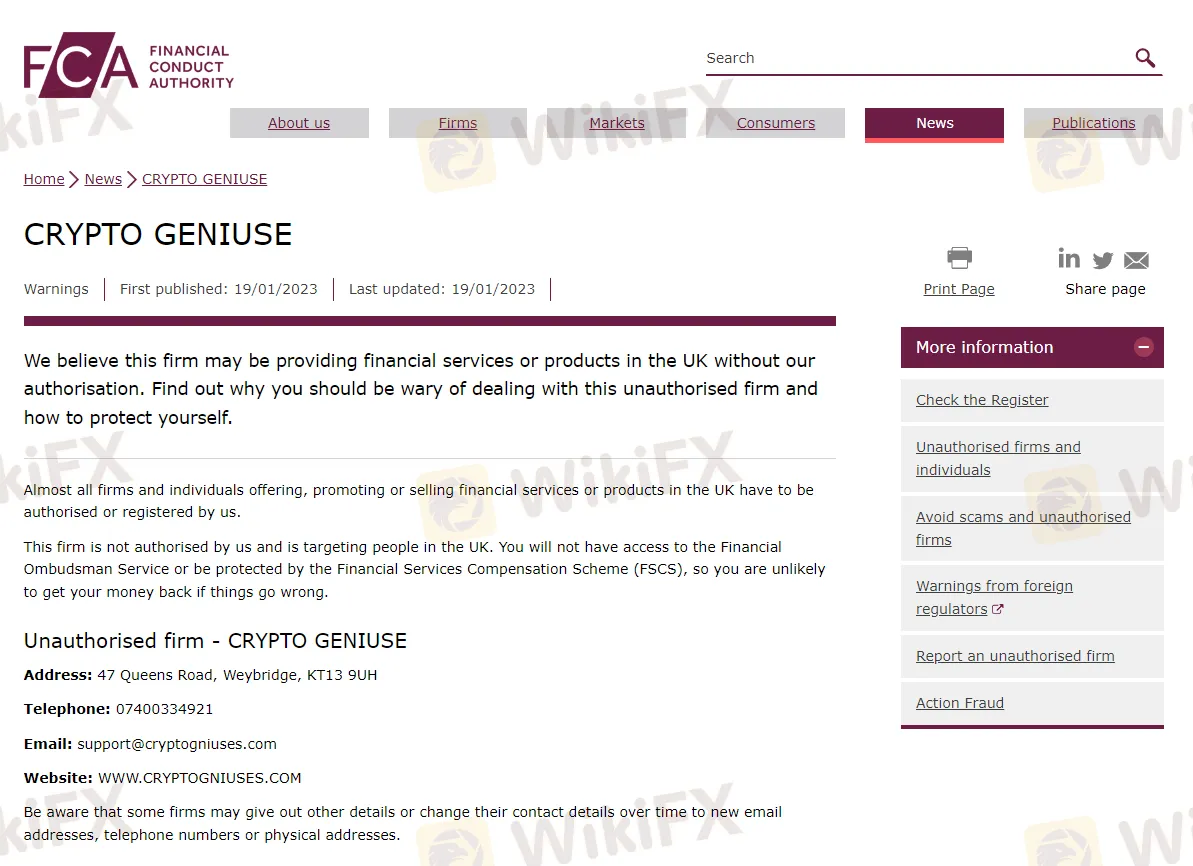

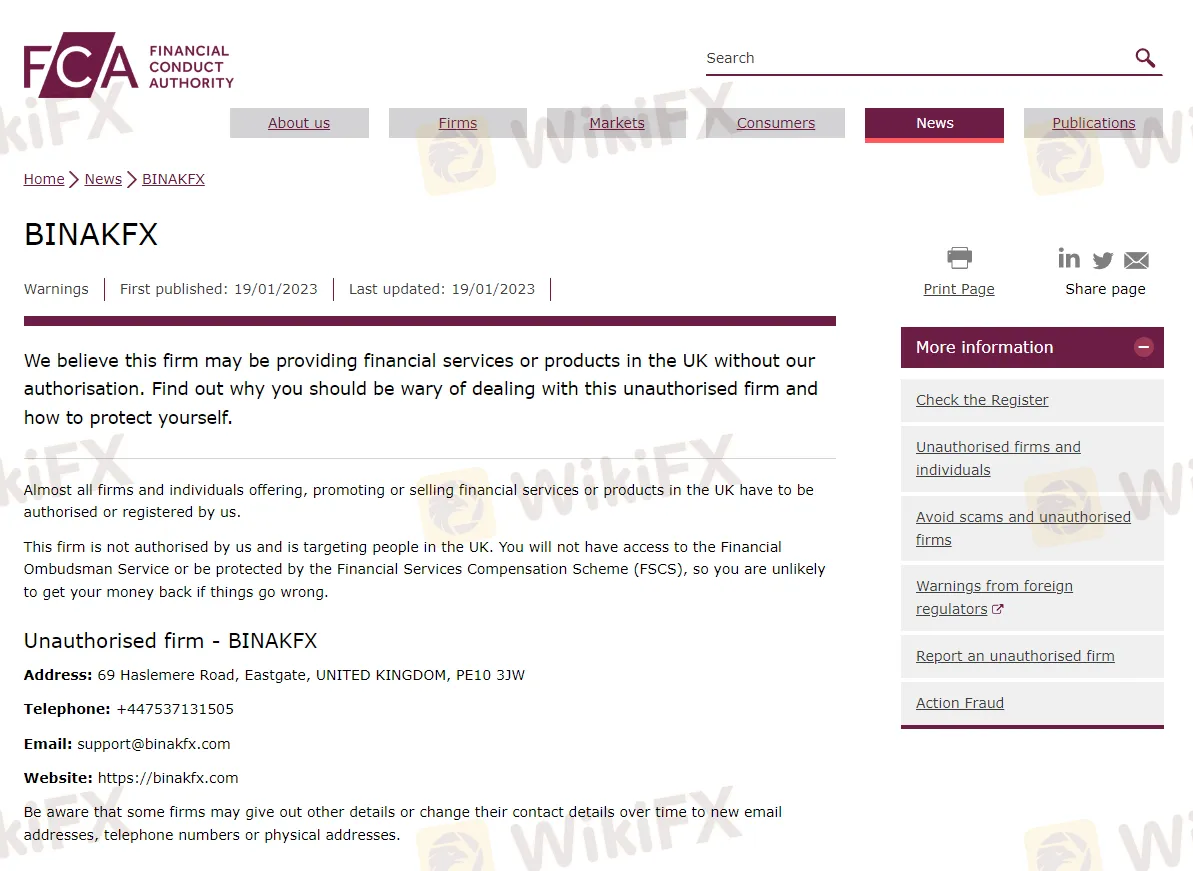

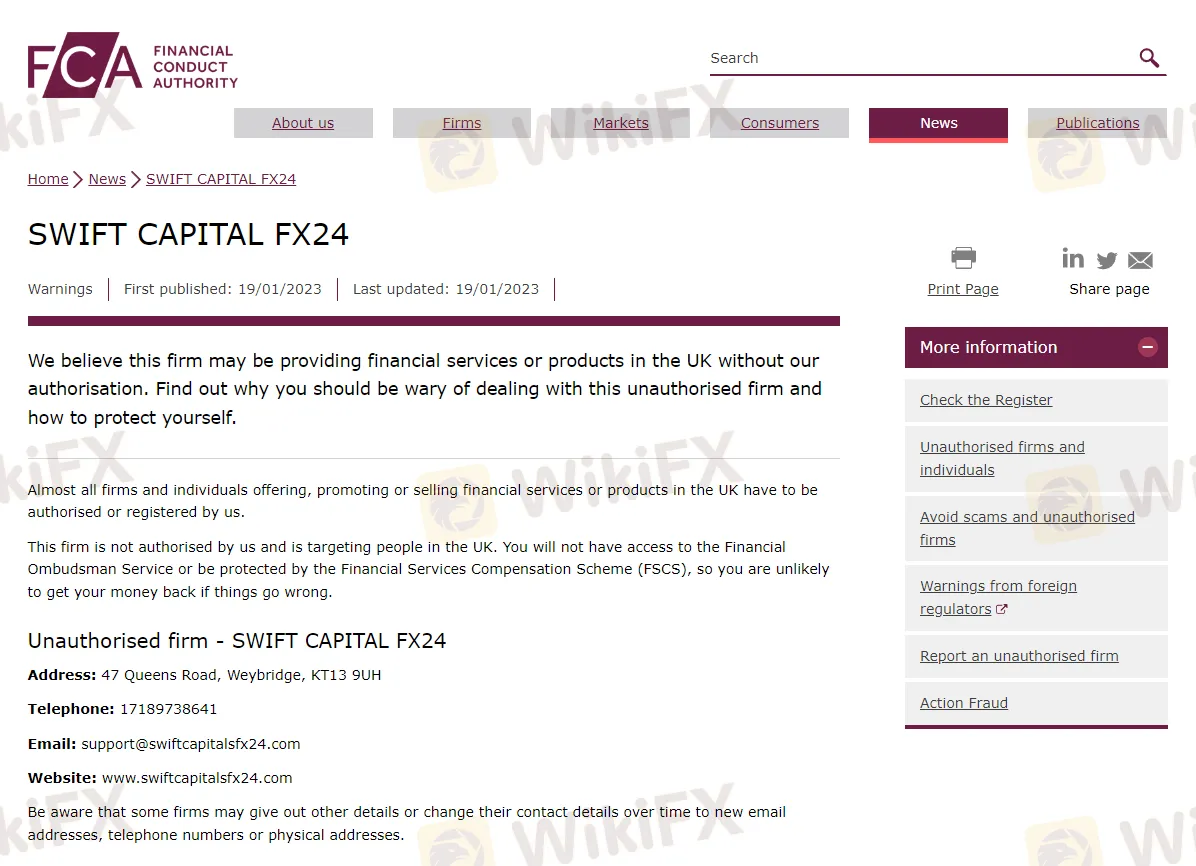

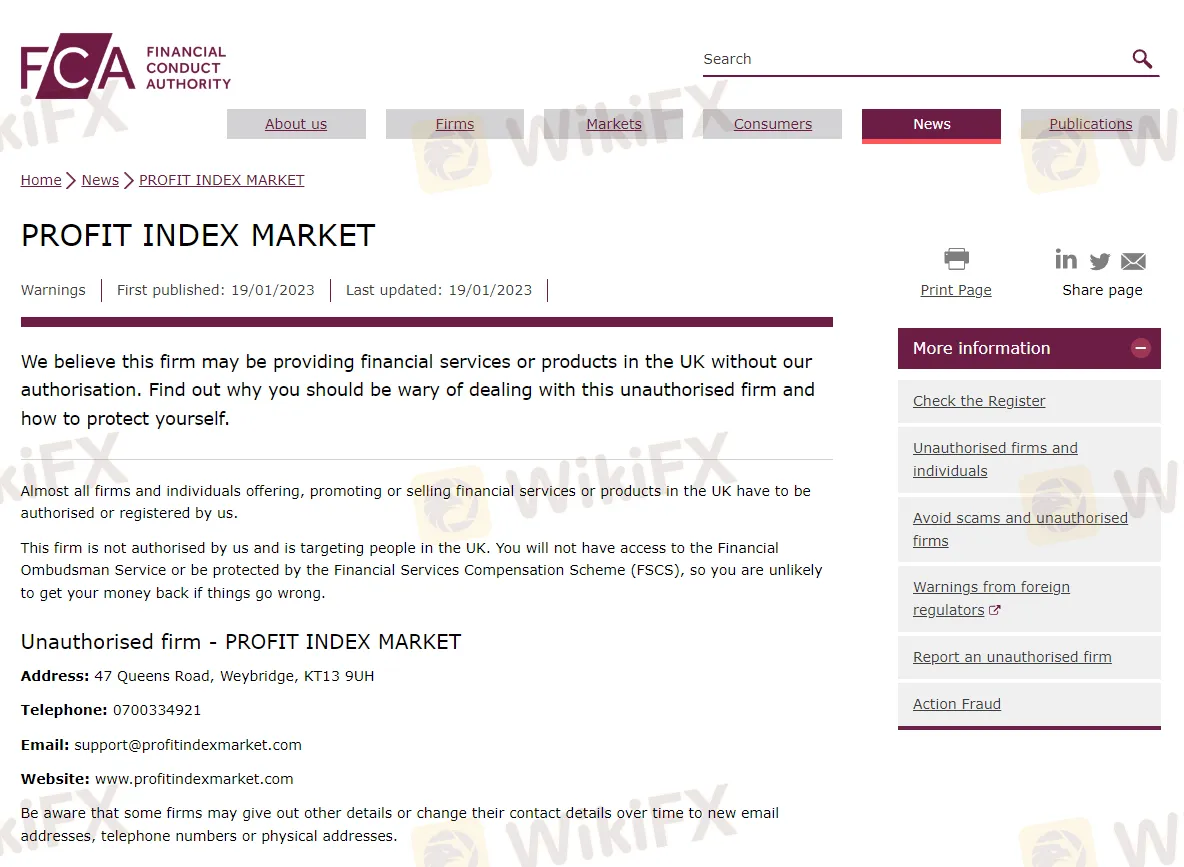

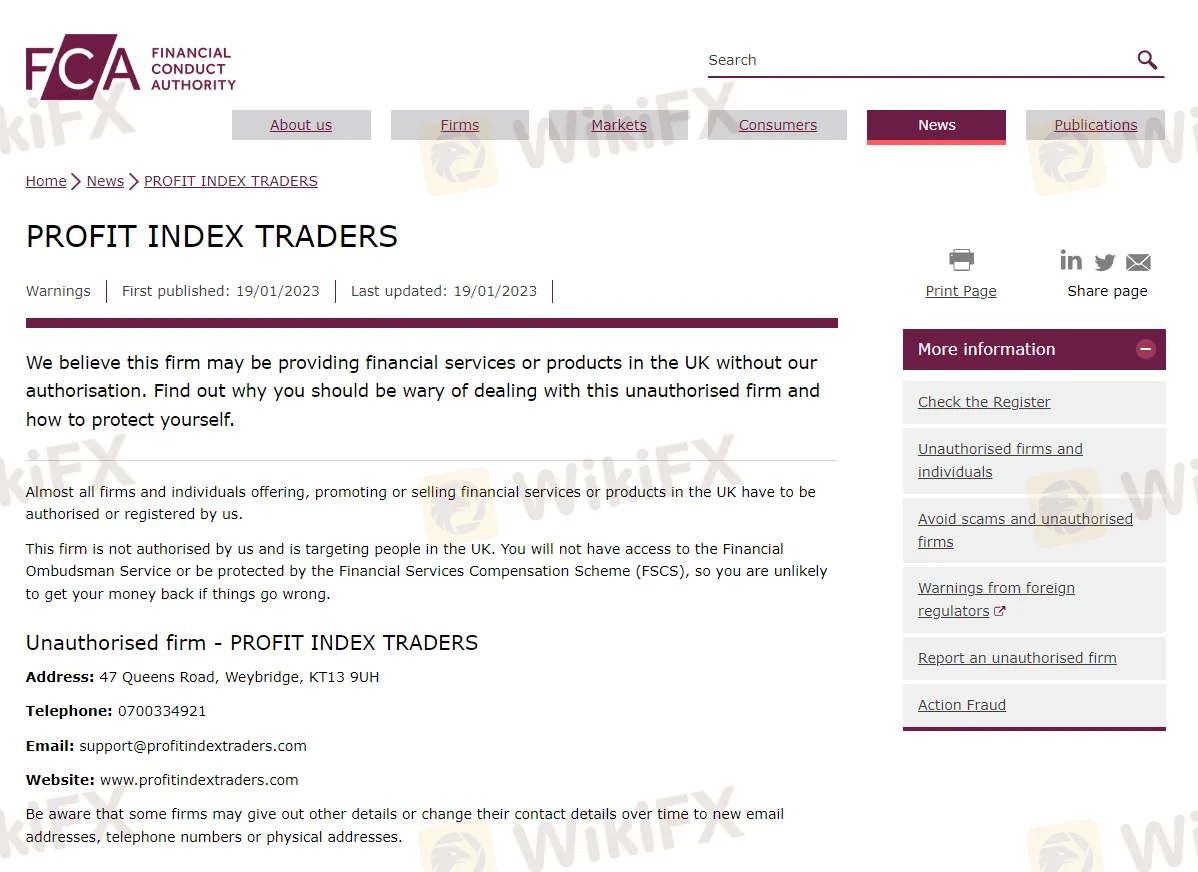

List of unauthorized brokers released on Jan. 19, 2023

CRYPTO GENIUSE

BINAKFX

SWIFT CAPITAL FX24

PROFIT INDEX MARKET

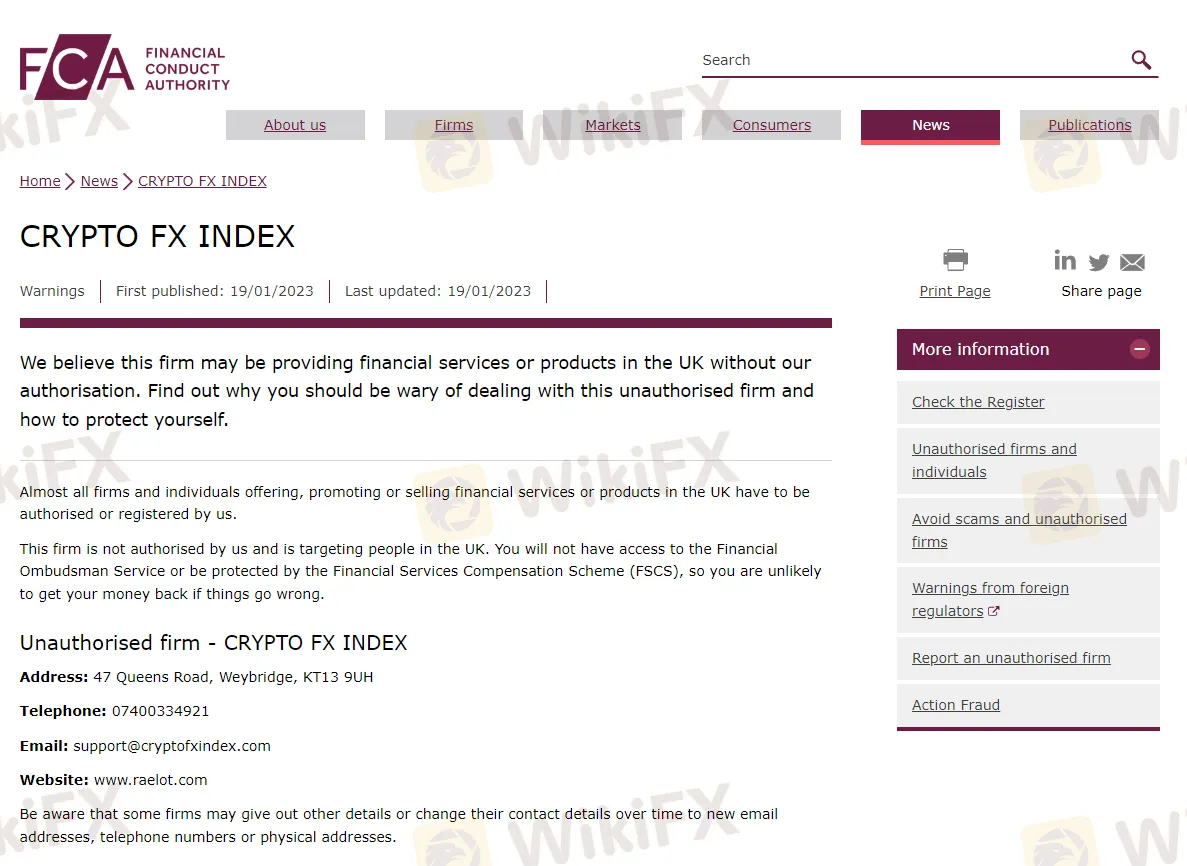

CRYPTO FX INDEX

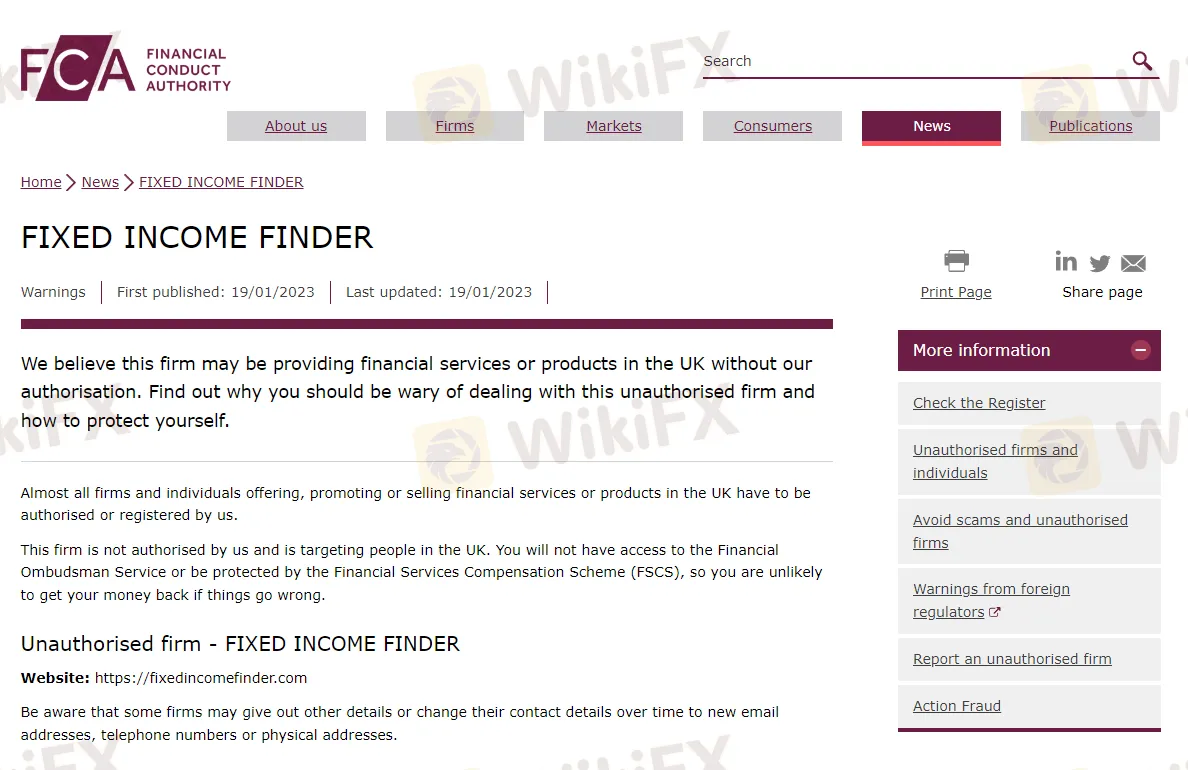

FIXED INCOME FINDER

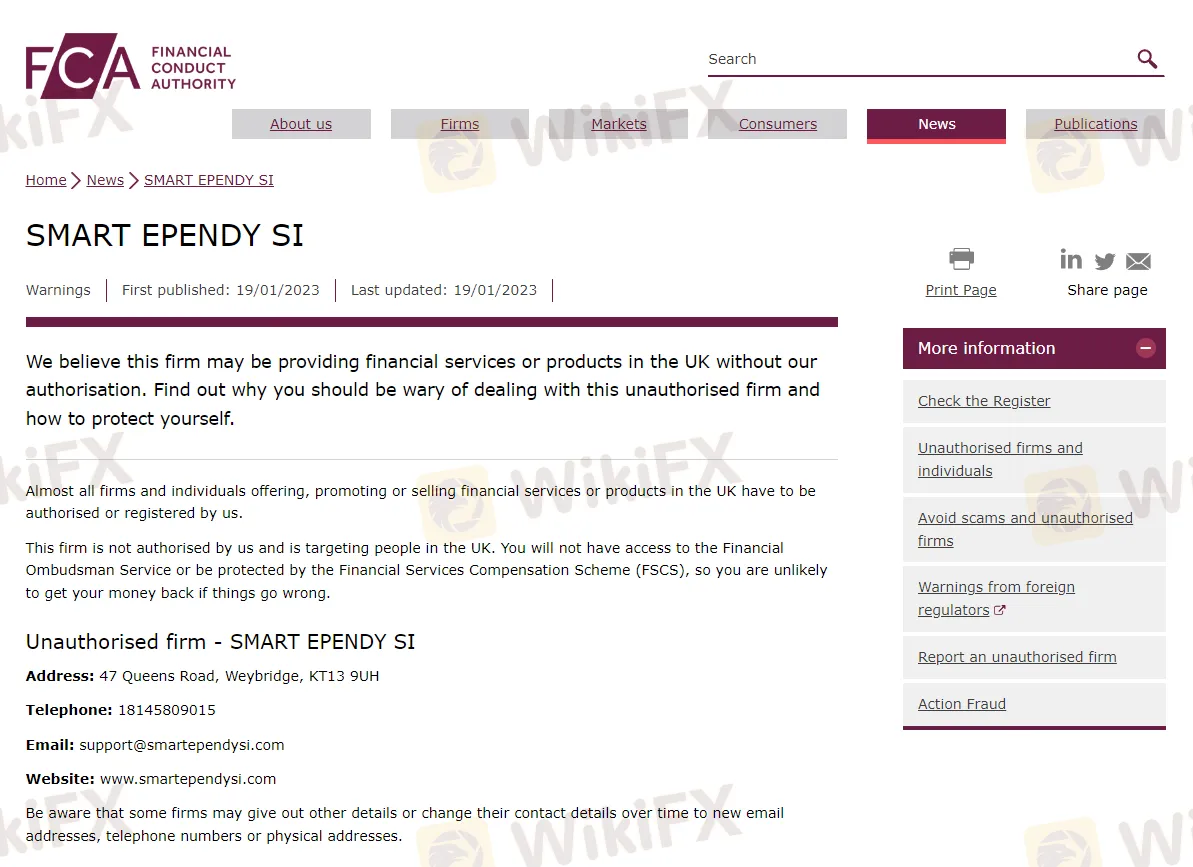

SMART EPENDY SI

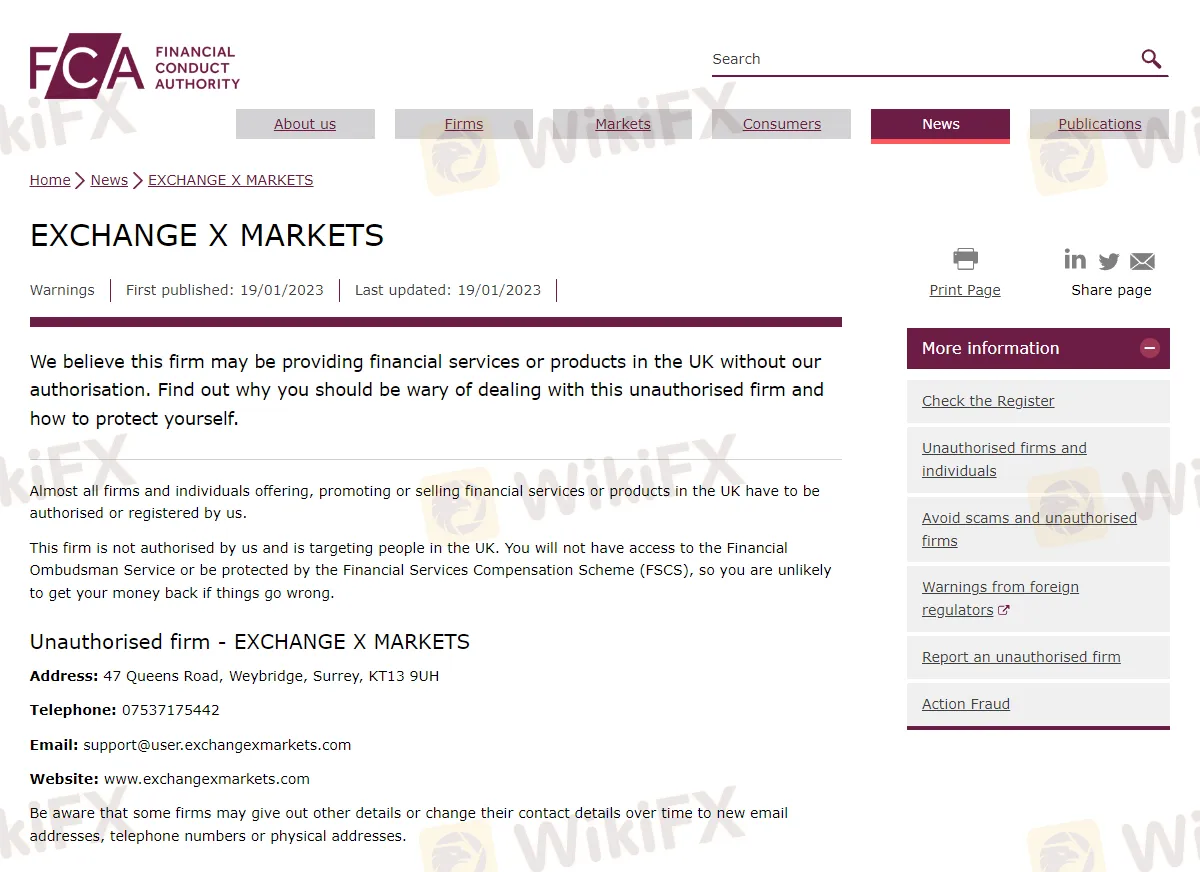

EXCHANGE X MARKETS

PROFIT INDEX TRADERS

The FCA's warning lists include several categories of firms and individuals that the FCA has identified as posing a potential risk to consumers. These include:

Unauthorised firms: These are firms that are not authorized by the FCA to conduct regulated activities in the UK, but are still offering financial services to consumers. Consumers should be particularly cautious of these firms, as they are not subject to FCA oversight and may not be operating in compliance with regulations.

Fraudulent websites: These are websites that the FCA has identified as being used in fraudulent activities, such as phishing scams or impersonating legitimate firms. Consumers should be careful not to provide personal or financial information to these websites.

Clone firms: These are firms that use the name and details of authorized firms in order to trick consumers into thinking they are dealing with a legitimate company. Consumers should check the FCA's register of authorized firms to confirm the authenticity of any firm they are considering doing business with.

Suspicious investment schemes: These are investment schemes that the FCA has identified as being potentially fraudulent or high-risk. Consumers should be wary of these schemes and should always conduct their own research before investing.

Enforcement actions: These are firms and individuals that the FCA has taken enforcement action against, such as fines or sanctions, for non-compliance with regulations. Consumers should be cautious about doing business with these firms and individuals.

The FCA also issues alerts and press releases to keep consumers informed of any significant risks to consumers and financial markets. It's highly recommended to check the FCA's warning lists and alerts regularly and to be cautious before doing business with any firm or individual that is on the list.

Final word

It is important for consumers to be aware of the FCA warning lists and to check them regularly to ensure they are not doing business with firms or individuals that have been flagged as potentially fraudulent or operating outside of regulations. The FCA's warning lists can be found on their website and include information on unauthorized firms and individuals, as well as firms and individuals that the FCA has taken enforcement action. It's also crucial to note that just because a firm or individual is on the FCA's warning list does not necessarily mean they are operating illegally or fraudulently, but consumers should still exercise caution and do their own research before doing business with them.

Stay tuned for more FCA warning lists of brokers.

You can install the WikiFX App on your mobile phones through the download link below, or from the App Store or Google Play Store.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Seaprimecapitals Withdrawal Problems: A Complete Guide to Risks and User Experiences

Worries about Seaprimecapitals withdrawal problems and possible Seaprimecapitals withdrawal delay are important for any trader. Being able to get your money quickly and reliably is the foundation of trust between a trader and their broker. When questions come up about this basic process, it's important to look into what's causing them. This guide will tackle these concerns head-on, giving you a clear, fact-based look at Seaprimecapitals' withdrawal processes, user experiences, and trading conditions. Most importantly, we'll connect these real-world issues to the single most important factor behind them: whether the broker is properly regulated. Understanding this connection is key to figuring out the real risk to your capital and making a smart decision.

iFX Brokers Review: Do Traders Face Withdrawal Issues, Deposit Credit Failures & Free Coupon Mess?

Have you had to pay several fees at iFX Brokers? Had your trading profit been transferred to a scamming website, causing you losses? Failed to receive withdrawals from your iFX Brokers trading account? Has your deposit failed to reflect in your trading account? Got deceived in the name of a free coupon? Did the broker officials not help you in resolving your queries? Your problems resonate with many of your fellow traders at iFX Brokers. In this iFX Brokers review article, we have explained these problems and attached traders’ screenshots. Read on!

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

Questrade Review Pros, Cons and Regulation

Is Questrade legit? Yes—CIRO regulated broker offering stocks, ETFs, forex, CFDs, bonds, and more with low fees and modern platforms.

WikiFX Broker

Latest News

Interactive Brokers Expands Access to Taipei Exchange

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Pepperstone CEO: “Taking Down Scam Sites Almost Every Day” Becomes “Depressing Daily Business”

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

eToro Cash ISA Launch Shakes UK Savings Market

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Currency Calculator