Abstract:Stocks slipped in Asia on Monday after a surprise drop in U.S. unemployment quashed any thought of a pivot on policy tightening ahead of a reading on inflation which is expected to see core prices move higher again.

Geopolitical tensions added to the uncertainty as markets waited to see how the Kremlin might respond to the blast that hit Russias only bridge to Crimea.

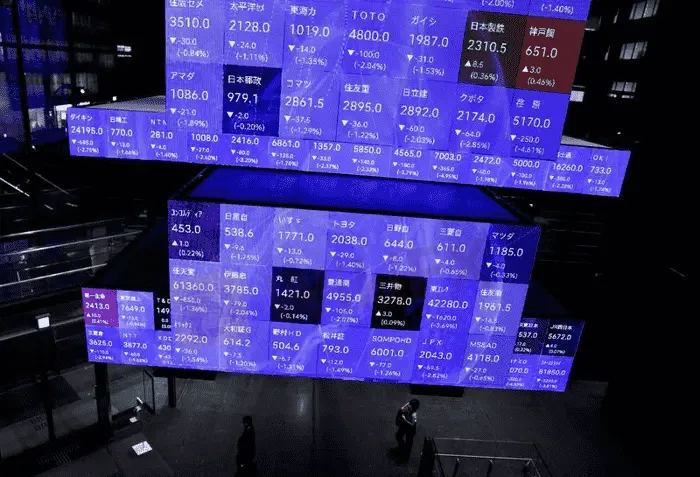

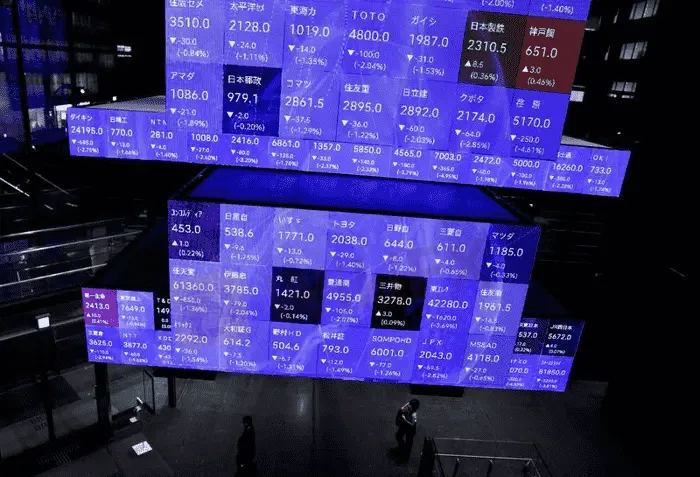

Holidays in Japan and South Korea made for thin trading in Asia, while the Treasury market is also shut on Monday.

S&P 500 futures led the early action with a drop of 0.5%, while Nasdaq futures fell 0.6% as U.S. earnings season kicks off later this week.

Nikkei futures traded at 26,615 compared to Fridays cash close of 27,116.

Wall Street sank on Friday after an upbeat payrolls report seemed to seal the deal on another outsized rate hike from the Federal Reserve.

Futures imply a more than 80% chance of rates rising by 75 basis points next month, while the European Central Bank (ECB) is expected to match that and the Bank of England hike by at least 100 basis points.

“We are in the midst of the largest and most synchronized tightening of global monetary policy in more than three decades,” said Bruce Kasman head of economic research at JPMorgan, who expects hikes of 75 basis points from all three of the central banks.

“The September CPI report should show a moderation in goods prices that is a likely harbinger of a broader slowing in core inflation,” he said. “But the Fed will not be responsive to a whisper of inflation moderation as long as labour markets shout tightness.”

Headline consumer price inflation is seen slowing a touch to an annual 8.1%, but the core measure is forecast to accelerate to 6.5% from 6.3%. The U.S. CPI data will be released on Thursday at 8:30 am ET (1230 GMT).

Minutes of the Feds last policy meeting are also out this week and are likely to sound hawkish given how many policy makers lifted their dot plot forecasts for rates.

Earnings test

Wall Street also faces a testing time on corporate earnings with the major banks kicking off the season on Friday, including JPMorgan, Citi, Wells Fargo and Morgan Stanley.

“Consensus expects 3% year/year EPS growth, 13% sales growth, and 75 bp margin contraction to 11.8%,” analysts at Goldman Sachs said in a note. “Excluding Energy, EPS is expected to fall by 3% and margins to contract by 132 bp.”

“We expect smaller positive surprises in 3Q compared with 1H 2022 and negative revisions to 4Q and 2023 consensus estimates.”

One likely bone of contention will be the strength of the dollar which will pressure offshore earnings.

The dollar index was firm at 112.75 having risen the for the past three sessions. It stood at 145.34 yen but had so far shied away from the recent 24-year top of 145.90 for fear of Japanese intervention. [USD/]

The euro looked vulnerable at $0.9734, having retreated from a high of $0.9999 last week.

Sterling fared little better at $1.1089, with traders on edge as the Bank of England is due to end its emergency bond buying campaign on Friday.

Yields on 10-year bonds are still up at 4.237% and a long way from the 3.31% level held before the British mini-budget sent the market into a tailspin. [GBP/]

The climb in the dollar and yields has been a burden for gold, which was hovering at $1,694 an ounce. [GOL/]

Oil prices edged higher after Brent climbed 11% last week in the wake of a deal on supply reductions by OPEC+. [O/R]

Brent firmed 12 cents to $98.04 a barrel, while U.S. crude rose 21 cents to $91.85 per barrel.