Abstract:BigOption brand manager Elad Bigelman was sentenced by Maryland District Court Judge Paula Xinis to pay $3.8 million in reparations. The appropriate order was signed by the Judge on September 26, 2022.

BigOption brand manager Elad Bigelman was sentenced by Maryland District Court Judge Paula Xinis to pay $3.8 million in reparations. The appropriate order was signed by the Judge on September 26, 2022.

The ruling orders Elad Bigelman to pay $3,766,449 in restitution on a joint and several bases with a co-conspirator, Lee Elbaz, the CEO of fraudulent binary options business Yukom Communications.

The reparation sum was set by the Department of Justice (DOJ) around four months ago.

Elad Bigelman, also known as “Michael Goldberg,” worked for Yukom Communications from at least January 2015 until about September 2017. He worked as a brand manager at BigOption. He was in charge of BigOption agents who provided retention services. Bigelman also provided retention services on behalf of BigOption.

The superseding indictment says that starting in May 2014, the defendants and their co-conspirators illegally promoted and sold binary options via a variety of websites, including BinaryBook and BigOption. According to the indictment, the conspirators worked for an Israeli firm called Yukom Communications, which was engaged in the selling and marketing of binary options.

According to the indictment, the defendants and their co-conspirators misled investors in BinaryBook and BigOption by inducing investors to deposit funds based on various false statements and material omissions regarding the purported alignment of financial incentives between investors and BinaryBook and BigOption representatives; the suitability of binary options as investments; the potential return on investment; and the names, qualifications, and physical location of the defendants and their co-conspirators.

The indictment further claims that the defendants and their co-conspirators misrepresented investors' capacity to withdraw monies from accounts and utilized misleading phrases such as “bonuses,” “risk-free transactions,” and “insured trades” to deceive investors.

About BigOption

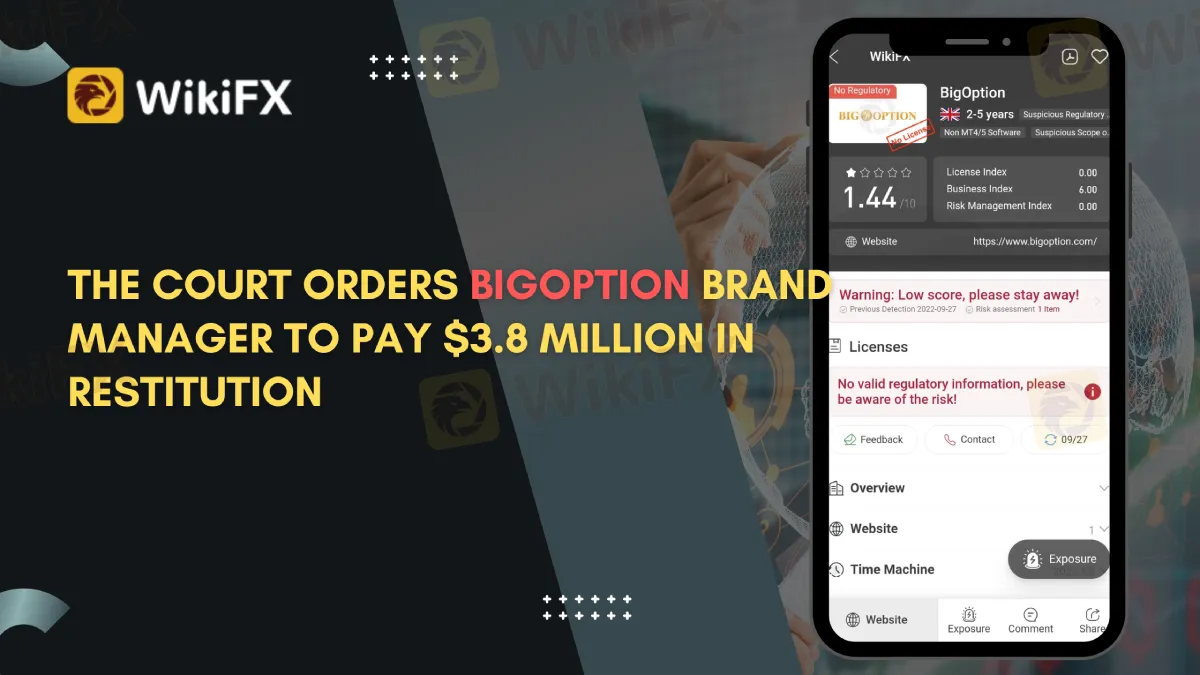

BigOption is based in London, England. It is one of the newest binary options brokers to open its doors, but it seems to be on its way to being a leader in the area. BigOption provides a diverse range of choices, an eye-catching selection of 200 assets, and a respectable 85% return rate. Its website is straightforward to use and accessible in English, German, French, Arabic, and Turkish. CySec oversees BigOption.

Read the whole details about BigOption: https://www.wikifx.com/en/dealer/2701268141.html

About WikiFX

WikiFX is a worldwide corporate financial information search engine. Its primary duty is to give basic information searching, regulatory license seeking, the credit assessment, platform identification, and other services to the included foreign exchange trading firms.

The portal lists approximately 39,000 brokers, both legal and unregistered. WikiFX's staff has been working hard with 30 financial regulators from across the world to guarantee that the information supplied is factual and correct.

Stay tuned for more Broker News.

Download the WikiFX App from the App Store or Google Play Store.