WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

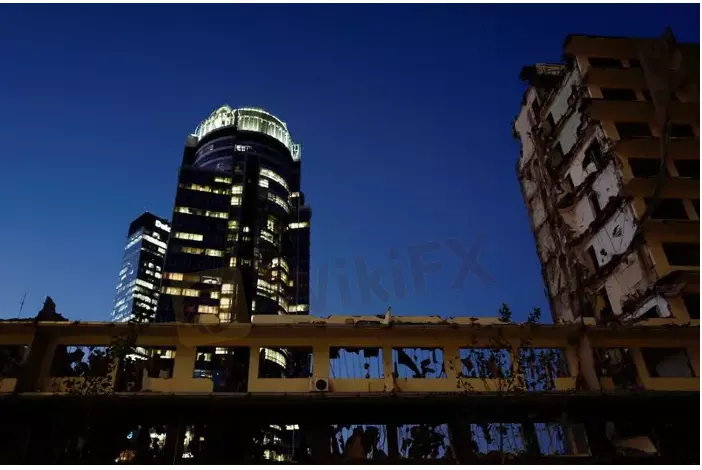

Abstract:The Pakistan rupee slid further against the U.S. dollar on Wednesday, as the local foreign exchange association warned that panic was spreading through the currency market following the sharp declines this week.

The rupee fell 2% on Monday, and 3% on Tuesday, despite last weeks staff level agreement reached with the International Monetary Fund (IMF) that would pave the way for a disbursement of $1.17 billion under resumed payments of a bailout package.

On Wednesday morning the rupee was trading at 225 per dollar, having ended Tuesday at 221.99 after Fitch ratings agency revised its outlook for Pakistan sovereign debt from stable to negative – though it affirmed Long-Term Foreign-Currency and Issuer Default Rating at “B-”.

“There is panic in the market, I fear it (the rupee)will go down further,” Zafar Paracha, Secretary General of a foreign exchange association, the Exchange Companies of Pakistan, told Reuters.

Paracha said he did not see any reason for the depreciation in the rupee other than a possible IMF pre-conditions. Neither the government or the IMF have said anything about the need for any further depreciation of the currency, though Pakistan recently adopted a market-based exchange rate under advice from the IMF under the economic reforms agenda.

“The recent movement in the rupee is a feature of a market-determined exchange rate system,” the State Bank of Pakistan said in a series of Twitter posts late Tuesday night, adding that rupees depreciation against dollar is in large part a global phenomenon.

Pakistan faces economic turmoil, with fast depleting foreign reserves, a declining currency and widening fiscal and current account deficits, and the rupee has lost 18% of its value since Dec. 21.

Reserves have fallen to as low as $9.8 billion, hardly enough to pay for 45 days of imports.

Pakistan has also passed through another bout of political instability, with the government of Prime Minister Shehbaz Sharif taking over from ousted premier Imran Khan in April.

On Tuesday, sovereign dollar bonds issued by Pakistan suffered sharp losses to record lows after Fitch‘s move, while the Pakistan Stock Exchange’s KSE100 Index .KSE fell 2.36%.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.