Abstract:Trying to label itself as a legitimate trading forex brokerage, the entity stated not only suspicious forex awards, but also misleading trading volume and company history.

Confusing Corporate Information

Brave Climbing Global Capital contains various false and misleading statements:

▶ False foundation Year

· founded in 2016, the entity claims to provide hundreds of forex currency pairs, precious metals, commodity and etc.

· with more than US $1 billion trading volume in 2021;

· with over 180,000 global active users

▶ Suspicious Forex Awards

· “Gold Award” for the best financial growth enterprise in the United States in 2018;

· 2018 Hong Kong most valuable enterprise award;

· Brave won the title of “talent enterprise”

At the first sight, you may fell the broker is reliable and reputable with these magnificent figures, data and awards and it must be welcomed by traders and individuals with good reputation. However, its domain name(https://braveclimbingfx.com/) check result shows the firm was newly created at the end of year 2021. So how it can win awards and has a company history before its establishment? Thus, it's a red flag here.

An anonymous company without any legal info

Viewing its homepage, we found Brave Climbing Global Capital is completely anonymous and a risk to all. Why? The firm's contact information including phone, physical address and email, is currently not available. Besides, there is no legal documents. Under these circumstances, you can't reach the phone number, verify the locations, and can't confirm in any other way whether the broker is authorized to sell forex goods or not, so that's most likely a fraud.

Clients reported Brave is a FX scam

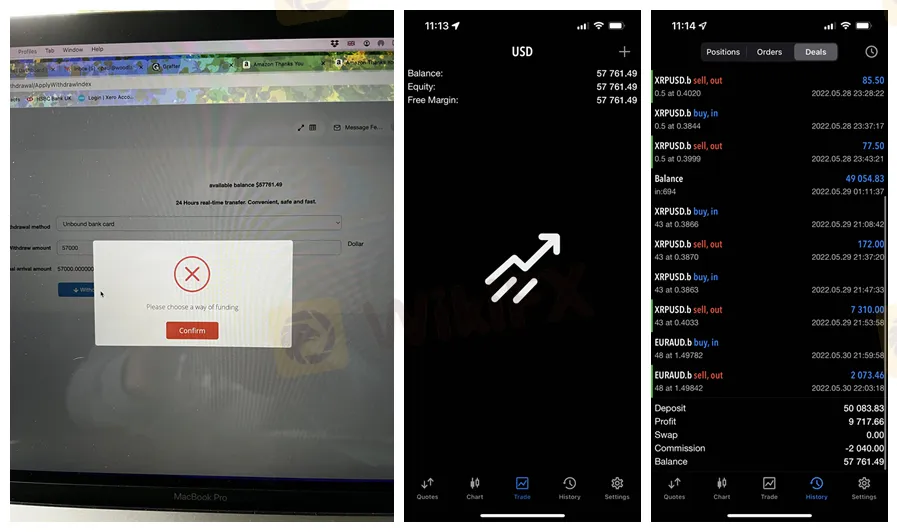

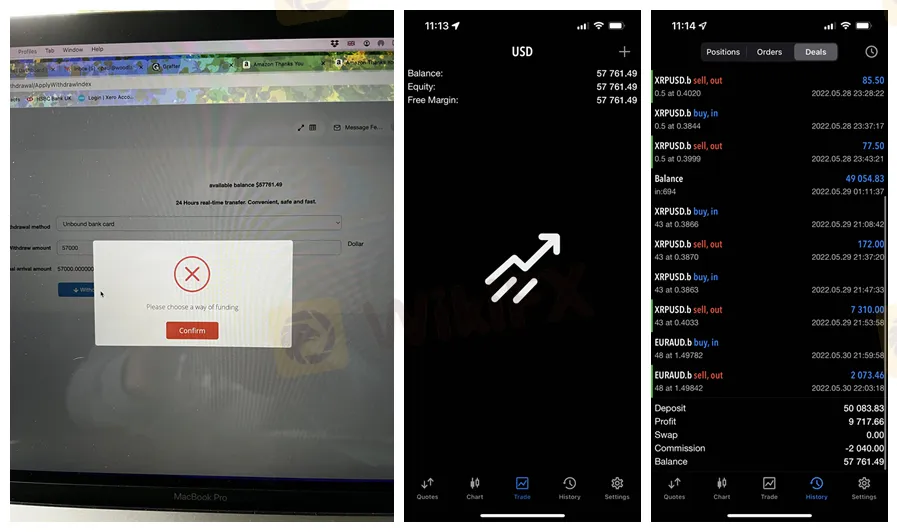

An investor named paulowillo84 said somebody added him as a friend on Instagram at first, but one day he was trapped to invest money on Brave after several successful trades. He put in 50,000 USD here but was declined by the Brave when he tried to withdraw.

Another client with a nickname Efos2016 said the Brave charges a 10% fee at withdrawal and 3% penalty for everyday past 7 days.