Abstract:A fraud has been reported by a trader and being revealed by WikiFX to give awareness to everyone the illegal activities of the broker

A trader contacted the WikiFX Rights Protection Team after his withdrawal request was found to be fraudulent. Raffles Market, the broker, accepted his money and allowed him to begin trading. After making some winnings, the trader demands a withdrawal of $2,385.00, however, the money has never been credited into his account after 20 days of waiting. A trader approaches the WikiFX Rights Protection Team in the hopes of recovering his funds from a dishonest broker. The evidence is as follows: (https://exposure.wikifx.com/en/detail/202206238562361980.html)

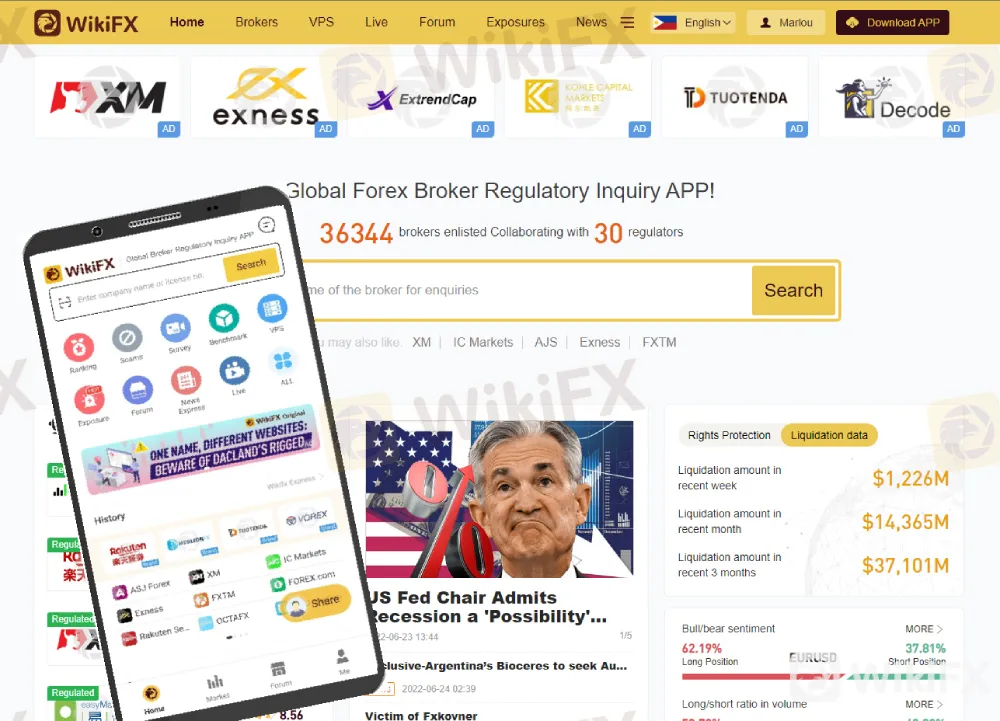

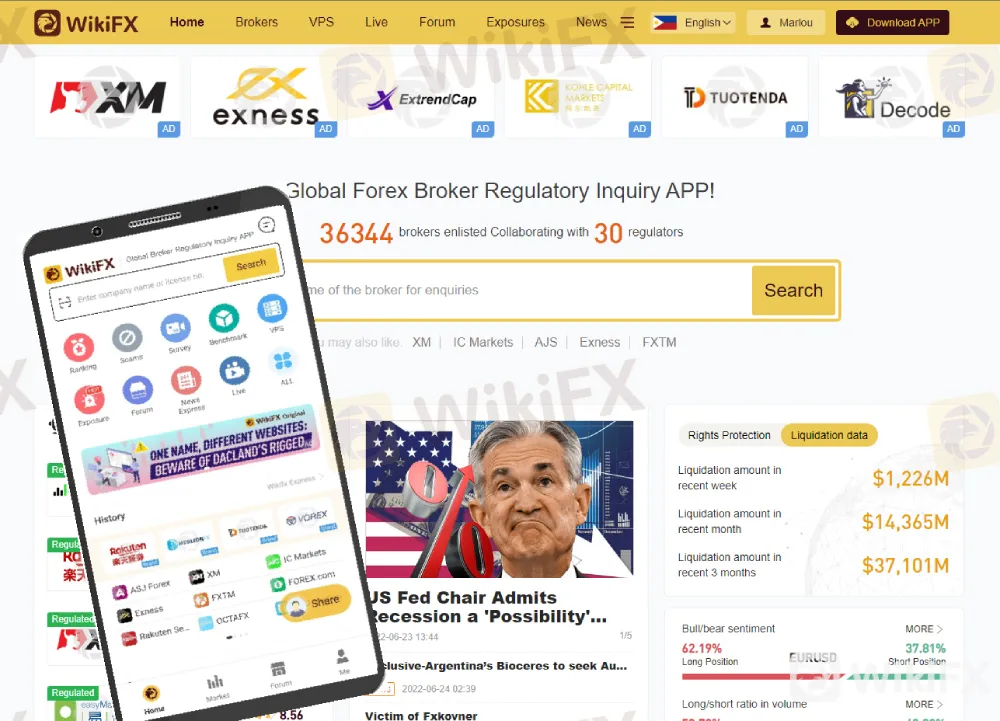

According to WikiFX's study, they claim to be regulated by the (FSA) and (NFA) based on their website, after confirming the aforementioned broker. Both regulatory organizations do not regulate the broker. WikiFX has over 35,000 brokers listed and works closely with 30 regulators. As a result, WikiFX can readily check the broker's genuine identity, whether it is legitimate or unregulated. Broker's link (https://www.wikifx.com/en/dealer/1704301923.html)

What exactly is Raffles Market?

Raffles Market claims to be an international broker with a presence in over 19 countries, primarily in the Asia Pacific region, that offers a good selection of forex pairs and CFDs on indices, stocks, precious metals, commodities, and crypto coins, as well as a choice of two account types, including an ECN account, unparalleled trading conditions - consistently tight spreads and leverage as high as 1:400 - and the industry-standard MetaTrader4 platform.

Furthermore, Raffles Market claims to be licensed in the United States, which sounds amazing if true. Raffles Market, unfortunately, is just another unregulated, offshore website with all the characteristics of fraud. The claim is as follows:

What is the required minimum deposit at Raffles Market?

The minimum deposit at Raffles Market is $500, however, because the website is anything but legitimate, you may want to check out our list of brokers that provide micro-accounts instead.

Aside from their Standard Account, Raffles Market also provides an ECN Premium Account with a minimum deposit requirement of up to $20,000.

What kinds of leverage are accessible at Raffles Market?

Raffles Market claims to provide leverage up to 1:400. Because they lie about their regulatory status, and their offshore registration doesn't help matters, we've included a list of brokers that provide leverage as high as 1:500 instead.

What trading platforms does Raffles Market offer?

Raffles Market claims to provide the industry standard MetaTrader4, however, due to our inability to download the software, you may also check our list of brokers that support MetaTrader4 for real money.

What means of payment are accepted at Raffles Market?

Raffles Market supports payments through many third-party payment providers, including Help2Pay, AwePay, and PayTrust, as well as cryptocurrencies such as USDT. Because credit cards are not specified, you may discover our list of brokers where you can use your VISA or MasterCard here.

How to report this kind of scam?

We are urging any traders who are having similar issues to contact the WikiFX Right Protection Team to get this problem rectified.

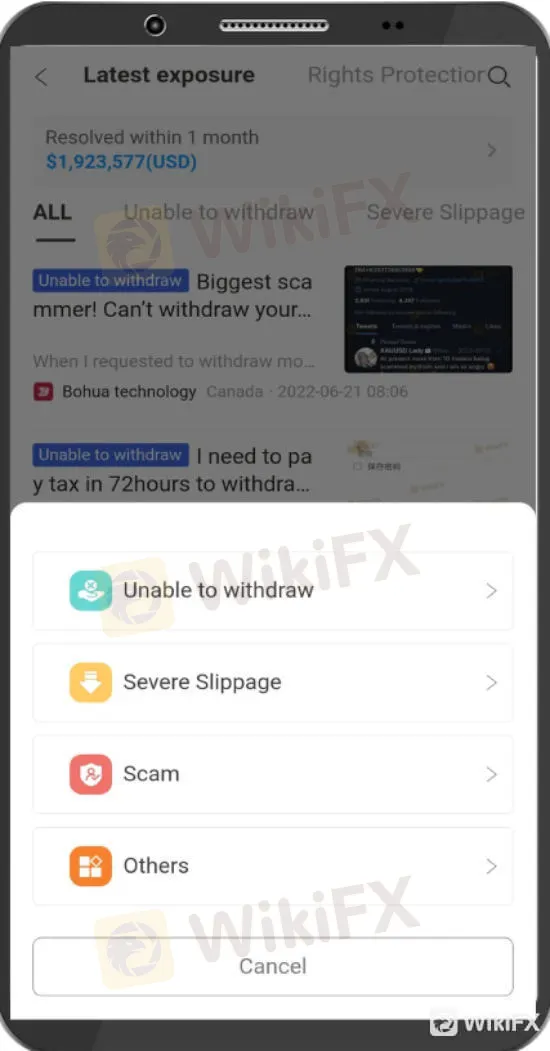

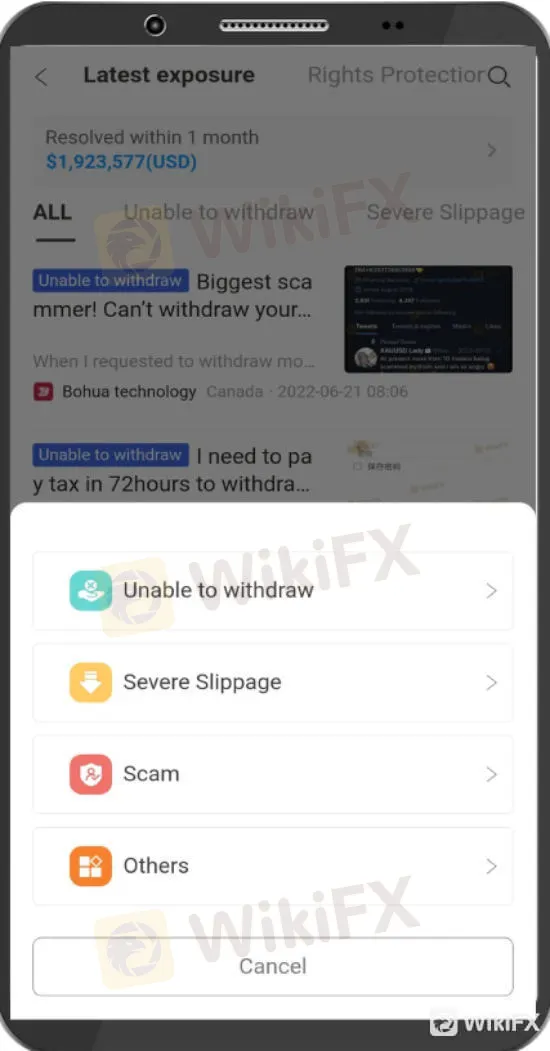

The following are the procedures for reporting the event to WikiFX.

Step 1: Launch the WikiFX app, which may be accessed through a computer or a smartphone.

Step 2: At the top of the app, click on the term “Exposure”.

Step 3: Look for the term “Exposure”, which is a red button at the bottom of the page, and click on it.

Step 4: Choose a case type from the list.

Step 5: Choose the broker who is involved.

Step 6: Begin reporting your experience by filling out the form.

How to avoid this kind of scam?

As we all know, Forex trading has a significant level of risk. Make certain that the broker you choose comes highly recommended and has excellent reviews on WikiFX (example shown below). Conduct extensive research on a certain broker to see whether they have any complaints, particularly on the withdrawal procedure, customer support, website stability, and so on. Some of us would like to test a new broker due to their incredible offers since we don't know what's behind them. It is their marketing approach to entice individuals, but once you are caught on their web, they will gradually begin the scamming process. That is how most scammers operate. Before investing, it is preferable to choose a reputable and well-recommended forex broker.

Final Decision

Raffles Market lacks a consistent trading method on which you may rely. Your savings are in danger, and it is unclear who controls the assets on the site. The founders may face criminal charges, and the business may cease to exist. As a result, Raffles Market seems to have no trading operations taking place on the platform.

The persons behind the corporation are unknown, and their business model is questionable. Furthermore, if they were earning the stated returns, it would be obvious in historical trading history. As a result, the corporation has a hidden goal in the absence of past trading activity.

WikiFX app is available for free download on the App Store and Google Play Store.