OANDA to Transfer Prop Trading Business to FTMO Platform

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:WTI sees more upside as Germany surrendered its opposition to the embargo on Russian oil.

Finding a substitute for bulk exports of oil from Russia wont be easy for the EU.

The announcement of more stimulus from the PBOC has raised hopes of oil demand recovery.

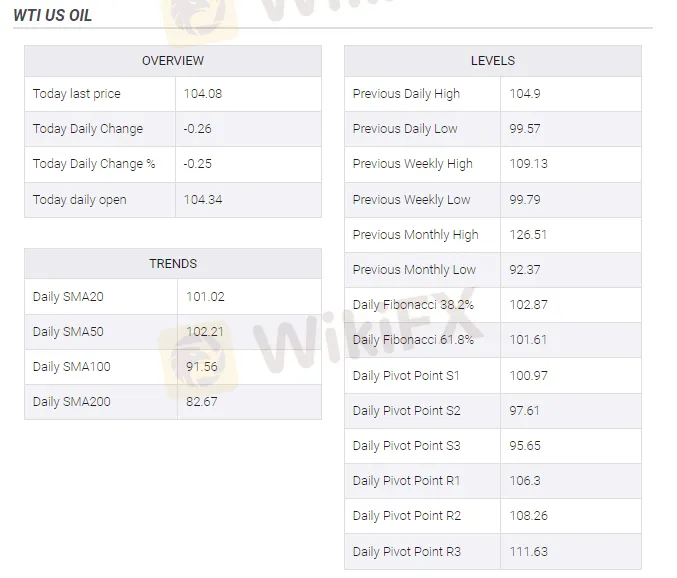

West Texas Intermediate (WTI), futures on NYMEX, are trading near Thursdays last traded price at $104.16. The oil prices have witnessed a strong rebound this week as supply worries overpowered the demand concerns. Supply concerns due to the prohibition of Russian oil by the Western leaders and demand worries due to the Covid-19 resurgence in China were resulting in a tug of war. Although bulls got underpinned and are likely to advance further as European Union (EU) progressed on the embargo on Russian oil.

The EU is aiming to prohibit the imports of oil from Russia sooner after Germany dropped its opposition. In earlier discussions, Germany was leading the criticism against the embargo on Russian oil overnight amid its higher dependency on fossil fuels and energy from Russia. Now, the major automobile exporter has surrendered its opposition, so the EU will do the required paperwork at the earliest. This may fuel the supply worries as a substitution of bulk Russian oil exports will not be a cakewalk. So probation of Russian oil by the eurozone in an already tight market will weigh pressure on the bulls.

Meanwhile, the announcement of prudent monetary policy guidance by the Peoples Bank of China (PBOC) will reduce the demand worries in the dragon economy due to the Covid-19 resurgence. More liquidity infusion by the PBOC in its economy will ram-up the aggregate demand and henceforth the demand for oil. It is worth noting that China is the largest importer of oil and demand recovery in China will have a positive impact on oil prices principally.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.