Abstract:Asian share markets slipped on Wednesday as investors faced up to the possibility of aggressive monetary tightening by the U.S. Federal Reserve to fight inflation, while focus was also on new Western sanctions against Russia over its invasion of Ukraine.

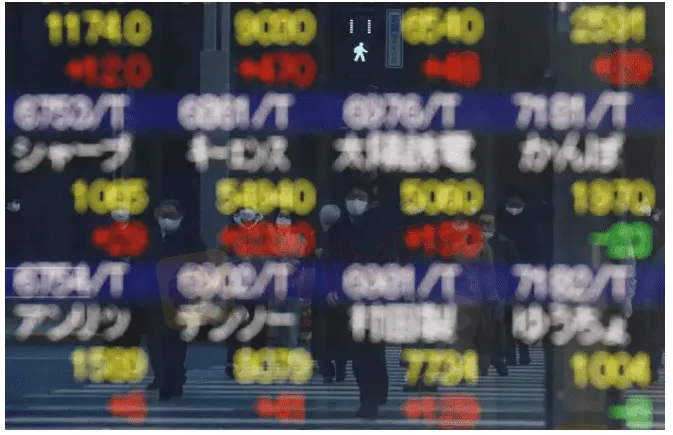

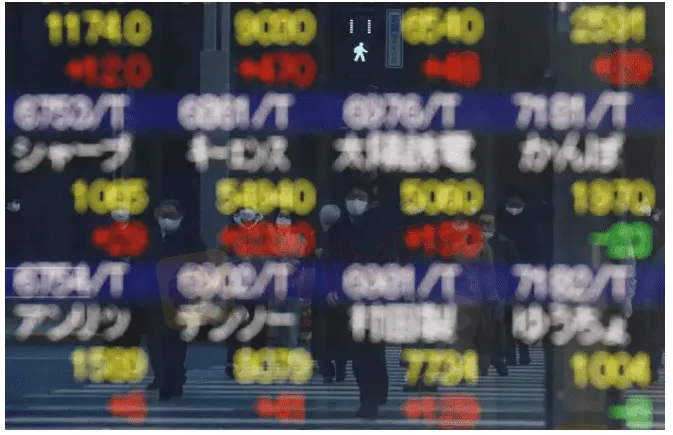

Asian share markets slipped on Wednesday as investors faced up to the possibility of aggressive monetary tightening by the U.S. Federal Reserve to fight inflation, while focus was also on new Western sanctions against Russia over its invasion of Ukraine.

U.S. Treasury yields hit multi-year highs and stock markets were red after Fed Governor Lael Brainard said overnight that she expected a combination of interest rate rises and a rapid balance sheet runoff to take U.S. monetary policy to a “more neutral position” later this year.

In morning trade in Asia, Japans Nikkei shed nearly 2.0%, while South Korean shares fell 0.9% and Australian shares lost 0.75%.

MSCIs broadest index of Asia-Pacific shares outside Japan skidded 1.3%.

Hong Kongs Hang Seng index was down 1.3%, moving away from a one-month high hit on Monday. Shanghai lost 0.1% as markets in mainland China reopened after two days of public holidays.

Activity in Chinas services sector shrank at the steepest pace in two years in March as a local Omicron surge restricted mobility and weighed on client demand, a closely watched private sector survey showed on Wednesday.

On Tuesday, Chinese authorities extended a COVID-19 lockdown in Shanghai to cover all of the financial centres 26 million people, despite growing anger over quarantine rules in the city.

Investors‘ focus on Wednesday will be on the release of minutes from the Fed’s last policy meeting, which they are expected to scrutinise for clues on the prospect of a 50 basis point hike at the U.S. central banks next meeting in May.

“It‘s currently considered an 80% chance the Fed will take that course,” said Kyle Rodda, a market analyst at IG in Melbourne. Investors hadn’t fully priced in such a move, so greater evidence for it may move markets, Rodda added.

“Theres expectation the Fed could hike 50 bps in June too, and if that becomes more likely, then a repricing of those risks could spark another spike in volatility,” he said.

The European Central Bank will publish its minutes on Thursday.

Investors were also waiting to see how a fresh round of Western sanctions on Russia would play out.

The United States and its allies will on Wednesday impose new sanctions on Russian banks and officials and ban new investment in Russia, the White House said.

The yield on benchmark 10-year Treasury notes continued to move higher, hitting a two-year high of 2.6120% before coming down slightly. It was last at 2.6048%.

The jump in yields following Brainards comments also played out in the currency market, providing support to the dollar.

The dollar index hit 99.638, its highest since late May 2020.

The greenback was also trading firm against the yen at 123.98 yen given the Bank of Japans conviction and repeated action last week to hold the yield on 10-year Japanese government bonds below 0.25%.

The euro was down 0.1% at $1.0889.

The rise in bond yields globally has put pressure on gold, which pays no return.

Spot gold traded down 0.1% at $1,921.76 per ounce. [GOL/]

Oil prices fell on pressure from the rising dollar and growing worries that new coronavirus cases could slow demand, despite ongoing supply concerns.

U.S. crude was down 0.4% at $101.54 a barrel. Brent crude was off 0.4% at $106.19 per barrel. [O/R]