Abstract:The price of oil trades to a fresh weekly high ($115.40) amid an unexpected decline in US inventories, and crude may continue to retrace the decline from the yearly high ($130.50) if the Organization of Petroleum Exporting Countries (OPEC) stick to the current production schedule at the next Ministerial Meeting on March 31.

Crude Oil Price Outlook Hinges on OPEC Meeting

CRUDE OIL PRICE OUTLOOK HINGES ON OPEC MEETING

The price of oil appears to have reversed ahead of the 50-Day SMA ($95.32) as it extends the series of higher highs and lows carried over from last week, and current market conditions may keep crude prices afloat as data prints coming out of the US point to strong demand.

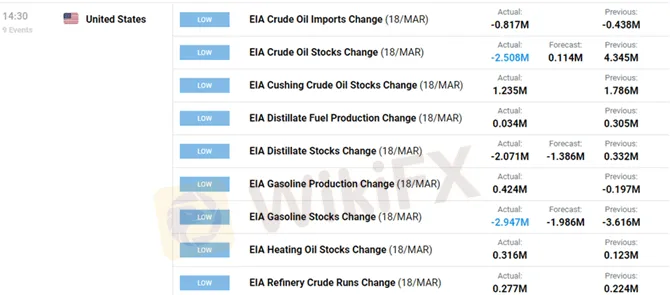

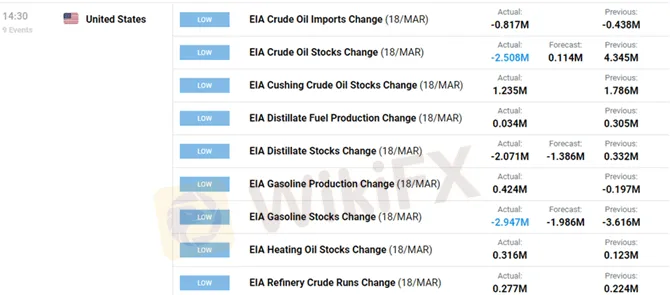

US stockpiles narrowed 2.508M in the week ending March 18 versus forecasts for a 0.114M rise, and the development largely align with the upbeat outlook entailed in OPECs most recent Monthly Oil Market Report (MOMR) as the update insists that “for the time being, world oil demand growth in 2022 remains unchanged at 4.2 mb/d, given the high uncertainty and extreme fluidity of developments in recent weeks.”

Indications of robust demand may encourage OPEC and its allies to retain the current production schedule with the group on track to “adjust upward the monthly overall production by 0.4 mb/d for the month of April 2022,” and the decline from the yearly high ($130.50) may turn out to be a correction in the broader trend as US production remains subdued.

A deeper look at the update from the Energy Information Administration (EIA) show weekly field production holding steady for seven consecutive weeks, with the figure printing at 11,600K in the week ending March 18, and more of the same from OPEC+ may ultimately lead to higher oil prices as the group retains a gradual approach in restoring production to pre-pandemic levels.

With that said, the price of oil may continue to carve a series of higher highs and lows ahead of the OPEC meeting as indications of stronger demand are met with signs of limited supply, and crude may stage another attempt to test the record high ($147.27) if the group shows little interest in responding to the Russia-Ukraine war.