Abstract:Brent is the name given to a relatively light crude oil made from a blend of crudes from 19 oil fields in the North Sea. Brent Crude is one of the three main benchmarks for crude oil prices per barrel, along with West Texas Intermediate (WTI) from North America and Dubai Crude from the Persian Gulf. Brent is also the name of an oil field located in the North Sea off the coast of Scotland, which was discovered in 1971 and started production in 1976. Brent is an acronym for Broom, Rannoch, Etive, Ness and Tarbert – the five geological formations that form the Middle Jurassic field.

Brent is the name given to a relatively light crude oil made from a blend of crudes from 19 oil fields in the North Sea. Brent Crude is one of the three main benchmarks for crude oil prices per barrel, along with West Texas Intermediate (WTI) from North America and Dubai Crude from the Persian Gulf. Brent is also the name of an oil field located in the North Sea off the coast of Scotland, which was discovered in 1971 and started production in 1976. Brent is an acronym for Broom, Rannoch, Etive, Ness and Tarbert – the five geological formations that form the Middle Jurassic field.

Brent Crude is a major trading classification of sweet light crude oil that serves as a benchmark price for purchases of oil worldwide.

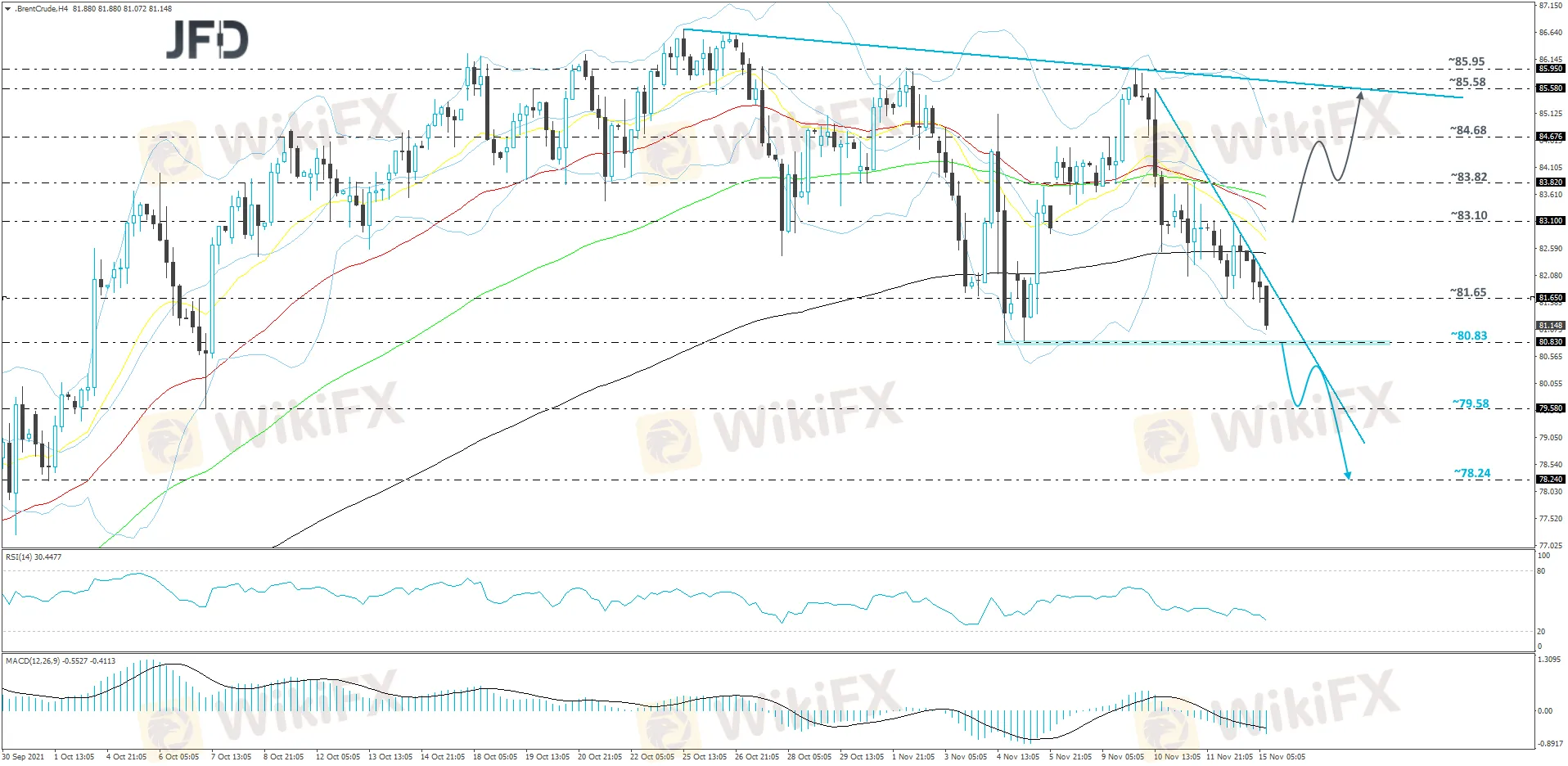

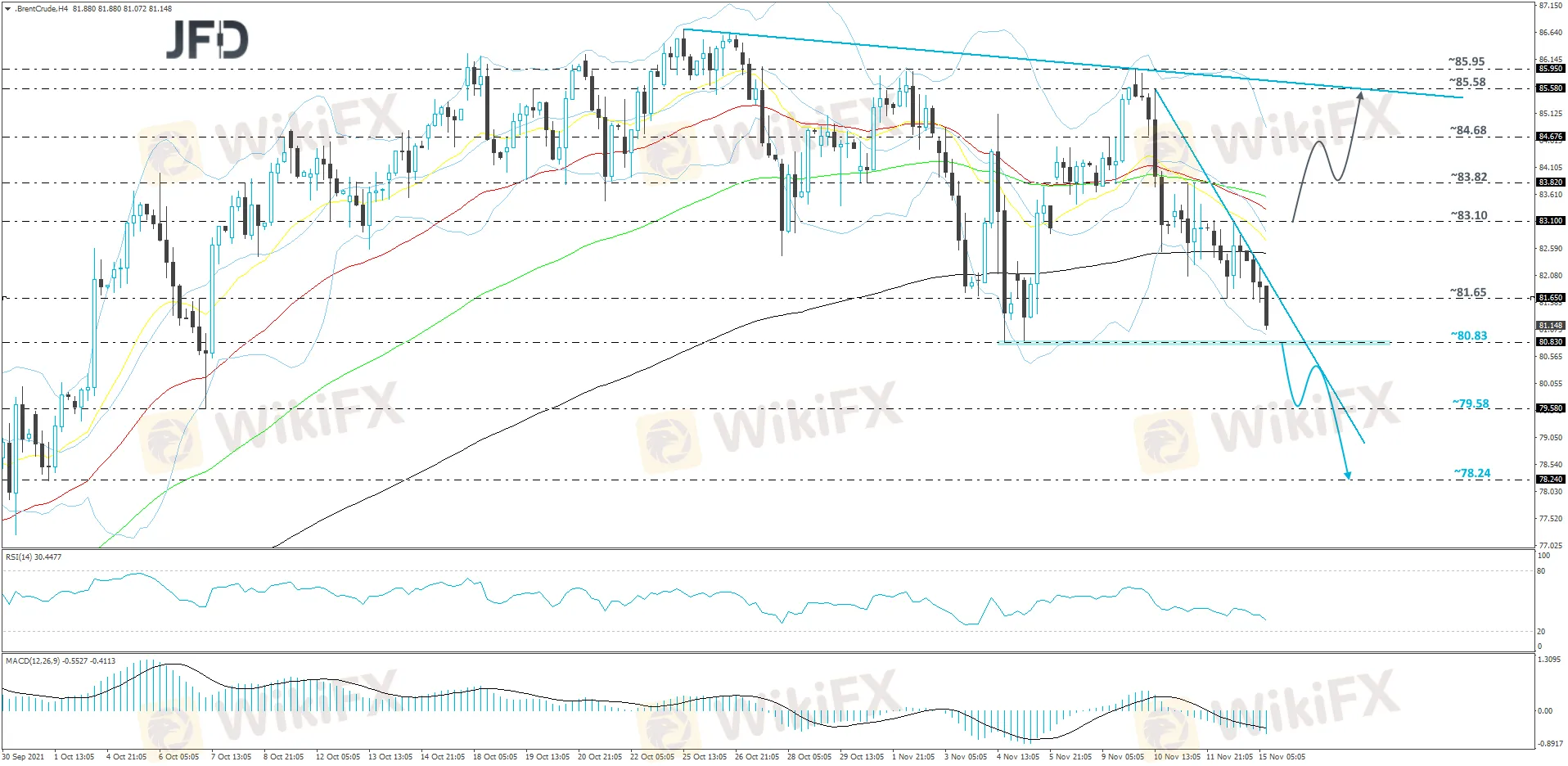

Taking look at the technical picture of Brent crude oil on the 4-hour chart, it can be observed that currently the commodity is trading below a steep short-term downside resistance line taken from the high of November 10th. The price is also near the 80.83 hurdle, which is the current lowest point of November. Even though Brent oil is showing willingness to move lower, as suggested preferably needs to wait for a break below that hurdle first, in order to get comfortable with lower areas after some Hours.

As the expected drop happens, and Brent oil moves below 80.83, this will confirm a forthcoming lower low, potentially opening the door towards lower areas. The commodity may drift to the 79.58 obstacle, marked by the low of October 7th, where a temporary hold-up might occur. Nevertheless, if the selling pressure remains strong, the price could continue sliding, possibly aiming for the 78.24 level, marked by the lowest point of October. The RSI and the MACD are currently pointing lower. In addition to that, the RSI sits below 50 and the MACD continues to run below zero and the trigger line. The two indicators show negative price momentum, which supports the above-discussed scenario.

In other way round, when the price breaks above the aforementioned downside line and then climbs above the 83.10 barrier, marked by the high of November 12th, that could attract a few more buyers into the game. Brent oil might then travel to the 83.82 obstacle, or even to the 84.68 territory, which is marked near an intraday swing high of November 9th and an intraday swing low of November 10th. If the buying fails to stop there, the next possible target could be the 85.58 level, marked by an intraday swing high of November 10th. Over there the commodity may test a short-term uncertain downside resistance line drawn from the high of October 25th, and it may likely provide an additional hold-up.