Unternehmensprofil

| Oriental Securities Corporation Überprüfungszusammenfassung | |

| Gegründet | 1979 |

| Registriertes Land/Region | Taiwan |

| Regulierung | Taipei Exchange |

| Handelsinstrumente | Wertpapiere, Futures, Anleihen |

| Handelsplattform | Oriental Securities Corporation-亞東e指賺 |

| Kundensupport | Tel: 02-7753-1899;0800-088-567;02-405-0218 |

| E-Mail: service@osc.com.tw | |

Oriental Securities Corporation Informationen

Oriental Securities Corporation, gegründet in Taiwan im Jahr 1979 und reguliert von der Taipei Exchange, ist eine Online-Handelsplattform, die den Handel mit verschiedenen Finanzanlagen ermöglicht und eine mobile Handelsplattform bereitstellt.

Vor- und Nachteile

| Vorteile | Nachteile |

|

|

| |

|

Ist Oriental Securities Corporation legitim?

Oriental Securities Corporation besitzt eine "Wertpapierhandelslizenz", die von der Taipei Exchange in Taiwan reguliert wird.

Was kann ich auf Oriental Securities Corporation handeln?

Die Plattform von Oriental Securities Corporation bietet Finanzanlagen zum Handel an, einschließlich Wertpapiere, Futures und Anleihen.

| Handelbare Instrumente | Unterstützt |

| Wertpapiere | ✔ |

| Futures | ✔ |

| Anleihen | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

Hauptgeschäfte

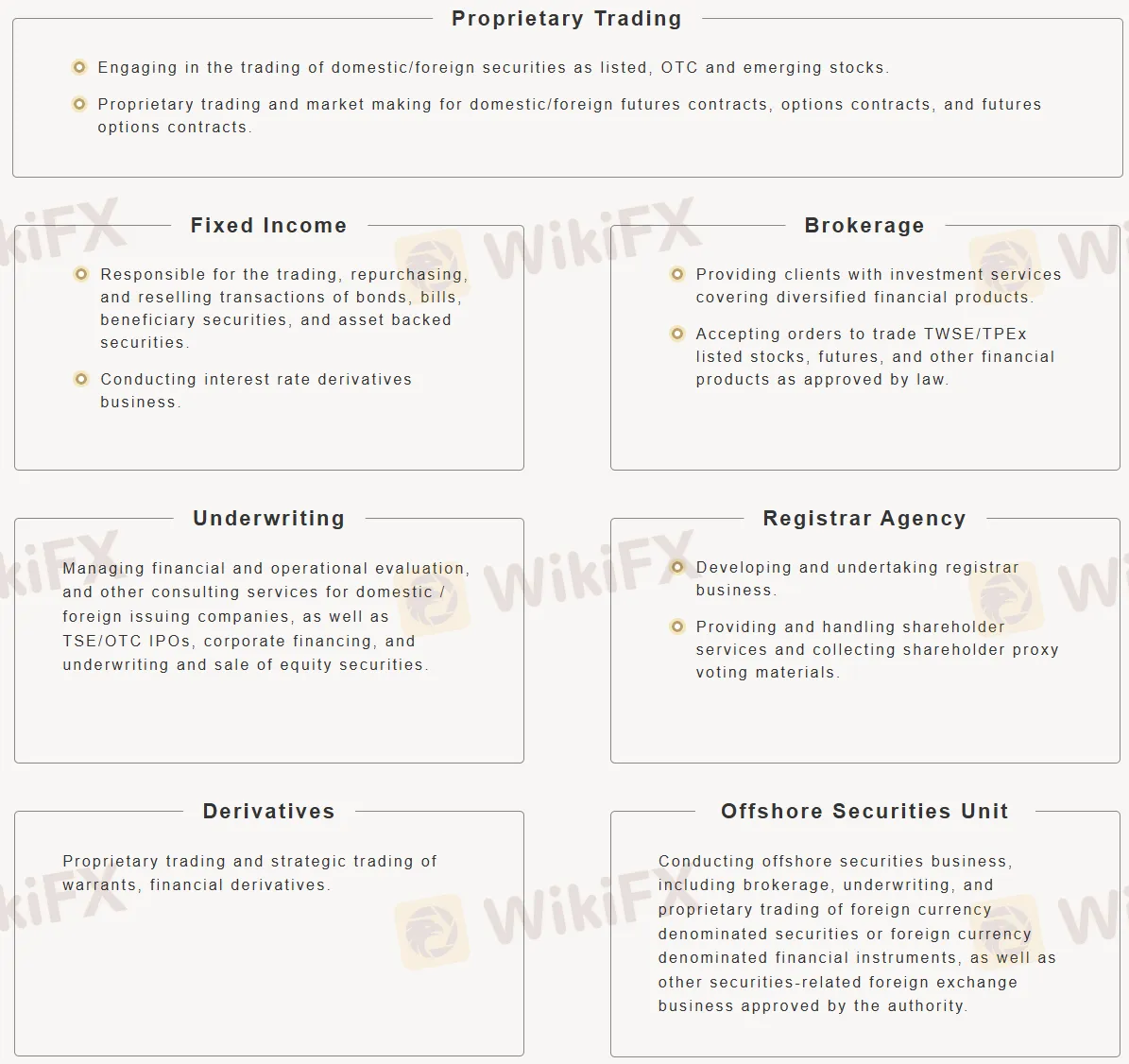

Hier sind die Hauptgeschäftsbereiche von Oriental Securities Corporation:

- Eigenhandel: Handelt mit Aktien und verschiedenen Futures/Optionen.

- Festverzinsliche Wertpapiere: Beschäftigt sich mit Anleihen und Zinsderivaten.

- Brokerage: Bietet Anlageberatung und führt Transaktionen für Kunden aus (Aktien, Futures, etc.).

- Unternehmensfinanzierung: Verwaltet Börsengänge, Unternehmensfinanzierungen und Eigenkapitalverkäufe.

- Registeragentur: Bearbeitet Aktionärsdienste und Stimmrechtsvertretung.

- Derivate: Handelt mit Optionsscheinen und Finanzderivaten.

- Offshore-Wertpapierabteilung: Führt internationale Wertpapiergeschäfte durch (Brokerage, Unternehmensfinanzierung, Eigenhandel in Fremdwährungen).

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| Oriental Securities Corporation-亞東e指賺 | ✔ | IOS, Android |