简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Nov 18, 2025

Sommario:Risk-Off Alert: Fed Hawkishness and Key Data/Earnings Set to Test MarketsThe market sentiment remains cautious and risk-averse following the Federal Reserves recent pivot, which slashed December rate

Risk-Off Alert: Fed Hawkishness and Key Data/Earnings Set to Test Markets

The market sentiment remains cautious and risk-averse following the Federal Reserve's recent pivot, which slashed December rate cut expectations and added by the concern of tech overvaluation concerns.

Global equities now saw selling pressure across the board. The Nasdaq led the weakness after recording its largest weekly drop since March, signaling persistent vulnerability in high-multiple tech stocks.

Macro Policy & Valuation Showdown

The market is preparing for two explosive events: the release of crucial delayed economic data and the ultimate test of the AI valuation boom.

1. Delayed Data Release Schedule Confirmed

The end of the government shutdown has allowed federal agencies to begin scheduling the release of critical, delayed economic reports.

· Nonfarm Payrolls (NFP): The previously delayed September NFP report is now confirmed for release this Thursday (November 20th). This will be the most crucial immediate indicator for the Federal Reserve and the market to assess the true health of the labor market.

· CPI/PCE Data: Following the jobs data, the Feds preferred inflation gauge, PCE (Personal Consumption Expenditures) and the revised Q3 GDP will be published on November 26th. The full picture of inflation and growth will guide the Fed's debate over whether to execute the December cut.

2. Nvidia Earnings & AI Valuation Test

On the other hand, the market focus has shifted intensely to the performance of the AI sectors bellwether.

Market attention is highly focused on NVIDIA's (NVDA) earnings report, scheduled for after the close on Wednesday. The performance and forward guidance provided by Nvidia are widely viewed as a referendum on the sustainability of the entire AI industry's valuation.

Technology momentum has already weakened significantly in the lead-up to the report. Should NVDA's guidance or results disappoint, it could easily trigger a new round of large-scale selling across the entire tech sector and the broader equity market.

Asset Outlook: Vulnerability and Risk-Currency Flows

The stock market faces significant downside risk and volatility this week. The combination of the imminent Nvidia valuation test and the highly anticipated NFP report ensures uncertainty is high. Strong policy signals from the Fed confirming “higher-for-longer” rates fundamentally undermine the premium built into growth stocks.

The market will remain challenged to maintain any significant upside until the NFP data is released and absorbed, dictating the next technical move.

SP500, Daily Chart

From a technical perspective, the S&P 500 has now decisively broken below the critical support zone of 6,700–6,760. This move, occurring after a recent Double Top pattern was formed, strongly suggests that further downside is technically likely.

Gold (XAU/USD): Consolidation Amid Yield Conflict

Meanwhile, Gold's recent movement reflects a fundamental struggle between policy drivers.

Gold may remain in a consolidative phase, swinging between two competing forces:

1. Risk-Aversion Flows: Growing fear that on global sentiment change

2. High Yield/Strong Dollar Pressure: The reality of the Fed's “hawkish pivot” keeps U.S. real yields high, increasing the opportunity cost of holding Gold.

This dynamic is likely to keep gold contained within the $4,100–$4,000 range ahead of key labor data releases and evolving global market conditions.

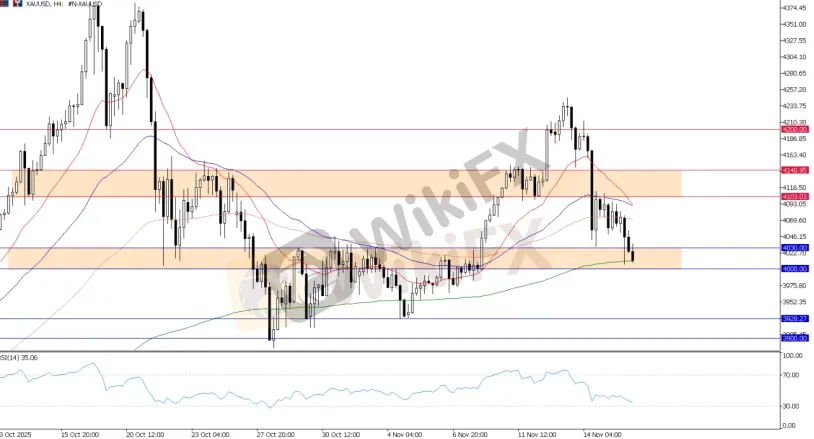

XAU/USD, H4 Chart

Gold recently rejected the $4,200 level, broke below $4,100, and is now retesting the $4,000 psychological support. If consolidation continues, this $4,000 zone may serve as near-term support.

AUD & NZD – High-Beta Currency Sensitivity

Over the FX space, the Australian Dollar (AUD) and New Zealand Dollar (NZD) are highly sensitive, high-beta commodity currencies, making them excellent barometers for global risk sentiment this week.

Directional Sensitivity: If the Nvidia earnings and NFP data confirm structural weakness and risk-off sentiment returns, the AUD and NZD will be sold aggressively as risk proxies. This could lead to further downside in both currencies.

Conversely, A strong performance in AUD and NZD would signal genuine risk appetite returning to the market.

AUD/USD, Daily Chart

The recent consolidation and converging triangle pattern in AUD/USD suggest that the market is poised for a breakout. While no decisive move has occurred yet, the current price action appears to favor a potential bearish bias.

Notably, the pair has lost ground around the 0.6500 support level. A sustained move below 0.6500, or a confirmed breakout from the triangle, would signal the activation of a bearish reversal.

NZD/USD, H4 Chart

Meanwhile, the recent breach of the short-term uptrend channel in NZD/USD indicates that the pair may be poised for another leg lower. This technical break suggests a shift in near-term momentum toward bearish pressure.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IC Markets Global

fpmarkets

Vantage

XM

GO Markets

STARTRADER

IC Markets Global

fpmarkets

Vantage

XM

GO Markets

STARTRADER

WikiFX Trader

IC Markets Global

fpmarkets

Vantage

XM

GO Markets

STARTRADER

IC Markets Global

fpmarkets

Vantage

XM

GO Markets

STARTRADER

Rate Calc