Riepilogo dell'azienda

Informazioni generali

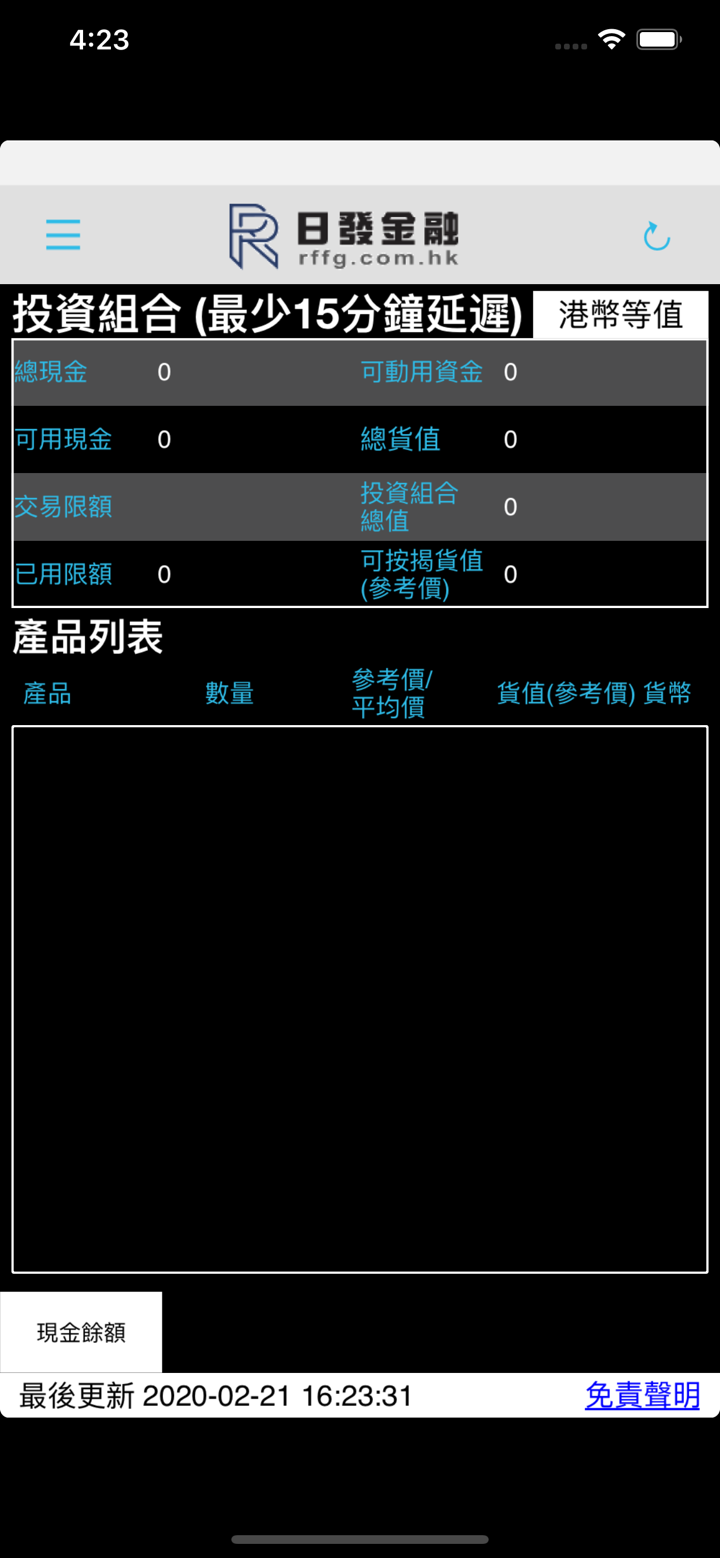

RIFAInternational Finance Co., Ltd. è una società finanziaria internazionale focalizzata sulla fornitura agli investitori di servizi di trading e consulenza che coprono i mercati finanziari globali. l'attività comprende il commercio di titoli, il commercio di futures ei servizi di consulenza in materia di investimenti. RIFA mira in particolare a offrire agli investitori l'opportunità di negoziare azioni di Hong Kong, indici e opzioni di Hong Kong Hang Seng, futures e opzioni di Hong Kong Hscei e prodotti finanziari su borse future estere (inclusi, a titolo esemplificativo ma non esaustivo, lme, cme group, ice). RIFA è la licenza della Securities and Futures Commission di Hong Kong per negoziare titoli e contratti futures.

prodotti e servizi

Titoli: mercato azionario di Hong Kong, mercato azionario statunitense;

Futures: future su indici azionari globali, future su prodotti agricoli, future su cambi, future su energia, future su metalli preziosi, future su metalli di base, future su tassi di interesse.

Tipi di conto

RIFAoffre conto cassa titoli, conto margine titoli e conto futures.

Commissioni e oneri

La commissione di transazione per le azioni di Hong Kong è pari allo 0,005% dell'importo della transazione.

Software commerciale

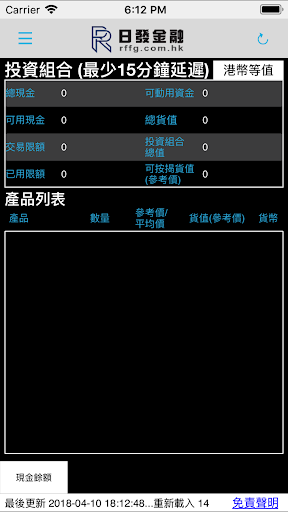

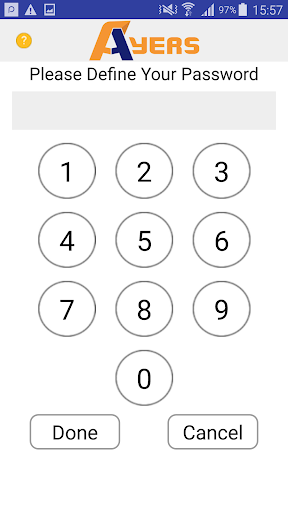

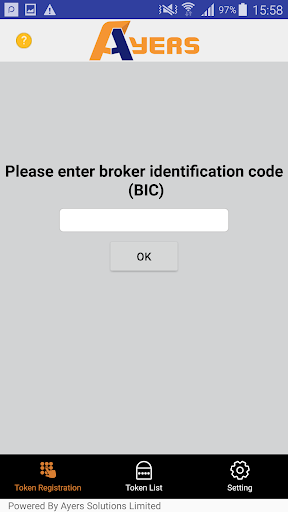

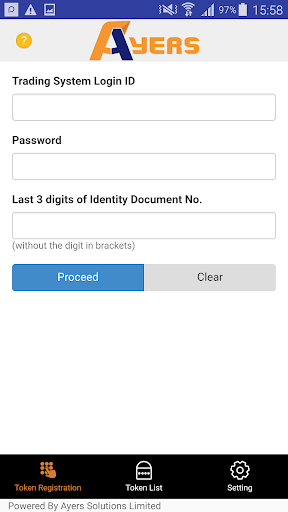

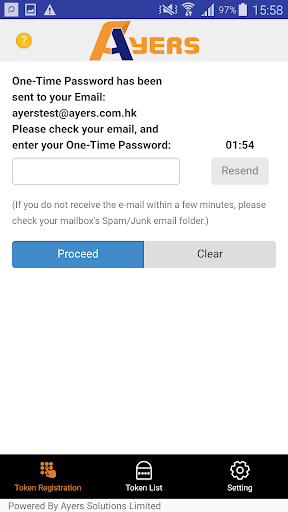

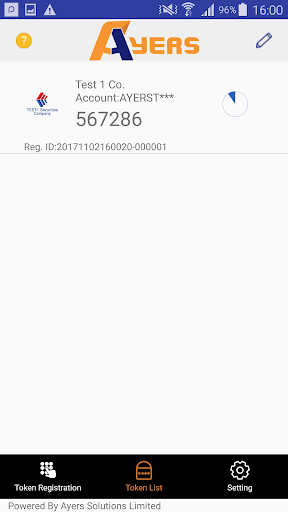

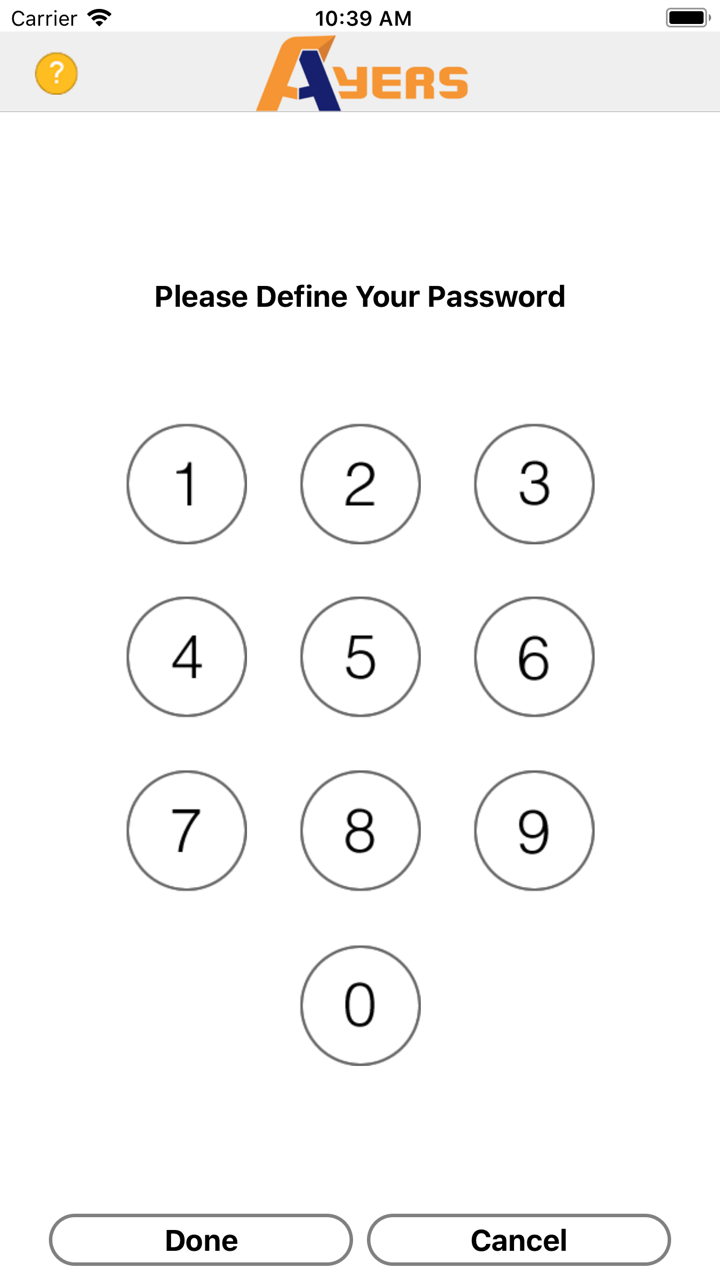

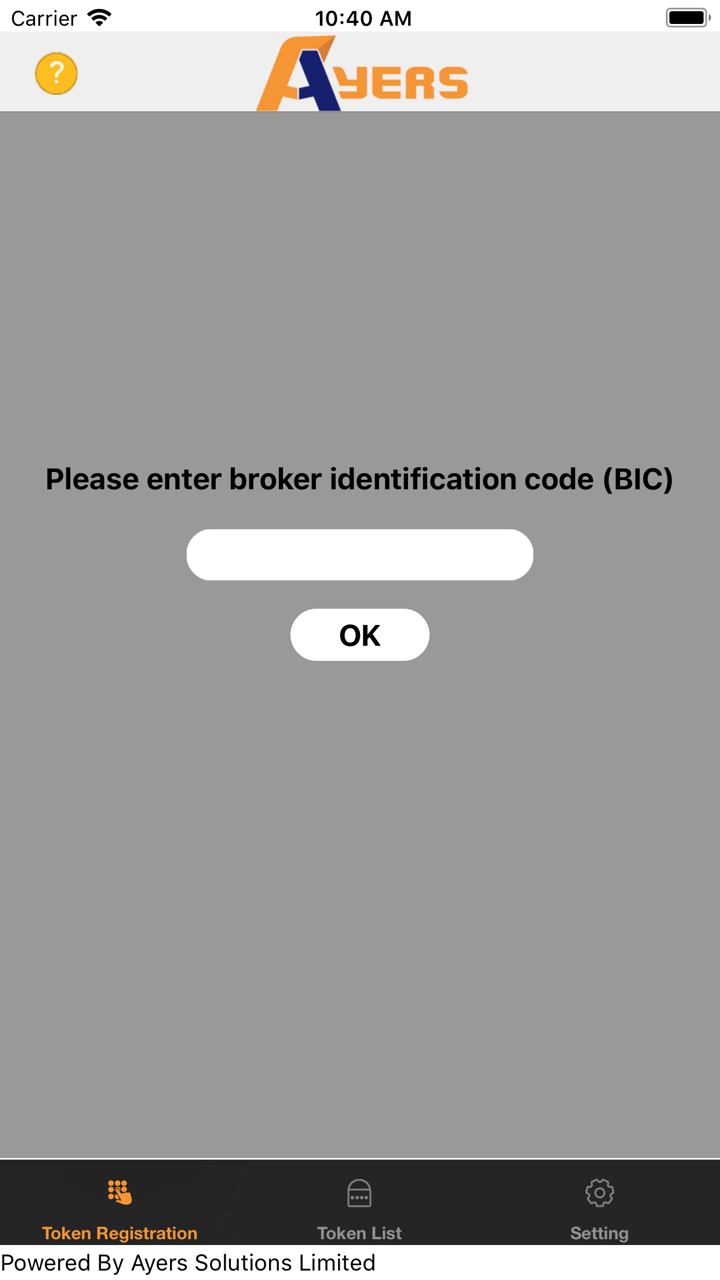

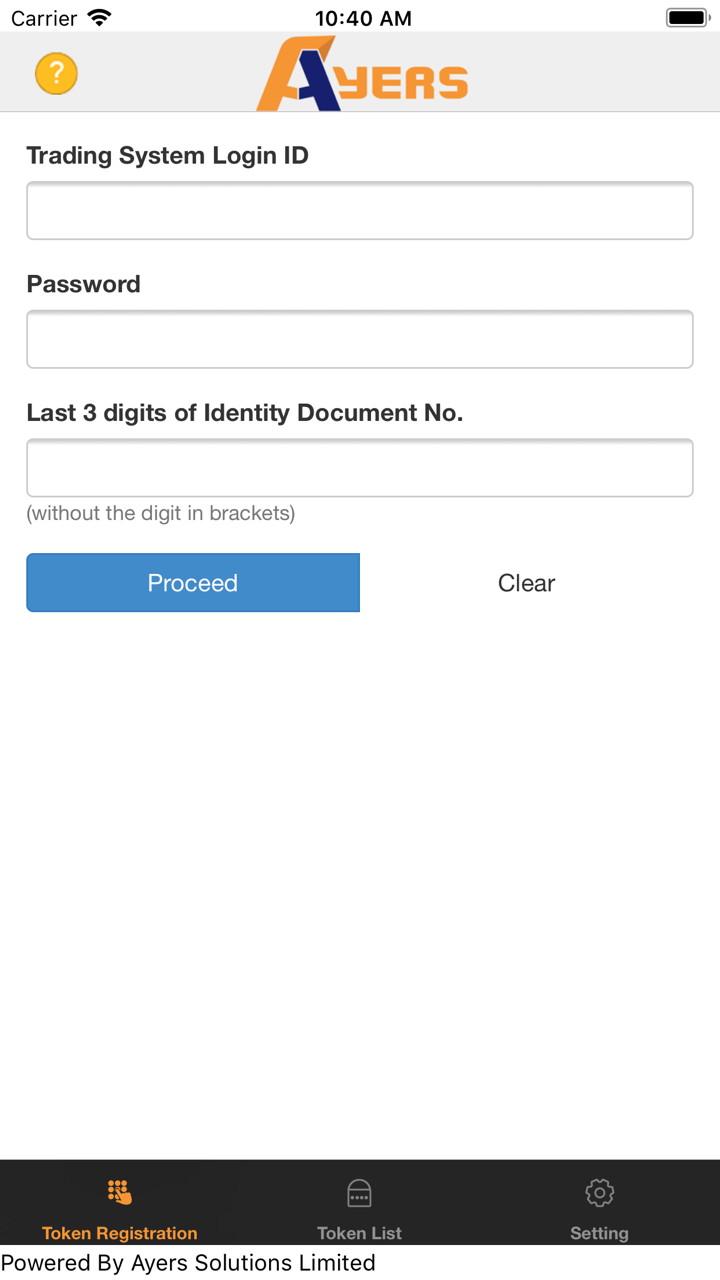

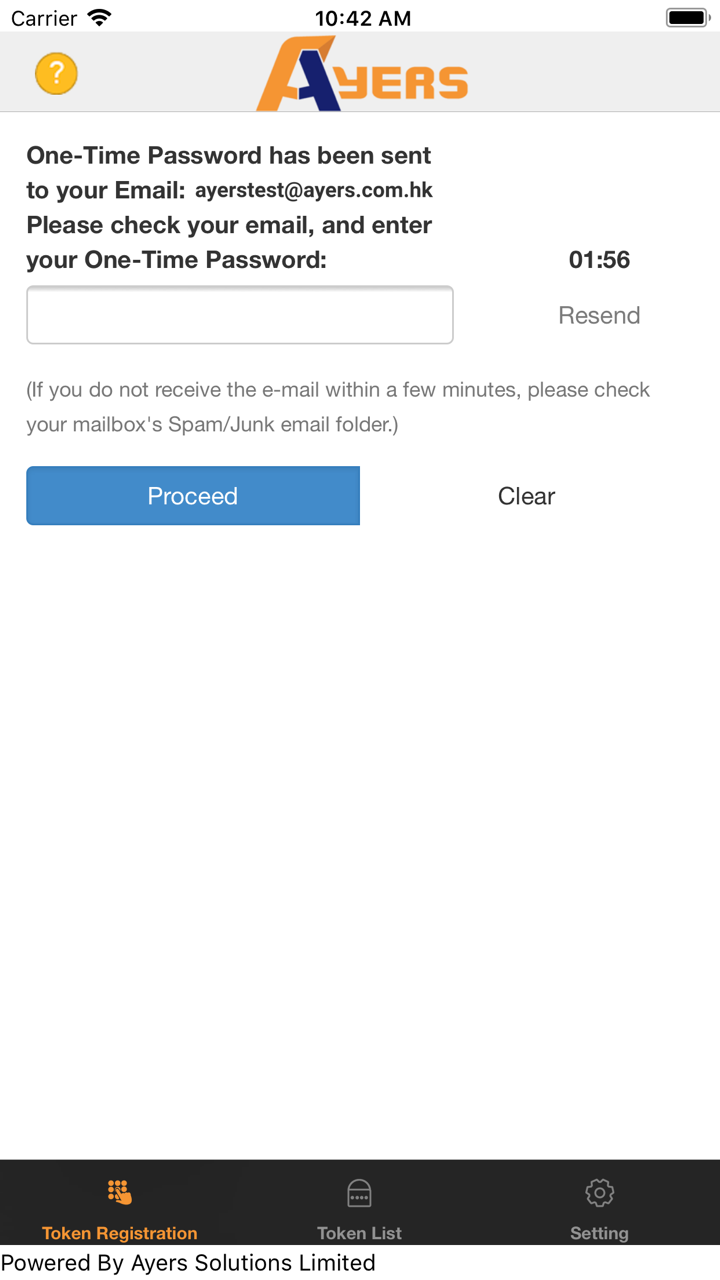

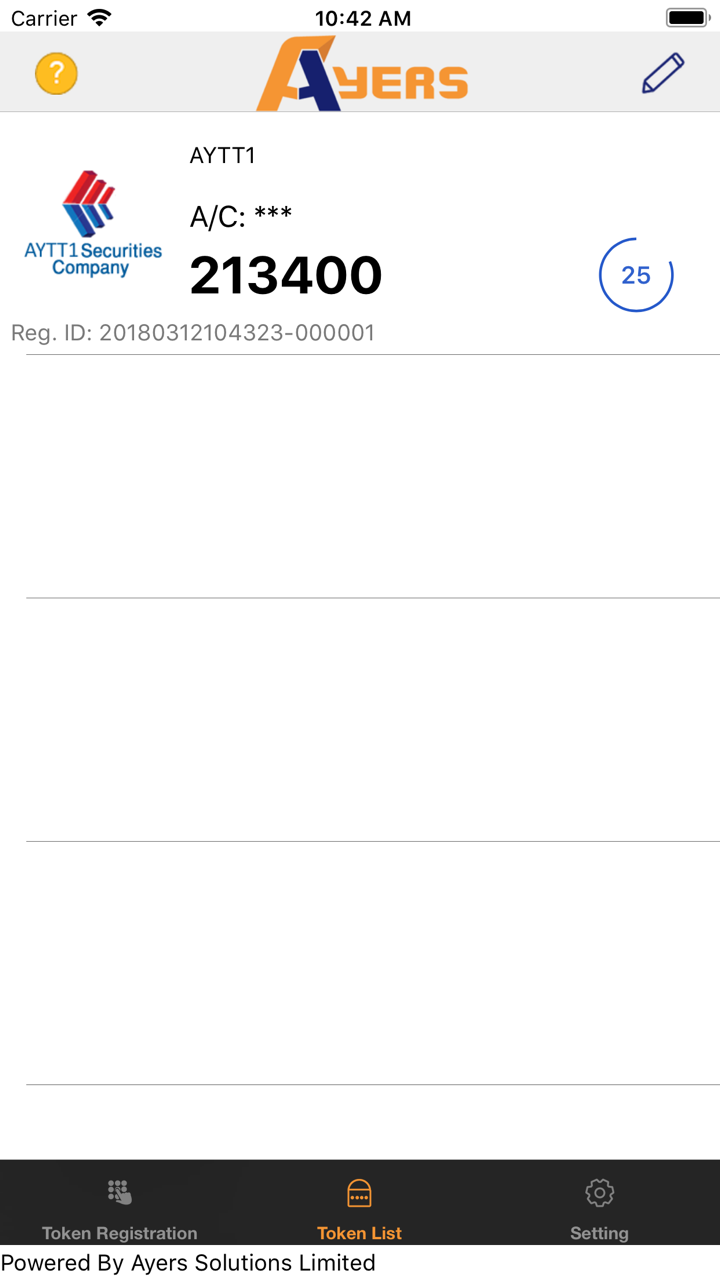

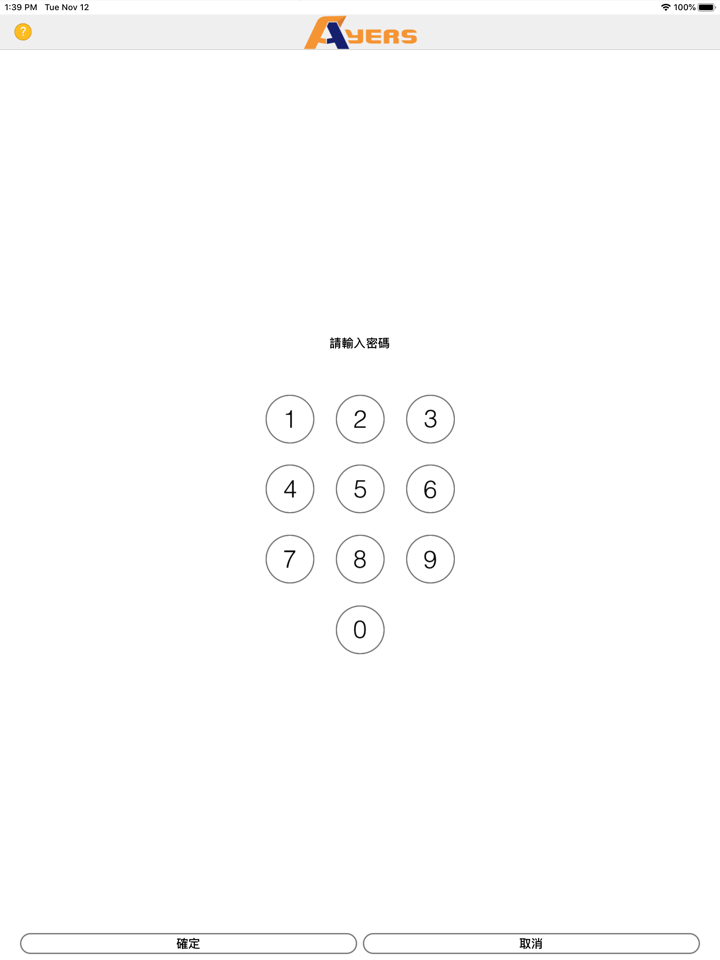

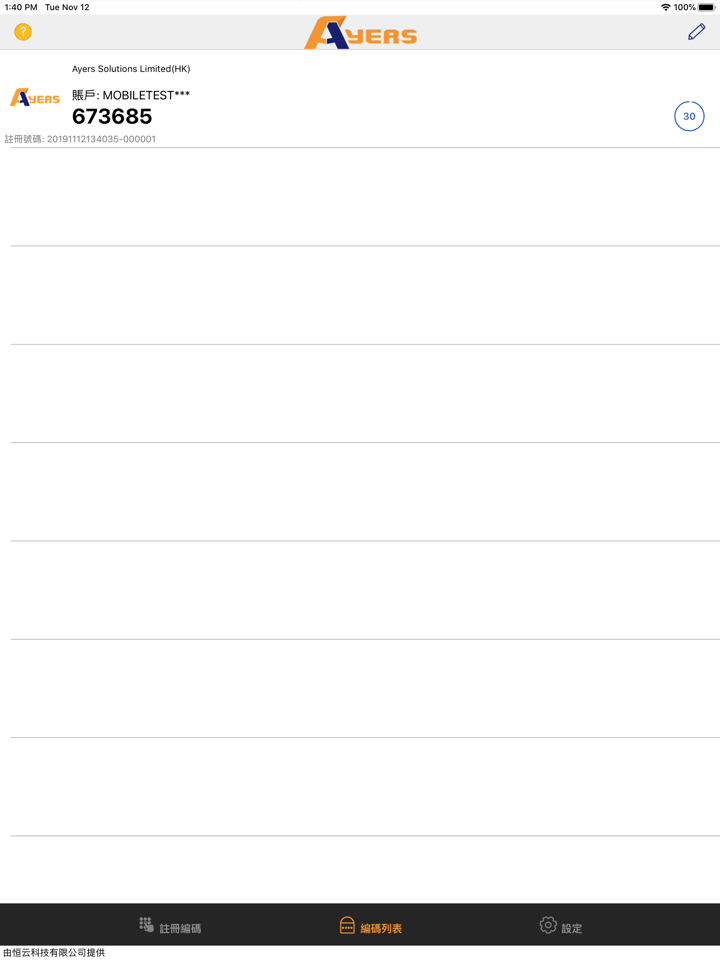

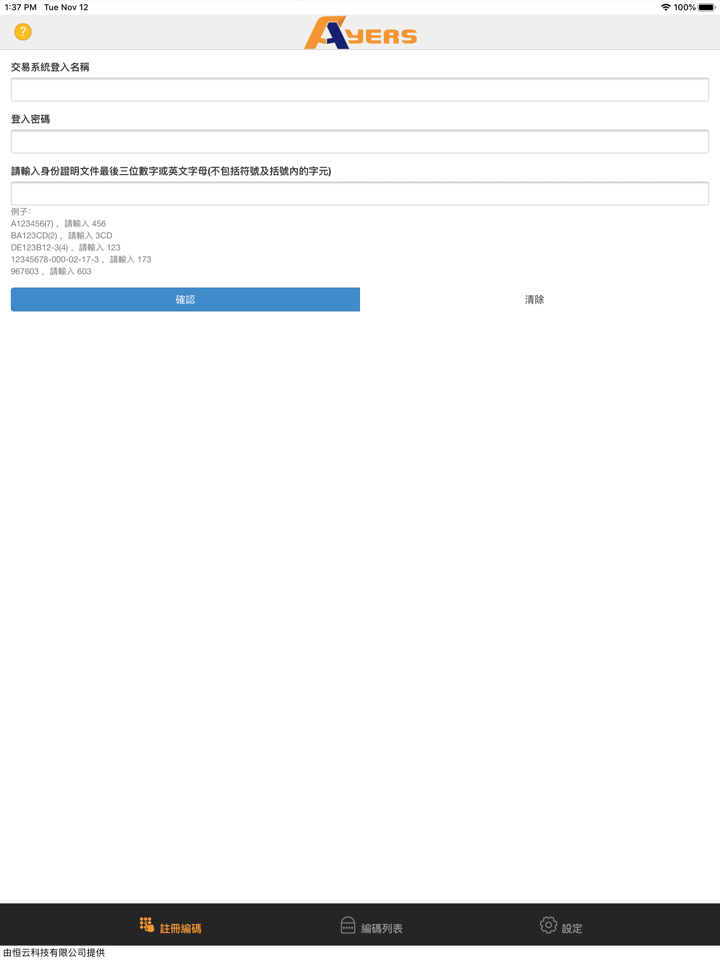

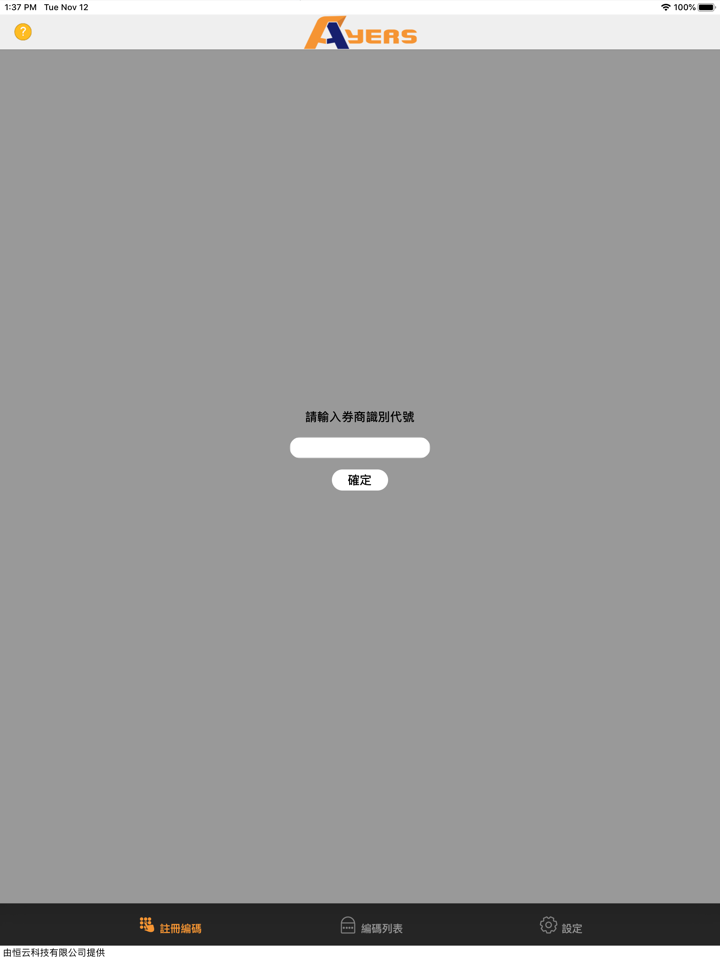

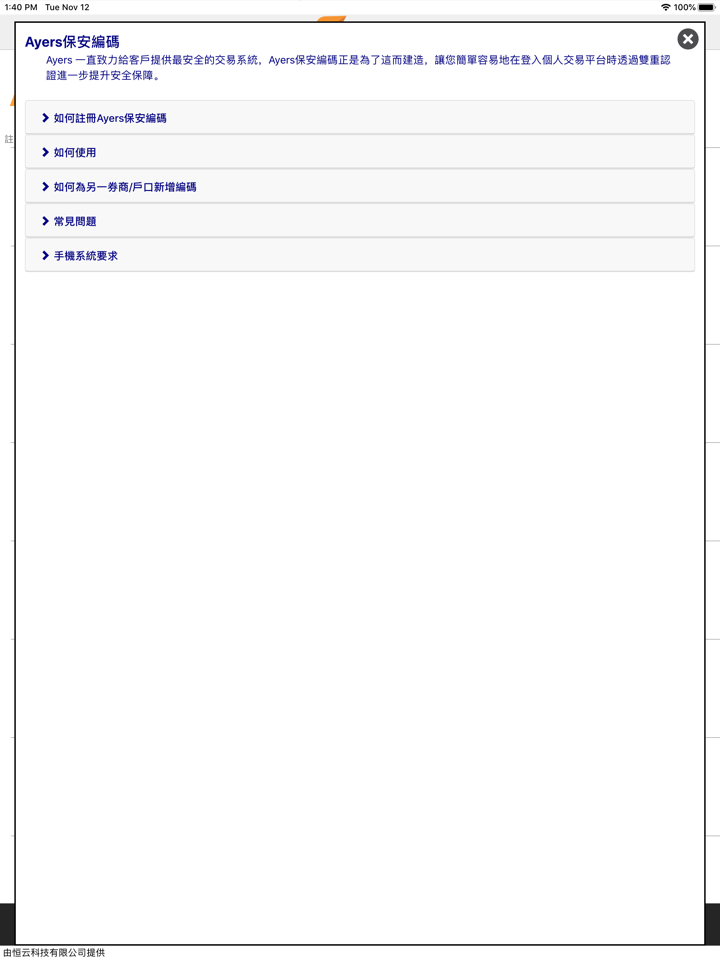

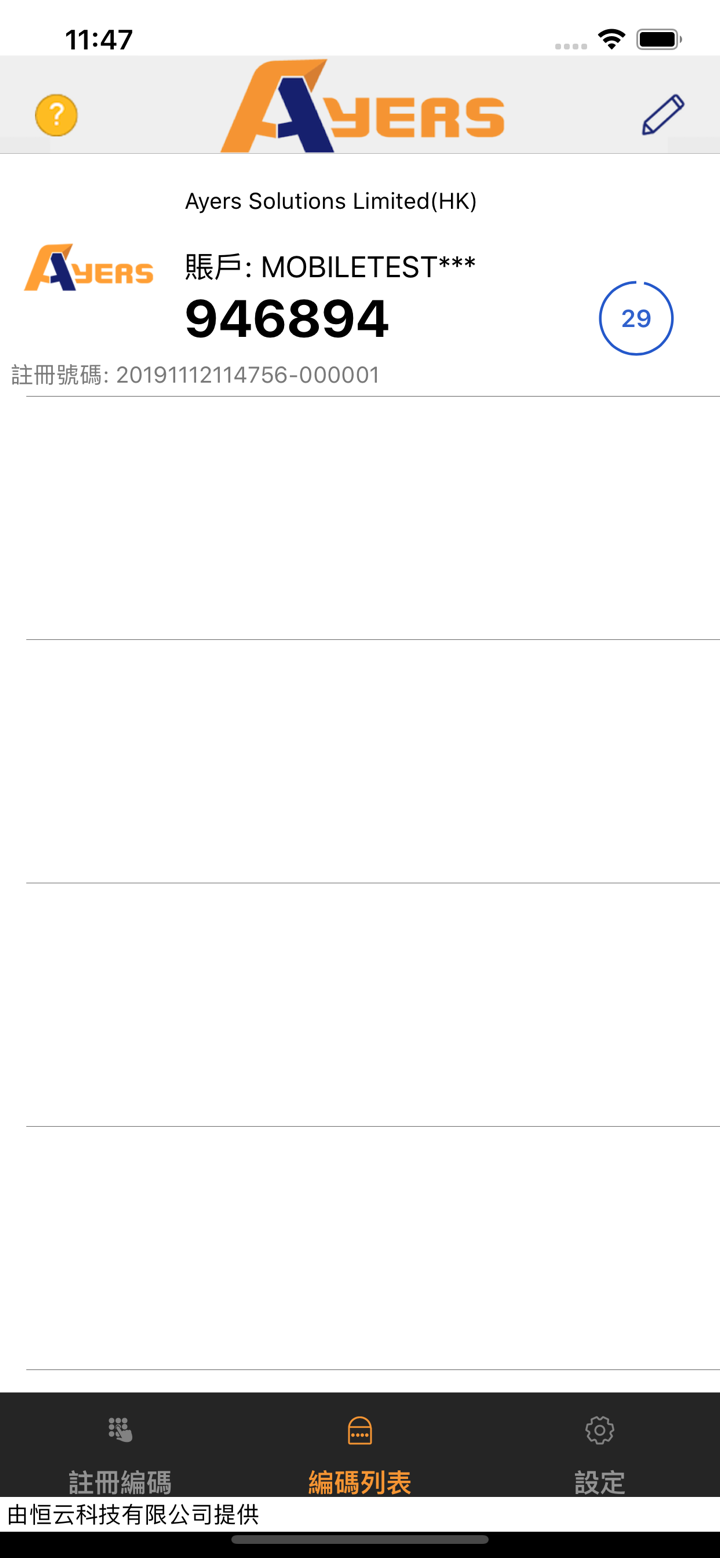

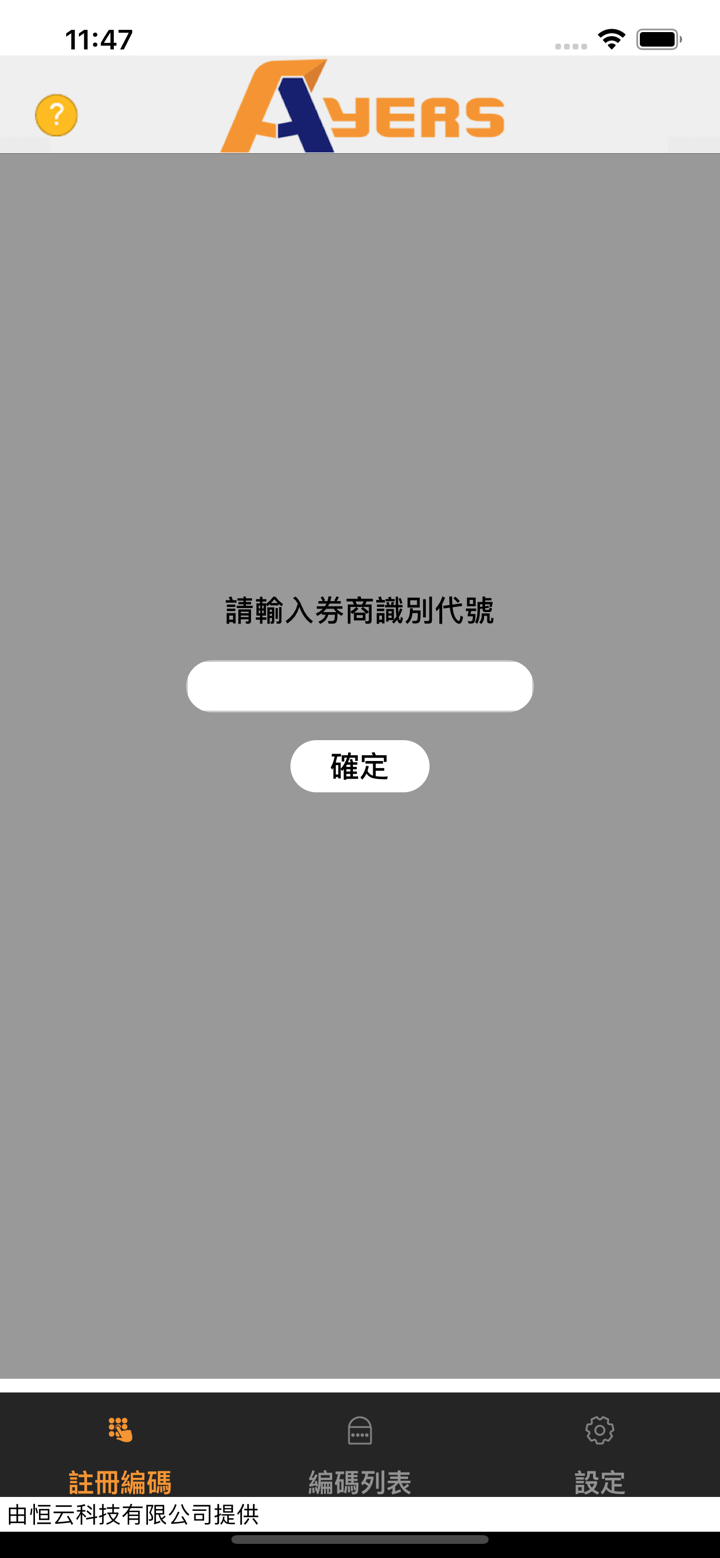

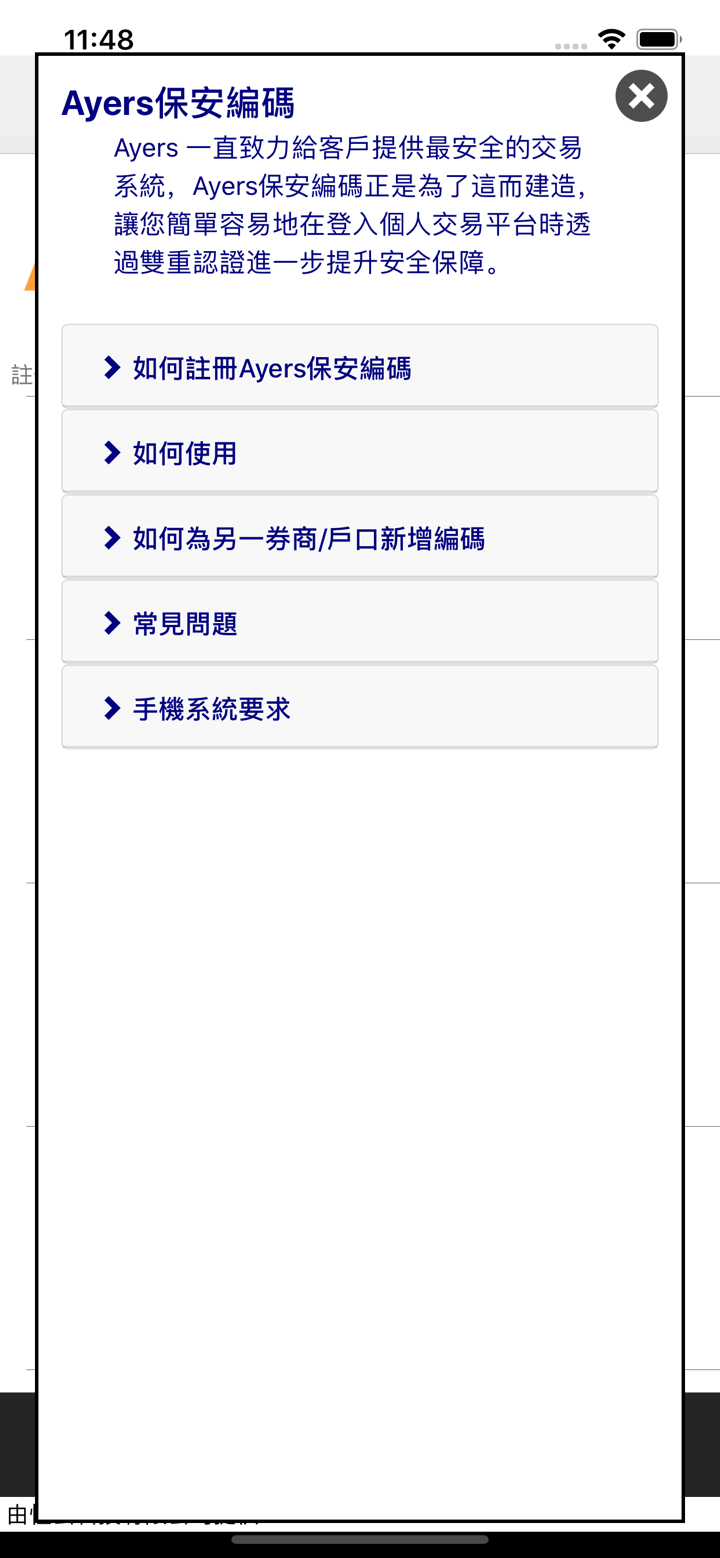

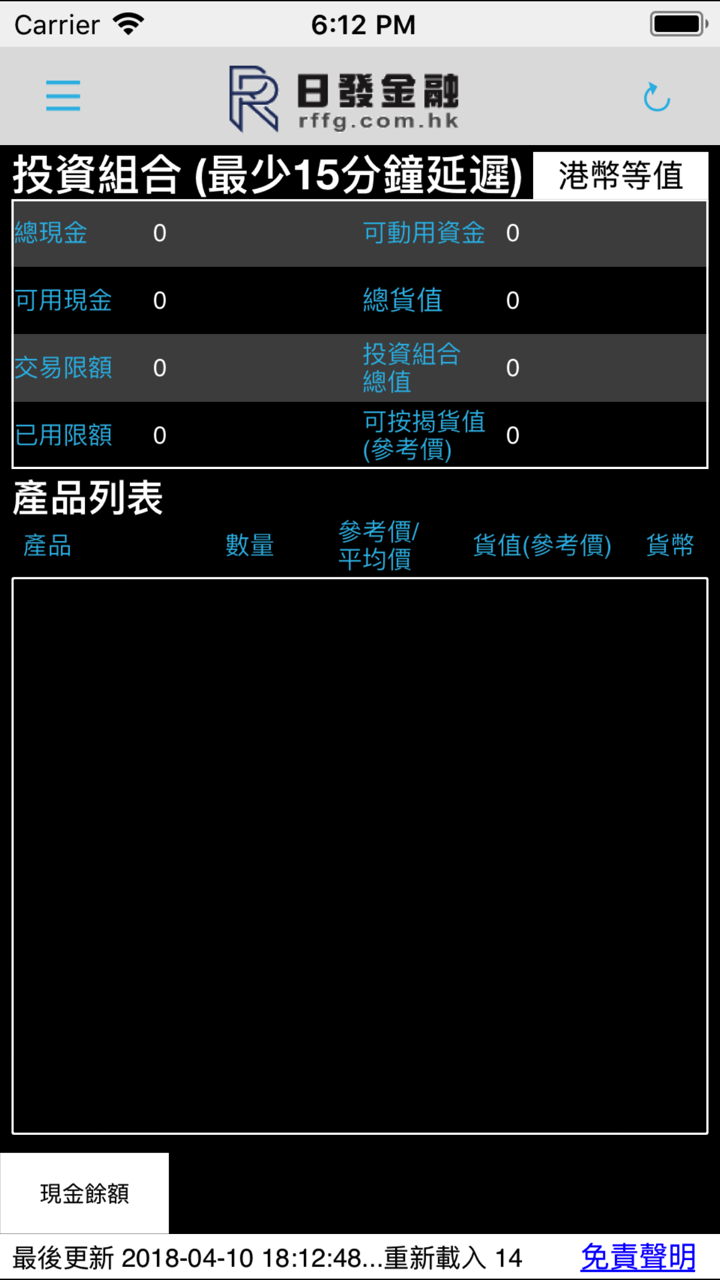

RIFAfornisce ai clienti RIFA piattaforma di trading mobile di titoli, codice di sicurezza ayers, RIFA software di trading di futures-esun polestar 9.3 e piattaforma di trading mobile esunny.

Orari di negoziazione

L'orario di negoziazione continua per i titoli è dalle 9:30 alle 12:00 nella sessione mattutina e dalle 13:00 alle 16:00 nella sessione pomeridiana.

Servizio Clienti

Se i clienti hanno domande o dubbi, si prega di chiamare la hotline per le transazioni (86) 4008 908 168 o (852) 3900 1781, o chiamare la hotline del servizio clienti (86) 14715035047 o (852) 3900 1718, o inviare un'e-mail a hkrf@rffg.com.hk per consultazione.

雨田lei

Hong Kong

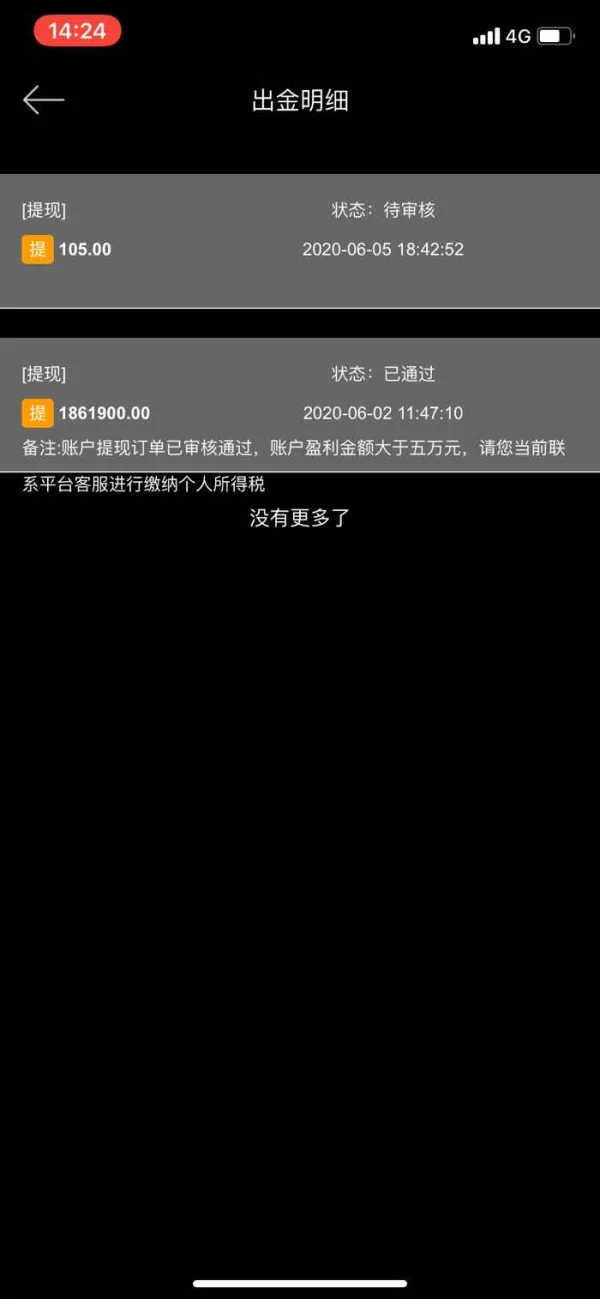

本人在一个朋友推荐下下载了日发期货软件,在她指导下平台入金了15万,于是她叫我下载米聊在操作前半个小时给我操作老师的账号加为好友进行操作,期间行情好加了5万操作,操作完毕,带我操作的老师说检测账户有风险,后冲去13.2万进行对冲操作,之后本金加盈利一共180多万,提现的时候,要求缴纳盈利部分的百分之二十的所得税即30多万元,于是我产生了怀疑,我是不是被骗了?

Esposizione

gustavo_fring

Malaysia

Se non posso pagare il 30%, dedurranno il 5% EVERDAY dal mio conto MT5. Ho pagato 33.340,69 USD, saldo 5.400 USD ancora da pagare. Non ho abbastanza soldi per pagarlo. Non riesco nemmeno a recuperare i miei soldi da MT5 per rimborsare il mio prestito. Stanno ancora trattenendo i miei soldi. Ho un saldo di 162k USD nel mio conto MT5. ho pagato molto. Ora vogliono prelevare mi hanno chiesto di saldare quel deposito del 30%, quindi rilasciare i miei soldi solo sul mio conto Binance. Come posso richiedere il rimborso dei miei soldi?

Esposizione

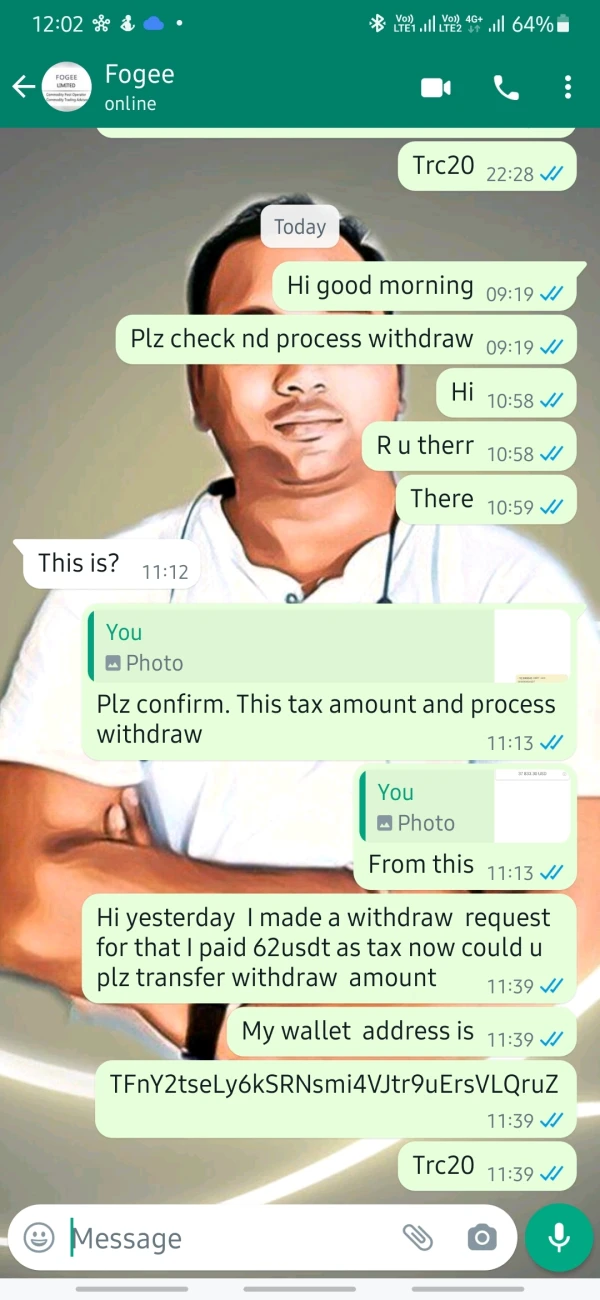

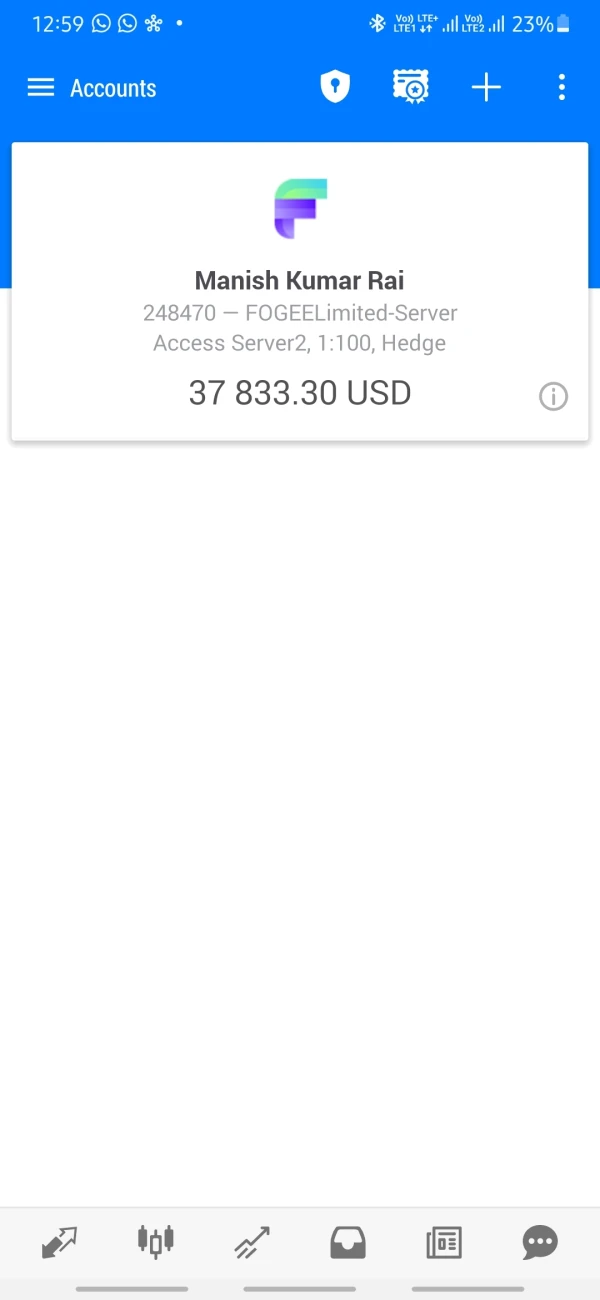

Manish Kumar Rai

India

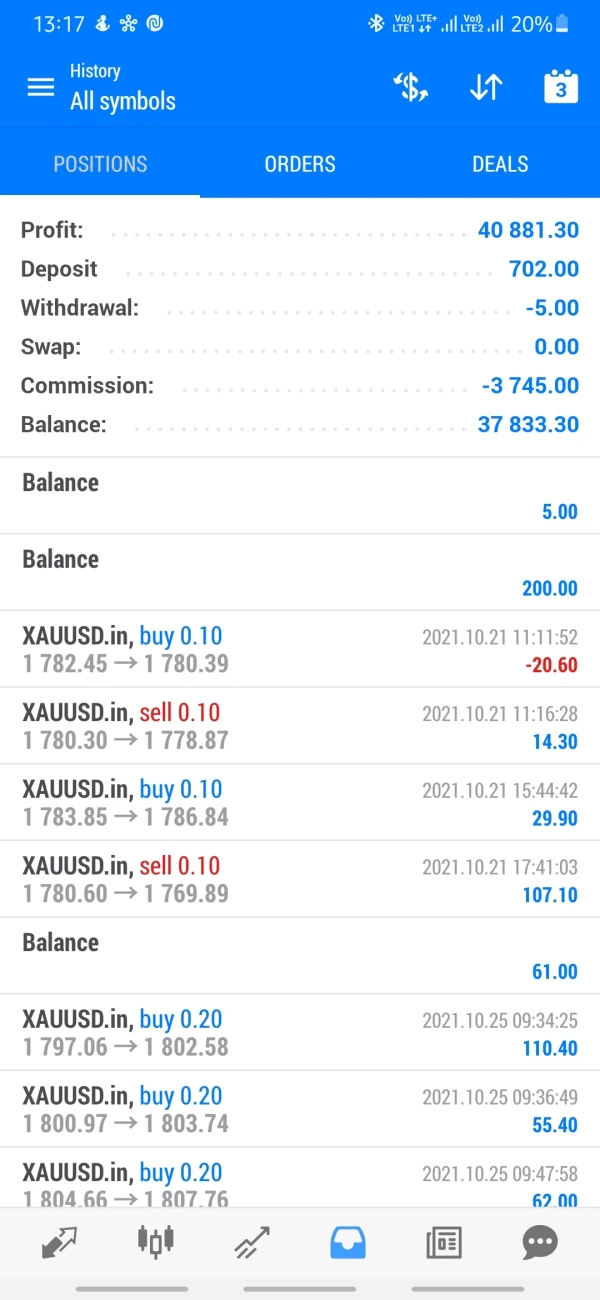

Ricevo messaggi whatsapp da un altro paese no e dopo ha iniziato a chattare e dopo qualche tempo mi ha chiesto aiuto finanziario e ho installato mt5 e poi ho iniziato a fare trading su Fogee in pochi giorni ho guadagnato 37833 usd quando ho sollevato una richiesta ritirata mi ha condiviso un gestore del servizio clienti no e quel manager mi chiede di depositare il 30% come tasse, negozio con lui e chiedo 200 usd prelevati solo ulteriormente trasferisco 62 usd come tasse dopo che si rifiutano per il fondo ricevuto e congelano il mio account ora.

Esposizione

刘涧

Hong Kong

我的本金 和要返的佣金一分没有出 日发期货就是骗子 从去年拖到现在 一直没有给我解决 最后他们业务员直接给我发个渠道商营业执照然后就没音信了

Esposizione

FX7269453295

Hong Kong

2018年11月8日,在平台发布了,日发金融业务员诱骗我通过向张贤奎 账号 6236681210001745012,中国建设银行股份有限公司上海期货支行入金2.5万人民币,以1:7.5的汇率3333.33美金,业务员王宝强说,他们平台聘请了刘(孤独)老师和李(木子)老师,两位都是金融界的精英,特别刘(孤独)老师初清失业金2小时内成功获利180点,带领客户资金翻了16倍,是一位有实力的分析师,都是带大资金客户(50万以上)。我说我资金少,风险大,他说这两位业界大佬就是咱们的盈利保障,符合咱们的合作共赢。 之后2018年11月10日,业务员变成客服了,要求我把网上贴在删除,说我是诽谤行为,他们不怕走法律程序。只有按照他们的要求操作,他们就把资金退给我。在此我呼吁为了不让更多的人授勋,一定要对这些黑平台进行严惩。

Esposizione

FX7269453295

Hong Kong

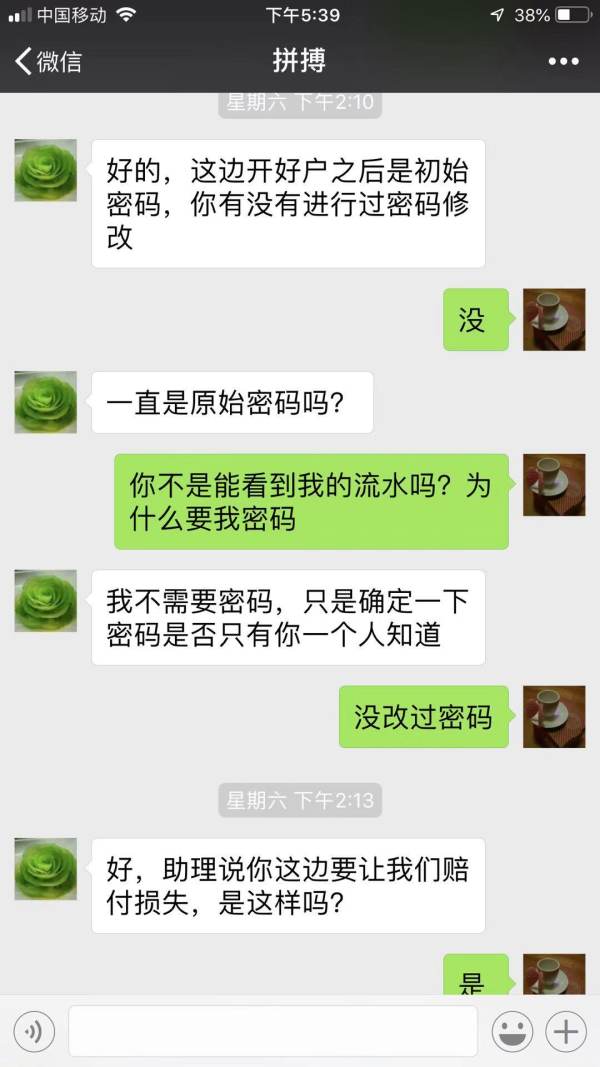

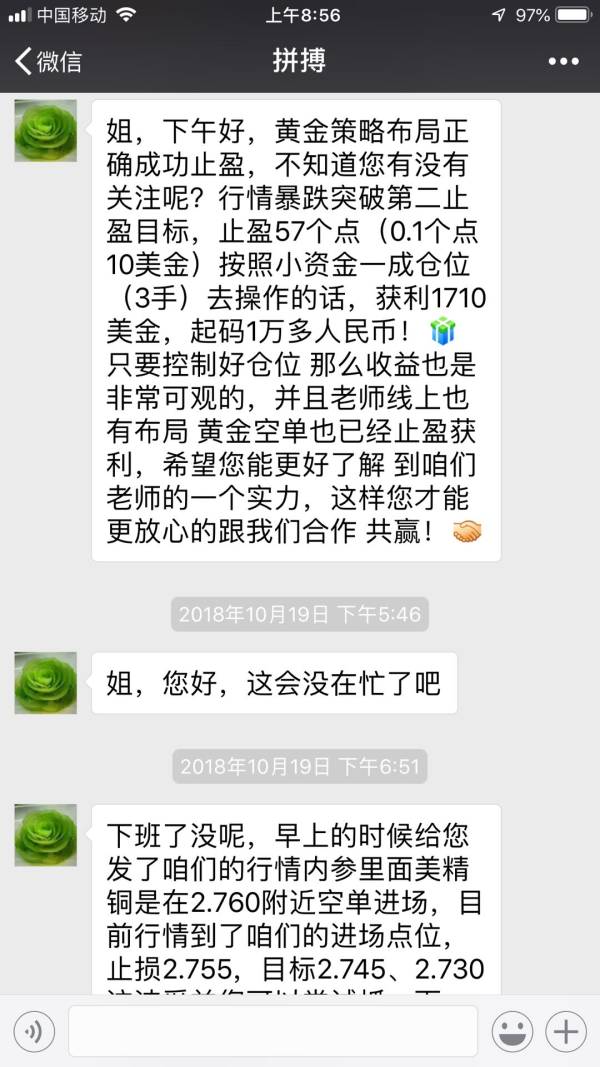

我认为日发金融必须赔偿我的原因: 1、提供的都是盈利记录,诱导介入 没有人按排我去做过任何的模拟盘,开户就马上要求我上手操作。还告诉我黄金眼软件可以投诉平台,我就是相信了所以都听老师的才导致亏损。 2、套牌的续假平台、虚假宣传转账给张贤奎的私人账 说不需要你懂,交给老师,保证能带着你赚钱,说平台有监管的。后来,在外汇天眼上面查询了一下监管类型,显示的是所持的中国香港证(监管号:AAA537)香港证券交易及其他咨询牌照监管牌照,属于超范围经营,而且香港的那个叫日发期货,这个属于套牌的续假平台。用的信管家交易平台早已取缔,怪不得在操作时卡、掉线。交易时出现卡死,问老师,老师让问助理,助理不回话,直接大损。 3、今年证监会的力度那么大,国家高度重视,都在严打,会员单位给我提供的整套交易系统跟证监会提示的伪期货交易模式完全一样。本人保留了与助理、喊单老师的微信交流记录,以及银行流水明细以及交易软件的明细单。 2018年9月,自称日发金融的业务员(王宝强 ,微信名拼搏,微信号:dpx0213)给我打电话,然后加了我微信,然后向我介绍了“日发金融”说比其他平台要正规,要求我跟他们日发金融操作。

Esposizione

FX9879385547

Hong Kong

2018年4月16日,一个自称日发金融的业务员(周燕辉QQ:283346287)给我打电话,说他们平台有跟交易侠合作,之前我有在交易侠注册,获取了我的手机号码,然后跟我推荐他们平台有专业的分析师(张忆东联系电话:18221091431、QQ:997005573),并且这位老师去年的业绩在公司排前几名,是一位有实力的分析师,手上都是大资金客户(40万以上)。听完之后,我没太在意,这名业务员就不停的给我发信息、打电话,让我加入他们团队,我当时直接说,我达不到你们的门槛,现在只有几万块钱,并且也没时间看盘。他说平用我看盘,他们老师和他都会随时提醒我,完全按照老师给的单子操作就好,并说愿意帮我申请一下。于是,第二天他又给我打了电话,说通过私人关系给我申请下来了,并把平台的信息发给我看了一下,让我把身份资料发给他,给我开户。在他的帮助下,开立了一个交易账户(1682705),提醒我及时入金。当天下午首次入金42000元。晚上,那位张老师就开始让我做单了,都是给的现价单,当时给了一个黄金的多单和油的空单,盈利的时候都有几百美金了,我问张老师要不要出了,他说不急,再等等,结果止损了。这两笔交易之后,我就提出了自己的想法(落袋为安),结果老师说要赚就赚大钱,赚这点小钱有什么用,听完之后,我有点质疑他。接着又让我做了恒指,德指,我说从来都没有接触过这两个产品,波动会很大吗?他说波动较大,一手就能赚回来之前亏损的。于是让我高点进了多,行情直线下跌,止损出局,我当时就不可思议,那明明就是下跌趋势,为什么会选择做多,找他理论了半天,他说今天行情有点妖,我说那我今天就不做了,睡觉。说完之后,他让我追空恒指,我说现在做空是不是会追在地板上,然后就没理他,结果他给我打了电话过来催我做单,我说了几次不做了,但最后还是没有坚持,在他的诱导下,进了一手空恒指,结果行情直接拉上去了,又是止损出局。我当时就很生气,为什么我一个大白都能看得懂的行情,他这么厉害的老师会看不懂?一晚上让我亏损了3000美金。第二天一大早,他就给我发信息让我现价做空恒指,我没理他,结果上演了昨天那一幕,又给我打电话催我做单,挂完电话后,还是进了一手空单,让我万万没想到的是,直接拉升200个点,他让我锁仓,让我完全按照他的思路来,不要犹豫,结果就锁了一手多进去。在涨到高点的时候,我说能不能把多单给出了,进一手空单进去,等会应该会跌下去。他说等会跌下去把空单出了,进一手多单,跟我的思路完全是相反的,看着可用预付款渐渐变少,临近爆仓,便问他怎么办,他说让我加资金进去扛扛风险,保证不会爆仓。于是就再次入金17000元,几分钟不到,直接爆仓了。当时我都懵了,说好的保证不爆仓呢。不到一天的时间,全部亏完了,这完全就是在诱导我亏钱,喊反向单子。 之后,找过代维权的团队,他们通过向人行投诉,业务员给我打电话说愿意退给我3000美金,并要求我立即撤诉,不然一分钱都不会退给我。我没同意,并说必须全额退给我才能撤诉。第三天就收到收单机构(银盈通)给我发的订单凭证(4200元),我琢磨了几天,终于让我查出破绽,订单凭证上面显示的是天天快递,还有快递号,我抓住了这点关键信息,在网上查询了一下订单号,让我没想到的是这个订单号是圆通快递,而不是天天快递。我便拨通了快递小哥的电话,了解了一下情况,快递小哥很热情,还帮问了当时为什么会寄一封空的信件,如果是刷单可以跟他们说,但寄件人说是公司要求的这样做的。 我认为日发金融和银盈通必须给我赔偿的原因: 1、没有给我进行任何风险讲解 没有人按排我去做过任何的模拟盘,开户就马上要求我上手操作。也没有人跟我细说现货的任何的风险,什么叫爆仓。我就是相信平台正规什么都听老师的才导致亏损。 2、开户前给我做的是虚假宣传 开户前,我说过没时间看盘,并且自己也不懂,她说不需要你懂,交给老师,保证能带着你赚钱,我问资金安全问题,他说平台大可放心,都有监管的。后来,在外汇天眼上面查询了一下监管类型,显示的是所持的中国香港证(监管号:AAA537)香港证券交易及其他咨询牌照监管牌照,属于超范围经营,所以会员单位为了招收客户做了很多虚假的宣传。 3、日发金融公然与投资者进行对赌交易,投资者如果赚钱作为会员单位就得亏钱,反之会员单位要赚钱就必须让投资者亏钱,这是明显的做市商对赌,是国务院的38文明令禁止的。 4、今年证监会的力度那么大,国家高度重视,都在严打,会员单位给我提供的整套交易系统跟证监会提示的伪期货交易模式完全一样。本人有收集了部分会员单位老师的QQ喊单聊天记录、银行流水明细以及交易软件的明细单。

Esposizione