abstrak:This offshore broker provides a wide range of forex pairings and CFDs, six account types, and multiple web-based trading platforms. With the exception of their trading accounts and conditions, we have serious concerns regarding this broker, which we will outline below. So, before you invest with INTRGROUP, read our thorough and unbiased review.

INTRGROUP is an offshore broker that offers a variety of forex pairs and CFDs as well as six different account types and access to several web-based trading platforms.

Aside from their trading accounts and terms, we have severe reservations about this broker, which are detailed below, along with a few potential benefits. So, before you invest with INTRGROUP, make sure you read our comprehensive and impartial evaluation.

The Benefits of INTRGROUP

Spreads are not awful.

We'll begin with the cost of trading with INTRGROUP, albeit this isn't the most significant factor to consider when choosing a forex broker.

They haven't published any spreads on their website, but the platform is open to the public. When we investigated, we saw that the benchmark EUR/USD spread was hovering around 1.5 – 1.6 pips, which is on the higher and average end of the sector. However, given that the broker is unregulated and most likely a fraud.

A strong variety of tradable assets

Another potential benefit of INTRGROUP is its large product range. The broker allows you to trade in a wide range of currency pairings as well as CFDs on indices, commodities, precious metals, stocks, and cryptocurrencies.

Disadvantages of INTRGROUP

A broker from another country

Let's get right to the point: INTRGROUP claims to be owned and controlled by Mindworks Ltd., a supposedly registered corporation in St. Vincent and the Grenadines (SVG).

We remind readers that the government of SVG has said publicly on several occasions that it does not control forex trading, therefore we can reasonably assume that this brokerage is not regulated. It is important to note that dealing with unregulated offshore brokers has several hazards. There might be financial commingling, platform interference, and any other sort of fraud plan you can think of.

While INTRGROUP does not claim to be regulated, they have offered many contact numbers with UK, Belgium, Australia, and New Zealand country codes, among others. This is a cause for concern since these nations have strong laws and licensing frameworks in place for financial service providers.

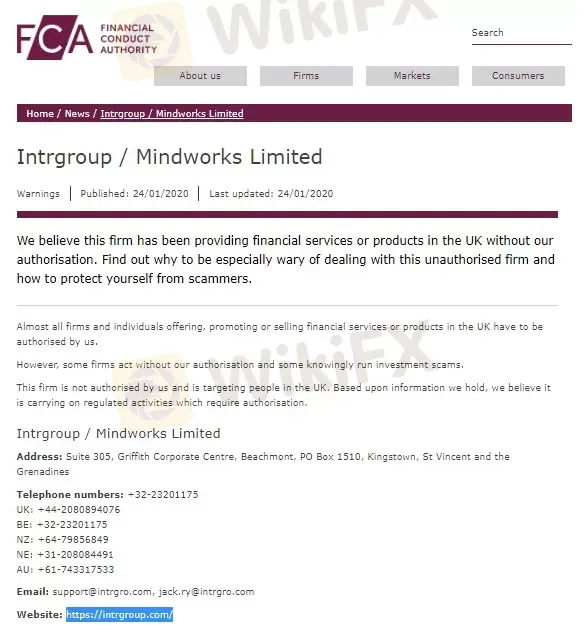

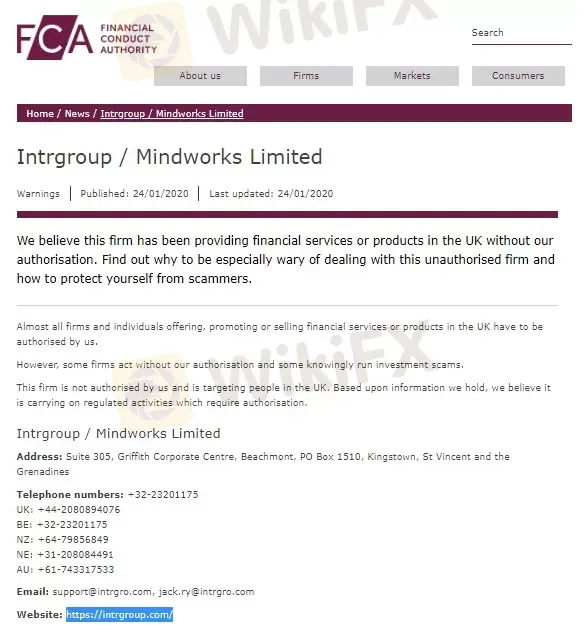

The FCA in the United Kingdom has issued a warning.

Given the above, it's no surprise that the Financial Conduct Authority in the United Kingdom has banned INTRGROUP as a possible fraudster.

The charges of trading are not revealed on the website.

As previously stated, INTRGROUP's website makes no mention of spreads, which is another concerning clue. Investors have every right to know in advance what the pricing of the services given to them are, including average spreads, commission fees (if any), roll-over, and so on.

Does not support the MT4/MT5 platforms.

As previously stated, INTRGROUP uses a web-based trading interface rather than more well-known alternatives like MetaTrader, Sirix, or cTrader.

Although the broker's platform has powerful charting tools such as analytical indicators, it pales in contrast to MetaTrader's incredible functionality. Those of you who want to trade using the industry's standard MT4, with its excellent charting and support for automated trading systems, may do so by clicking on the link below.

Finally, here is a synopsis of the current review:

COMPARISON OF INTRGROUP