简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ETO Markets Global Pulse: Gold Surges 1%, Inches From Record High

Zusammenfassung:Market Review According to ETO Markets monitoring, on Wednesday, December 17, spot gold extended its strong upside momentum. Prices surged to an intraday high of USD 4,348.70 per ounce and settled nea

Market Review

According to ETO Markets monitoring, on Wednesday, December 17, spot gold extended its strong upside momentum. Prices surged to an intraday high of USD 4,348.70 per ounce and settled near USD 4,338 per ounce, posting a daily gain close to 1%. The broader precious metals complex also strengthened. Silver broke above USD 66 per ounce to a fresh record high, while platinum climbed to its highest level in more than 17 years.

During early Asian trading on Thursday, December 18, spot gold entered a narrow consolidation phase. Prices are hovering near USD 4,340 per ounce, as bullish momentum pauses and the market digests recent gains at elevated levels.

Global Headlines

Trump Signals Aggressive Rate Cuts

In a White House address on Thursday morning, Donald Trump said he would soon announce the next Federal Reserve Chair. He suggested the new chair would favor aggressive rate cuts. The comments reinforced expectations of easier monetary policy and pushed spot gold up by around USD 7 in the short term.

US-Venezuela Tensions Lift Safe Havens

The U.S. ordered a blockade on sanctioned Venezuelan oil tankers and signaled potential military actions. Rising geopolitical risks quickly boosted risk-off sentiment. Capital flowed into safe-haven assets, providing strong support for gold prices.

US Passes $900.6bn Defense Bill

The U.S. Senate approved the FY2026 National Defense Authorization Act worth USD 900.6 billion. The bill includes expanded military spending and funding for Ukraine. The move adds to long-term geopolitical and fiscal uncertainty, reinforcing demand for defensive assets.

Waller Signals Gradual Rate Cuts

Fed Governor Waller said there remains room for 50 to 100 basis points of rate cuts, but there is no urgency to act. He noted that the labor market and inflation remain resilient. Policy normalization, he said, will proceed gradually toward neutral levels.

Delayed US CPI Limits Guidance

November U.S. CPI data will be released later than usual this Thursday due to the government shutdown. With no October baseline for comparison, data integrity may be limited. Markets expect short-term volatility rather than a clear pricing trend.

BOE BOJ Policy Divergence Widens

The Bank of England is expected to cut rates by 25 basis points on Thursday as inflation cools and growth weakens. Borrowing costs could fall to a three-year low. In contrast, the Bank of Japan is widely expected to hike rates to 0.75% on Friday, though future moves will remain data-dependent.

ETO Markets Analyst View (Spot Gold)

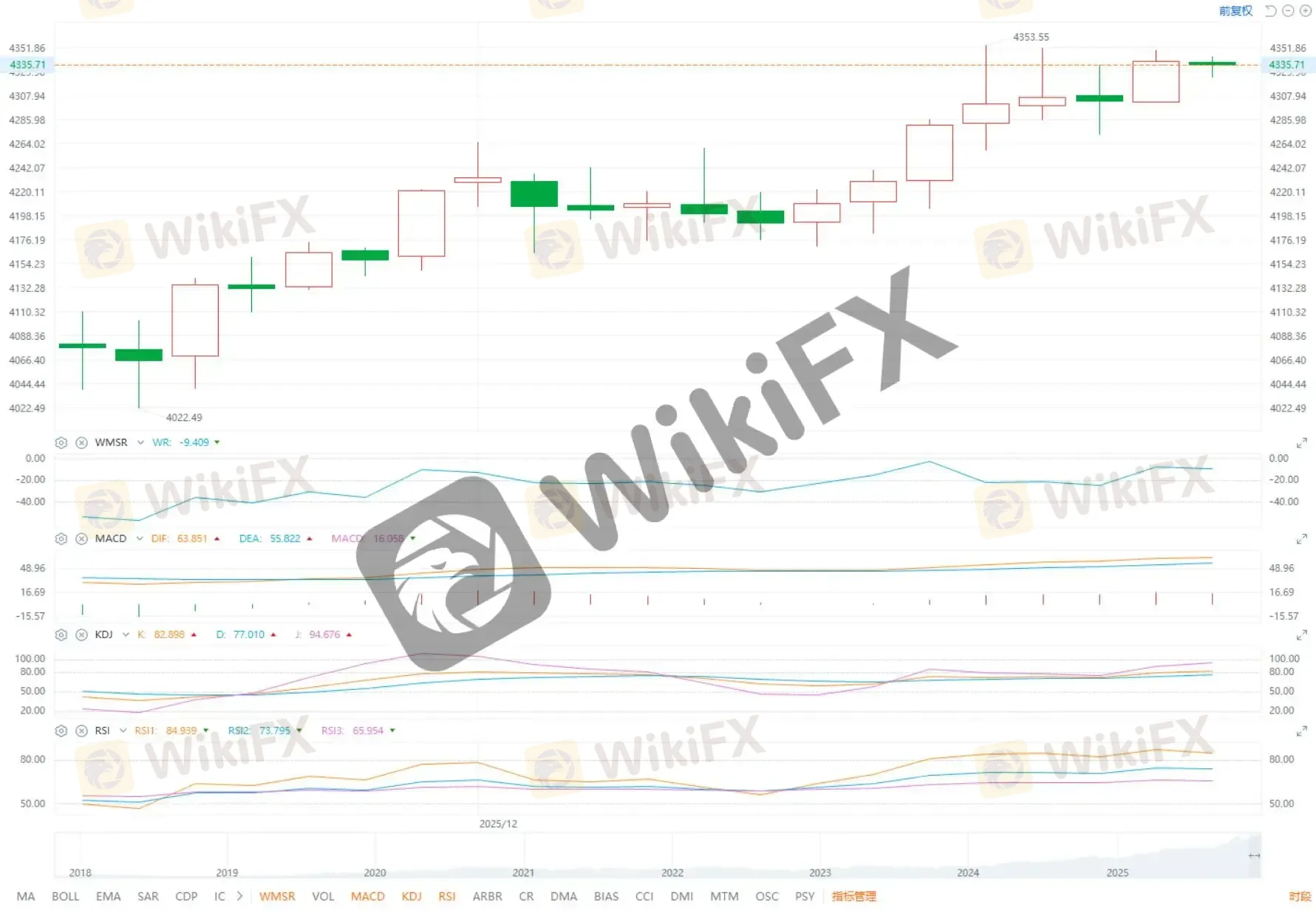

From a technical perspective, spot gold remains firmly bullish. The USD 4,315 per ounce level acts as the key intraday pivot. As long as prices hold above this level, upside bias dominates. Immediate resistance is seen at USD 4,353, followed by USD 4,375.

If prices retreat and break below USD 4,315, short-term correction risks may rise. Downside support is located near USD 4,290 and USD 4,275. Momentum indicators such as RSI show mixed signals but still lean upward overall. Ahead of dense macro data releases, gold is likely to digest volatility through high-level consolidation rather than sharp reversals.

Disclaimer

The content provided is for informational purposes only and should not be considered as investment advice.

Derivative products involve high levels of risk and may not be suitable for all investors. Before making any investment or trading decisions, please carefully assess your financial situation, investment goals, and risk tolerance. Seek independent professional advice where appropriate.

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

XRP-Schockzahlen: 57 Mio. Dollar liquidiert – Ripple verliert Kontrolle

(CFD und Forex) – was ist besser für dich?

Warum du Prop Firms Brokern vorziehen solltest

Wusstest du, dass du deine eigene Forex-Trading-Strategie erstellen kannst?

Forex News Trading: Welche Risiken gibt es?

Crash-Gefahr oder Jahrhundertchance? Gold, Silber und die 6.300-Dollar-Wette

Gold explodiert – Bitcoin fällt zurück: Jetzt zeigt sich die brutale Wahrheit

Wechselkursberechnung